The EPA's China Syndrome

Its EV rule will fuel China’s monopoly over NdFeB magnets.

Two years ago, about 40 environmental groups, including Friends of the Earth, 350 Action, Earthworks, Sunrise Movement, and Union of Concerned Scientists, signed a letter urging Congress and the Biden Administration to work with China on a “new internationalism” based on “open sharing of green technologies” as well as “resource sharing and solidarity.” They called on Biden and “all members of Congress to eschew the dominant antagonistic approach to U.S.-China relations and instead prioritize multilateralism, diplomacy, and cooperation with China to address the existential threat that is the climate crisis.”

They went on: “China is the world leader in industrial capacity across a number of clean energy industries” and that “working together could speed the transition away from dirty energy economies. It could also ensure that the countries and communities benefit from the local extraction of raw materials essential for clean energy supply chains.”

It’s important to recall the context of that July 7, 2021 letter. Friends of the Earth, Sunrise Movement, Union of Concerned Scientists, and the other groups published their epistle two weeks after the U.S. banned the importation of solar materials tied to forced labor in Xinjiang. As the New York Times reported on June 24, 2021, “The White House announced steps on Thursday to crack down on forced labor in the supply chain for solar panels in the Chinese region of Xinjiang, including a ban on imports from a silicon producer there... The action was notable given the Biden administration’s push to expand the use of solar power.”

It also came about a month after the U.S. State Department claimed the Chinese government was carrying “out a mass detention and political indoctrination campaign against Uyghurs, who are predominantly Muslim, and members of other ethnic and religious minority groups,” in Xinjiang province. The document also said that Chinese officials “use threats of physical violence, forcible drug intake, physical and sexual abuse, and torture to force detainees to work in adjacent or off-site factories or worksites producing garments, footwear...materials for solar power equipment and other renewable energy components.” (Emphasis added.)

The alt-energy NGOs may want “solidarity” and “cooperation,” but China Inc. isn’t ready for a cuddle.

On April 6, NikkeiAsia reported that “China is considering prohibiting exports of certain rare-earth magnet technology in a move that would counter the U.S.'s advantage in the high-tech arena.” It continued, “Officials are planning amendments to a technology export restriction list, which was last updated in 2020. The revisions would either ban or restrict exports of technology to process and refine rare-earth elements. There are also proposed provisions that would prohibit or limit exports of alloy tech for making high-performance magnets derived from rare earths.”

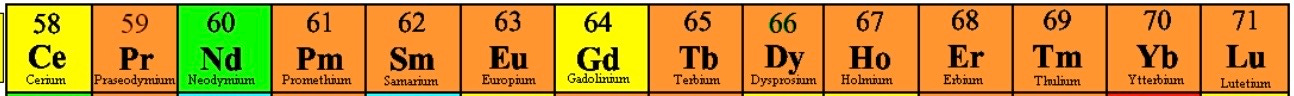

The magnets at issue are known as neodymium-iron-boron (NdFeB) magnets. Those magnets are critical components in electric vehicles and wind turbines as well as in military applications like ship propulsion systems and guided-missile actuators. (They’re also used in a wide range of consumer products, including water pumps, loudspeakers, phones, and refrigeration compressors.)

On April 12, just six days after that NikkeiAsia story was published, the EPA announced pollution rules that could require up to two-thirds of all the new vehicles sold in America to be fully electric by 2032. If U.S. automakers are going to dramatically increase their production of EVs over that time frame, the only way they will be able to do so is by buying more NdFeB magnets from China.

Before going further, let’s put the EPA’s proposed rule in perspective. The U.S. will manufacture about 15 million cars and light trucks this year. Thus, in less than a decade, the EPA, without so much as a by-your-leave from Congress, is aiming to require domestic carmakers to be stamping out 10 million EVs per year. For further perspective, that’s roughly equal to all of the EVs that were sold globally in 2022.

In an article published on April 12, the Associated Press quoted EPA Administrator Michael Regan as saying the EV mandate “will accelerate our ongoing transition to a clean vehicle future, tackle the climate crisis head-on and improve air quality.” The AP also quoted Margo Oge, a former EPA official in the Obama administration, who called the EPA rules the “single most important regulatory initiative by the Biden administration to combat climate change.”

