Two new Forbes on ERCOT debt, Wilson on the podcast, Evening Grosbeaks

Two Forbes pieces on ERCOT debt, Stephen Wilson on the podcast, & Evening Grosbeaks at Fred Baca Park

It’s good to be back in Austin. Lorin and I had a great road trip through Oklahoma, Kansas, Colorado, and New Mexico. It was a lot of driving -- more than 2,200 miles in 10 days – but it was great to get out of the Texas heat for a while. Taos was a highlight of the trip. I haven’t spent much time in New Mexico since I lived on the Navaho reservation back in the early 1980s. Taos has grown a lot since then. Plus, I’d forgotten how beautiful the area is. The valley around Taos has been getting a lot of rain which meant the streams were flowing and the wildflowers were running rampant. We had some great hikes, did some birdwatching, and a lot of relaxing. We got back to Austin late Sunday, just in time to luxuriate in some hard rain on Monday. We got about three inches at our house. While it wasn’t enough to end the drought that has been baking the state, the rain was very welcome.

I’ve been catching up on writing and reading this week. Emmet Penney has a very good essay in American Affairs called “The Rise and Fall of the American Electrical Grid.” I’ve also begun reading The Fabric of Civilization: How Textiles Made The World, by Virginia Postrel. I love fabric and textiles and will have Virginia on the podcast soon. I also just bought the latest book by my pal, Byron Reese. The title: Stories, Dice, and Rocks That Think: How Humans Learned to See the Future--and Shape It. Byron is a sharp thinker and writer. I’m hoping to get him on the podcast, too. I’ve been working on new podcasts this week and a piece on Europe’s energy crisis. There’s plenty of gloom there. Front-month nat gas at the Dutch TTF trading hub is selling for $94 per mmbtu. That’s roughly equal to $560 per barrel of oil! I’m also prepping for several upcoming speaking engagements. Four items today:

Forbes: Texas consumers on the hook for $10B in debt from Uri

Forbes: Update: NRG-funded report puts Texas debt at $10.5B, Oklahoma debt at $2.8B

Stephen Wilson on electricity in Australia, coal, and renewables

Evening Grosbeaks in Taos

The Grosbeak photo above was taken in Quebec in 2011

Subscribe to this "news" letter. Click here

On Wednesday, I published a piece in Forbes on the debt that Texas consumers will have to repay due to the losses incurred by utilities from Winter Storm Uri. I began:

Texas ratepayers are on the hook for at least $10.1 billion in debt that was incurred during the deadly February 2021 storm and they will be paying off much of that debt for the next 30 years. Making matters worse, the surcharges added to consumers’ bills to repay that debt will come on top of soaring electricity rates. (More on that in a moment).

During the storm, wide swaths of Texas were hit by blackouts. Prices for both electricity and natural gas soared during the crisis. Dozens of lawsuits have been filed against gas and electricity providers and against ERCOT, the state’s electric grid operator. The litigation will likely take years to resolve. But whatever the outcome of the litigation, it’s readily apparent that Texas consumers will have to repay at least $10.1 billion in debt related to the storm and the state’s mismanagement of its most important energy network.

I concluded:

Two decades ago, when the Texas electric grid was — in the words used by the late Enron CEO, Ken Lay, “restructured” — politicians promised that ratepayers were going to benefit. In 1999, then-governor George W. Bush held a press conference during which he said the recently concluded legislative session delivered “the most far-reaching deregulation” of electricity “of any state in this United States“ and that it would “mean lower electric rates for people all across the spectrum.”

That hasn’t happened. Instead, the restructuring of the Texas electricity market resulted in the near collapse of the ERCOT grid in February 2021. Nor is the situation getting better. Instead, as Brent Bennett, Katie Tahuahua, and Mike Nasi of the Texas Public Policy Foundation, noted in a new report, the Texas grid is being overwhelmed by heavily subsidized wind and solar. In addition, the Texas grid is ever-more-reliant on natural gas-fired generators at the very moment when gas prices are soaring.

In short, last year’s disaster and the ensuing tsunami of costs related to it, are resulting in vastly higher electric rates for Texans all across the spectrum. And consumers will be paying higher prices for the state’s mismanagement of its electric grid for the next 30 years.

