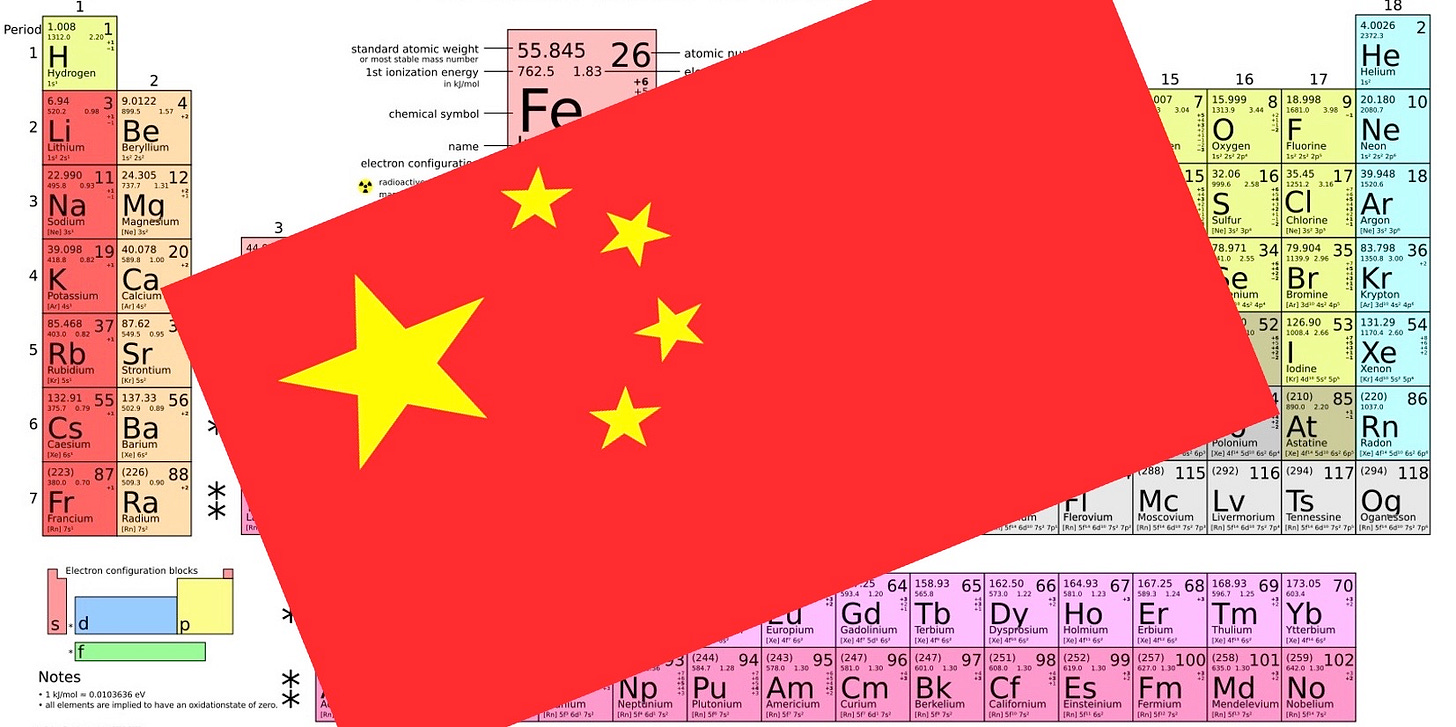

China Inc. Has The West In A Strategic Metals Stranglehold

A new IEA report shows Beijing has a near-monopoly on key metals, rare earth elements, and other critical commodities. These 10 charts spotlight China’s chokehold.

On Wednesday, Axios published comments from a top CIA official who declared that “China is the existential threat to American security in a way we really have never confronted before.” Deputy Director Michael Ellis also said his agency’s top priorities were to help the US maintain a “decisive technological advantage” in several areas, including AI, batteries, biotech, and computer chips.

Ellis said that the CIA is being restructured to deal with threats from China. It aims to hire more skilled people, including “more people with technical backgrounds...more STEM grads.” While America’s top spy agency is focusing on AI, batteries, and chips, China has spent the past three decades cornering the market on the metals, minerals, and other commodities needed to fabricate and mass-produce those very same technologies.

Ellis’ comments were published the same day the International Energy Agency released its Global Critical Minerals Outlook 2025. And the findings of that report are a sobering reminder that China has a near-monopoly on numerous key commodities. The IEA found that “China is the dominant refiner for 19 of the 20 minerals analyzed, holding an average market share of around 70%.” However, even that figure understates China’s dominance because it lumps all the rare earth elements (REEs) into a single line item. In reality, China’s grip is even tighter.

The IEA pays particular attention to the escalating trade war, which has led China to restrict the export of dozens of items. Here’s the key passage:

In a world of high geopolitical tensions, critical minerals have emerged as a frontline issue in safeguarding global energy and economic security. The wave of recent export restrictions highlights the strategic urgency of strengthening the resilience and diversity of critical mineral supplies as the world moves towards a more electrified, renewables-rich energy system. (Emphasis added.)

While the IEA pleads for “strategic urgency,” the facts show China’s grip on the commodities needed to produce computer chips, batteries, EVs, wind turbines, and other high-tech products is only tightening. Beijing is ratcheting export restrictions on everything from antimony to yttrium, and Western manufacturers are starting to feel the pain.

Here’s a deep dive into the new IEA report, with 10 charts.

Keep reading with a 7-day free trial

Subscribe to Robert Bryce to keep reading this post and get 7 days of free access to the full post archives.