It must be noted that the AP did not mention that Oge serves on the advisory council of one of the richest climate-focused NGOs in America, Climate Imperative. As I reported in these pages back in January, in The Billionaires Behind The Gas Bans, Climate Imperative “is the newest and richest anti-hydrocarbon, anti-natural gas group you’ve never heard of.” Climate Imperative is a dark money NGO. It took in $221 million in its first full year of operation but did not disclose the identities of any of its donors. Climate Imperative and other members of the anti-industry industry are providing tens of millions of dollars per year to groups that are pushing to “electrify everything” including transportation. The effort is being boosted by high-profile academics from elite schools like Princeton, Stanford, and Middlebury, as well as another dark-money NGO, Rewiring America.

The electrify everything scheme is also being promoted by Tesla Inc., the biggest EV maker in the U.S. Last month, it released a report which claimed that a “fully electrified and sustainable economy is within reach.” (See my April 7, piece, Elon’s Terrible, Horrible, No Good, Very Bad Battery Math.) But Tesla’s report, humbly titled “Master Plan Part 3,” didn’t contain a single mention of China, nor did it mention the word “magnet.”

Nor do the words “China” and “magnet” appear in the EPA’s April 12 fact sheet on the new rule. Nor do those words appear in the EPA’s fact sheet titled “Proposed Standards to Reduce Greenhouse Gas Emissions from Heavy-Duty Vehicles For Model Year 2027 and Beyond.” Nor do they appear in the agency’s 688-page “draft regulatory impact analysis” called “Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium Vehicles.”

The EPA’s ignorance and/or intentional omission is nothing short of stunning.

Other agencies in the U.S. government have repeatedly warned about China’s dominance of the magnet sector. In February 2022, the Department of Energy issued a report titled “Rare Earth Permanent Magnets: Supply Chain Deep Dive Assessment.” It said, “Nearly all supply chain stages are concentrated in China and the chemistry associated with processing rare earths is challenging, expensive, and hazardous. Furthermore, substitution is difficult through the supply chain due to the unique characteristics and technical advantage of rare earth magnets.”

Last September, the Commerce Department issued a report which projected that U.S. demand for NdFeB EV magnets would quintuple between 2020 and 2030 to 10,000 tons per year. It further estimated it would hit 23,000 tons per year by 2050. The report also found that America’s dependence on imported NdFeB magnets meets the statutory definition of threatening national security. Here’s the key sentence: “Based on the findings in this report, the Secretary concludes that the present quantities and circumstances of NdFeB magnet imports threaten to impair the national security as defined in Section 232 of Trade Expansion Act of 1962, as amended.” It continued, noting that the U.S. “has extremely limited capacity to manufacture NdFeB magnets and is nearly one hundred percent dependent on imports to meet commercial and defense requirements. In 2021, the United States imported 75 percent of its sintered NdFeB magnet supply from China, with nine percent, five percent, and four percent coming from Japan, the Philippines, and Germany, respectively.”

Despite that finding, as the law firm Mayer Brown noted, the Commerce Department “stopped short of recommending the imposition” of tariffs on magnet imports and instead offered “recommendations to develop and promote a US- and ally-driven supply chain for NdFeB magnets.”