Again, here’s a link.

Today, I published another article in Forbes that updates the article I published on Wednesday. I did so because I was alerted to a report that has good numbers and shows the costs being imposed on consumers in other states due to Winter Storm Uri. I began:

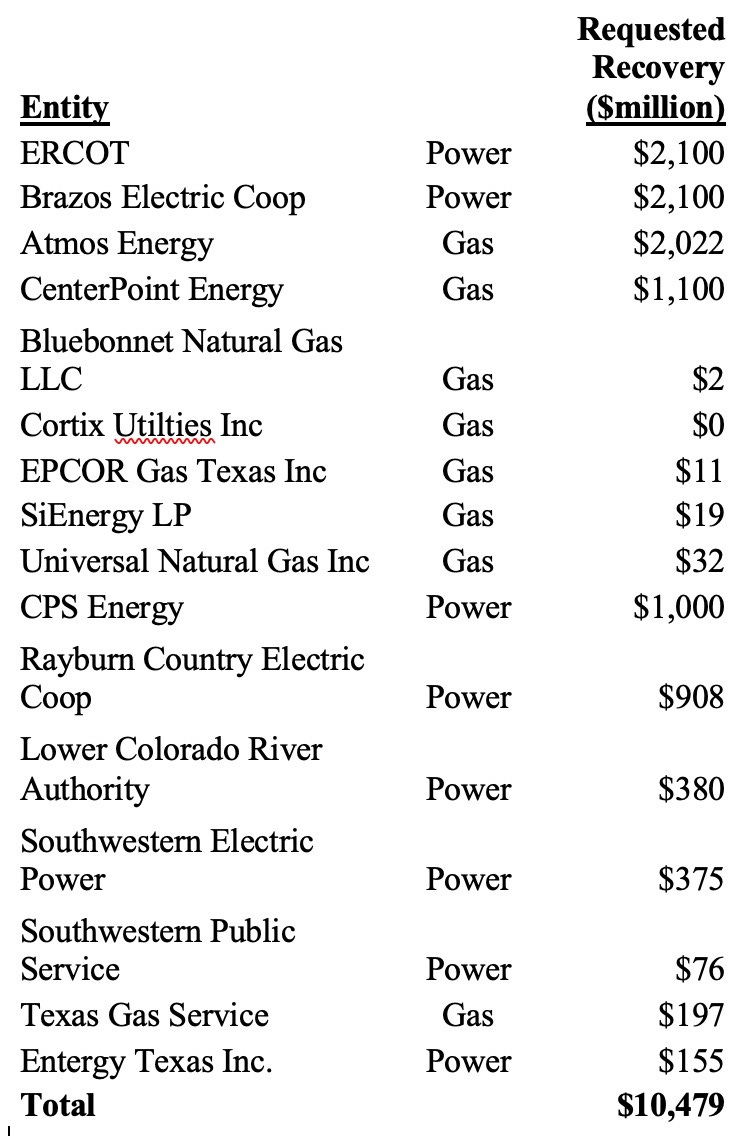

Two days ago in these pages, I estimated the utility debt related to Winter Storm Uri that will have to be repaid by Texas ratepayers may total $10.1 billion. Shortly after that piece appeared, I was alerted to an August 16 report commissioned by NRG Energy, a Houston-based independent power producer, titled “Beyond Texas: Evaluating Customer Exposure to Energy Prices Spikes, A Case Study of Winter Storm Uri, February 2021.” The report, done by consulting firm Intelometry, puts the total utility-related debt from the storm in Texas at $10.5 billion, a number that’s $400 million higher than what I reported... The Intelometry report lists the utilities that are seeking cost recovery in Texas, as well as the total losses incurred by utilities in other states during the deadly storm. And while Texas consumers are getting dinged, it’s clear that Oklahoma ratepayers are getting mugged. Intelometry reports that Oklahoma utilities – led by Oklahoma Natural Gas, which lost nearly $1.3 billion, and Oklahoma Gas & Electric which lost about $740 million — will recover a total of $2.8 billion from consumers.