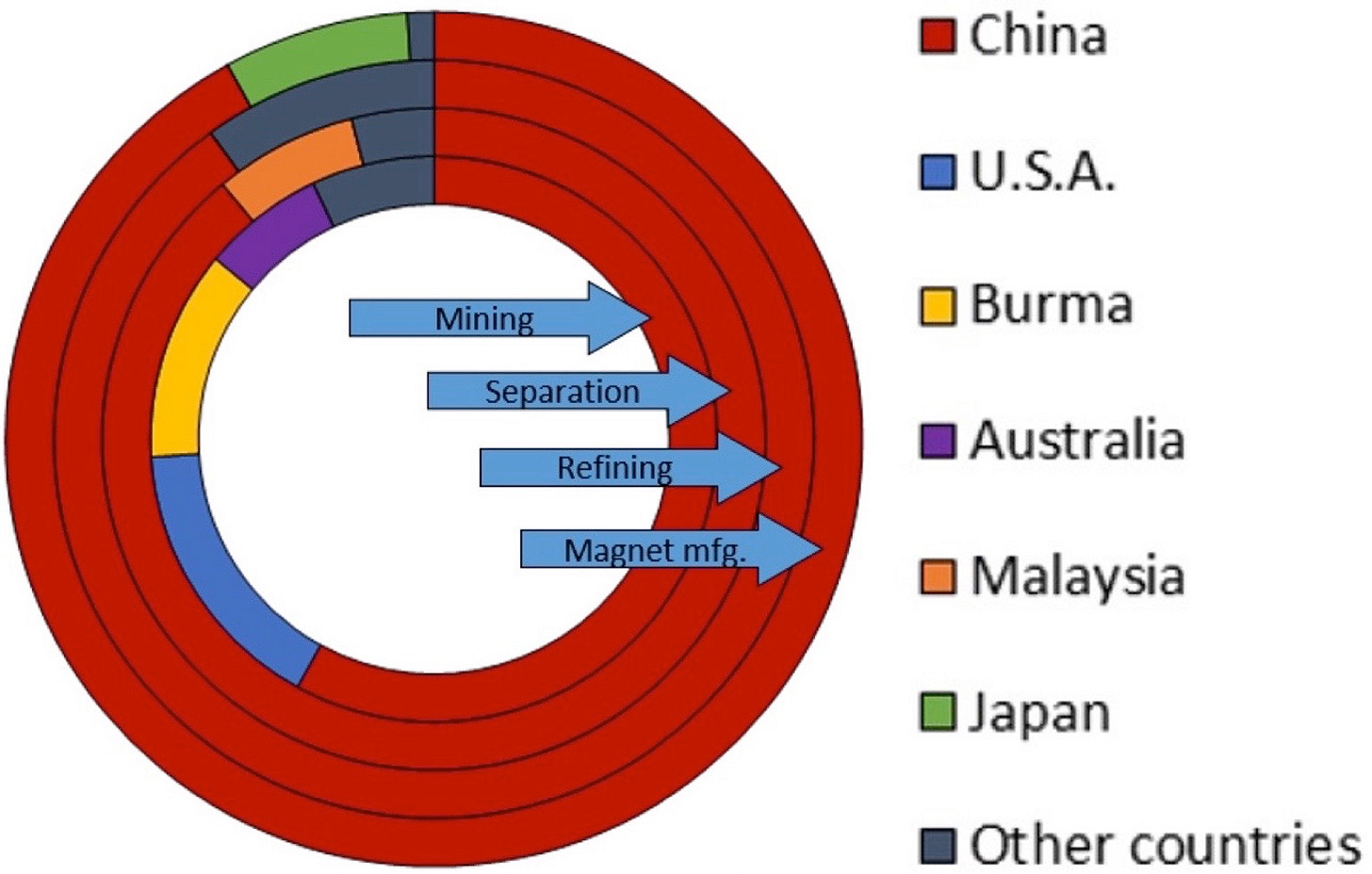

The reason the Biden administration didn’t impose tariffs is obvious: Doing so would have raised the cost of EVs at the same time that the climate activists in the administration were pushing for more EV production. But that’s only part of the story. The Commerce Department’s report clearly shows that it will take years, or even decades, before the U.S. and its allies will be able to produce enough magnets to escape China’s de facto magnet monopoly. Page 8 of the Commerce report lays out the situation in stark terms: “China dominates all steps of the global NdFeB magnet value chain. In 2020, China controlled about 92 percent of the global NdFeB magnet and magnet alloy market. China also dominated the 2020 upstream value chain steps, controlling about 58 percent of the rare earth mining market, 89 percent of the oxide separation market, and 90 percent of the metallization market.”

It then provides a telling mention of terbium and dysprosium: “China controls an even higher percentage of the heavy rare earth mining market, including dysprosium and terbium, which are critical for high-performance NdFeB magnets.” (Emphasis added.)

It continues, saying “China’s dominant position in the global NdFeB magnet value chain enables it to set prices at levels that can make production unsustainable for firms operating in market economies. China is the only country with operations in all steps of the NdFeB magnet value chain including upstream (mining, carbonates production, and separation to oxides) and downstream (metal refining, alloy production, and final magnet production) markets. All other countries maintain operations in only some steps of the upstream or downstream magnet value chain...The NdFeB magnet value chain’s fragmentation means that even countries which produce NdFeB magnets remain dependent in part on Chinese inputs.”

James Kennedy is the president of ThREE Consulting, a St. Louis-based firm that specializes in rare earth elements and critical minerals. In a report published May 2, he and his co-author, John Kutsch, emphasized the importance of terbium and dysprosium. “Currently, no one can make a high-operating-temperature NdFeB magnet without Chinese controlled inputs of separated Tb and Dy –– and there are no substitutes for these elements. This is a major distinction. Standard NdFeB magnets, without Tb or Dy, cannot be used in high-temperature applications such as EV critical components (drive motors and braking systems), wind, or weapons systems. If any country/company wants to produce high-value pre-magnetic REE alloys, they must purchase separated Tb and Dy oxides from China.”

In a phone interview, Kennedy told me the “Biden administration is mandating EVs. What they are mandating is that our supply chains are wholly dependent on China and Chinese suppliers.” He continued, saying that China will sell to us “as long as it serves their purpose. We are locking in China’s monopoly for another decade.”

Automakers are aware of China’s pivotal role in the EV supply chain. Consider this statement in Ford Motor Company’s latest 10-Q filing with the SEC:

Steps taken by governments to apply or consider applying tariffs on automobiles, parts, and other products and materials have the potential to disrupt existing supply chains, impose additional costs on our business, and may lead to other countries attempting to retaliate by imposing tariffs, which would make our products more expensive for customers, and, in turn, could make our products less competitive. In particular, China presents unique risks to U.S. automakers due to the strain in U.S.-China relations, China’s unique regulatory landscape, and the level of integration with key components in our global supply chain. (Emphasis added.)

Last month, two members of Congress introduced a bill that will offer a production tax credit for rare-earth magnets. The measure would pay $20 per kilogram for magnets that are manufactured in the United States and “$30 per kilogram for magnets that are both manufactured in the United States and for which all component rare earth material is produced and recycled or reclaimed wholly within the United States.”

But ramping up production of NdFeB magnets will take years. One company, USA Rare Earth, has plans to mine rare earths in Texas and build a magnet-production facility in Oklahoma. But it’s not clear from the company’s website that it has begun mining or building the plant. The company’s “career opportunities” page lists just one opening and it is for a technical accountant that will be based in Tampa, Florida. MP Materials, a publicly traded company that operates the Mountain Pass rare-earth mine in California, broke ground on a magnet plant in Fort Worth last year. But the Department of Commerce notes that at full production, it will only be making “enough NdFeB magnets to power 500,000” new EVs per year. That’s a far cry from the millions of new EVs per year that the EPA is mandating.