I concluded:

Finally, as I mentioned in my piece on Wednesday, the increased costs that will be absorbed by ratepayers in the form of surcharges on their bills to pay for cost recovery to the electric and gas utilities will come on top of higher prices already being paid by Texas consumers. I also noted that data published by the Texas Public Utility Commission shows that electricity prices in several areas of the state more than doubled between June 2021 and June 2022. That matches with what I am hearing anecdotally. A friend of mine in Houston told me yesterday that the electric bill for his modest ranch-style house has nearly doubled over the past year, going from $335 per month to $637.

The $10.5 billion debt, which will be repaid over the next 30 years, along with today’s higher electricity prices show yet again, that ratepayers always get stuck with the bill.

Again, here’s a link.

And here's a list of the Texas entities that are requesting cost recovery:

Stephen Wilson on the "romantic poetry of renewable energy

I met Stephen Wilson through some mutual friends in Australia. I was first alerted to his work when I read his recent report on the future of nuclear energy in Australia. Wilson has spent nearly all of his career in the energy sector, including a stint at mining giant Rio Tinto. These days, he’s an adjunct professor at the University of Queensland.

In this episode, Wilson talks about the “church of electricity free markets,” why Australia’s electricity prices have been so volatile, the “romantic poetry of renewable energy,” and why regulators must play a bigger role in managing electric grids. I also asked him why coal continues to be such a dominant fuel. He replied simply: “it’s cheap gigajoules...it’s cheap energy... it’s much harder than people appreciate to get coal out of the global mix. It’s...because of its characteristics, because of the attractiveness of coal to the people that are using coal. And because of the relative attractiveness of the alternatives, the alternatives tend to be more expensive, the alternatives tend to reduce your security of supply, or make it even more expensive in order to mean in order to achieve the same security of supply.”

It was a very interesting conversation, particularly when we talked about electricity markets and deregulation. Here’s a link to the audio. As always, you can find the podcast on YouTube. Please give it a listen, and be sure to subscribe to my YouTube channel.

Subscribe to this "news" letter. Click here

New bird for us: Evening Grosbeaks in Taos

Fred Baca Park is about a mile southwest of the plaza in Taos. Lorin and I didn’t know what to expect when we got there. But the park was listed as a good birding spot. There was plenty of water in Rio Fernando, which runs through the park and we ambled onto an open tract of land that covered maybe four or five acres. We were the only ones there. At first, we didn’t see much activity but as we walked to one of the fences on the southern boundary of the park, we saw a group of birds perching in the trees and flying down to the ground. It took a while to identify them, but after winnowing down the list of possibilities, we decided we were seeing a new bird for both of us: Evening Grosbeaks (Hesperiphona vespertina). They are active, brightly colored birds and have the familiar thick beak that I recall seeing on the Rose-breasted Grosbeak. (The photo above was taken at Angel Fire, New Mexico in 2019 by Bettina Arrigoni.) Allaboutbirds says this:

Adult male Evening Grosbeaks are yellow and black birds with a prominent white patch in the wings. They have dark heads with a bright-yellow stripe over the eye. Females and immatures are mostly gray, with white-and-black wings and a greenish-yellow tinge to the neck and flanks. The bill is pale ivory on adult males and greenish-yellow on females... About the size of a Northern Cardinal, but more compact and thicker bodied; smaller than a Steller’s Jay or Blue Jay... These are social birds that are often found in flocks, particularly in winter. They forage in treetops for insect larvae during the summer, buds in spring, and seeds, berries, and small fruits in winter... they winter in forests and feed in both deciduous and coniferous trees, often at higher elevations. They breed in spruce-fir, pine-oak, pinyon-juniper, and aspen forests of northern North America and the mountains of the West.

Have a great weekend.

Want to help?

1. Share this email to your friends and colleagues. Or have them email me so I can add them to my distribution list.

2. Subscribe to the Power Hungry Podcast.

3. Rent or buy Juice on iTunes or Amazon Prime.

4. Buy A Question of Power: Electricity and the Wealth of Nations and give it a positive review.

5. Follow me and Juice on Twitter.

6. Need a speaker for your conference, class, or webinar? Ping me!

Watch Juice for free on Roku!

If you haven't seen our documentary yet, here's a reminder: you can watch Juice: How Electricity Explains the World, on Roku Channel, for free. Just click this link. If your friends haven't seen it, send them a link. Or if you have a prime membership, you can watch it on Amazon Prime.