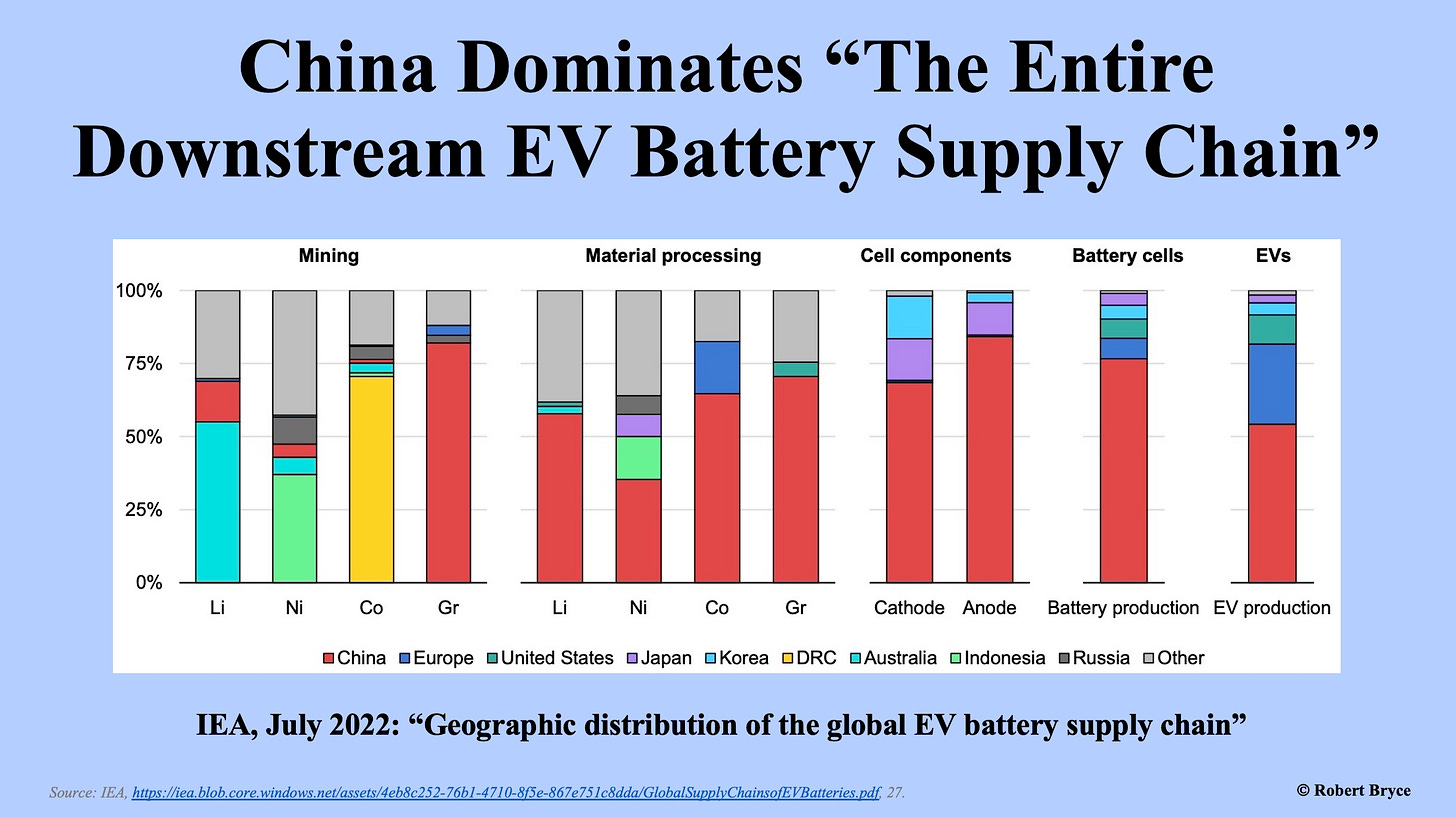

In addition to magnets, China has a commanding position in nearly every other aspect of the EV market. Last year, the International Energy Agency issued a report called “Global Supply Chains of EV Batteries,” which said “today’s battery and minerals supply chains revolve around China.” As can be seen in the slide above, which features a graphic from the IEA report, China dominates, in the words of the IEA, “the entire downstream EV battery supply chain.” That dominance includes the processing of Lithium (Li), Nickel (Ni), Cobalt (Co), and Graphite (Gr), as well as the production of anodes, cathodes, battery cells, and finished EVs.

I will close by noting that none of these developments in the EV or NdFeB magnet markets are new. I wrote about U.S. dependence on rare earths from China back in 2010, in my fourth book, Power Hungry: The Myths of “Green” Energy and the Real Fuels of the Future. (See chapter 13.) What is surprising is how little attention these issues have gotten over the years, and how assiduously the Biden administration and the climate claque are ignoring the problems. The challenge goes beyond protectionism. The U.S. is increasingly at odds with China over Taiwan and it appears China is moving closer to Vladimir Putin and Russia. It is also strengthening its ties with Iran and Saudi Arabia.

Despite these facts, Biden’s EPA wants to make one of America’s most important sectors, the automobile business –– an industry that accounts for about 5% of GDP and some $100 billion per year in exports –– more beholden to China. And it is doing so at the very same time that China is developing plans to restrict exports of the NdFeB magnets needed to make the EVs that the EPA is mandating.

If China does cut off the flow of NdFeB magnets to the U.S., or hikes prices, or restricts exports of elements like terbium and dysprosium –– or the technologies needed to make magnets –– no one should be surprised. We were warned.

Before you go: If you like this piece, please hit the ♡ like button. And if you’ve hit the like button, make sure to subscribe and share this article.

Also please note that this Substack is free and will continue to be free for a while. It’s free because I make my living as a public speaker. If you want me to speak at your event, please contact me. And since I’m in self-promotion mode, don’t forget the Power Hungry Podcast. This week, I had a great conversation with Ruy Teixeira about how the Democratic party has lost touch with working-class Americans. Check it out on my YouTube channel.

Article summary: Environmentalists are going to ruin us and Biden sits by and claps like a seal.

To be honest, I prefer driving electric cars- but of course I live in a European city and probably drive once per month... so I am not under any illusion that my situation is the same as folks outside major cities in the US.

The EPA is the same agency that makes disposal of Thorium based “wastes” from rare earth ore processing essentially impossible.

All of this is going to fall apart eventually, but how to limit the damage in the short term? Part of me wants to let the EPA continue to dig its heels in, and then maybe there will be momentum to destroy the agency and put in place something more practical. Or maybe society will collapse and we will live in mud huts like the NGOs want...