Dr. Copper Takes Off

Trump's tariff plan sent copper prices to a record high on Tuesday. Will Cu prices stay high? Is copper investable? Here’s a deep dive with 11 charts.

There’s no shortage of bullish calls on copper.

In 2021, Goldman Sachs declared that “copper is the new oil.” In 2022, Daniel Yergin and several colleagues at S&P Global declared that global copper demand “will double by 2035, opening up a supply gap that threatens climate goals and poses serious challenges” to the net-zero mandates that have been made by various governments around the world. They also estimated that doubling global copper production would require spending more than $500 billion.

In 2023, an article in Mining.com said, “the road to reaching net zero begins and ends with copper. All infrastructure built to support renewable energy uses large amounts of copper, as the metal is a highly efficient conductor of electricity and heat.”

In January, Fatih Birol, the executive director of the International Energy Agency, published a piece on LinkedIn, declaring, “The approaching Age of Electricity is powering a big surge in copper demand, driven by grids, batteries, EVs & renewables.”

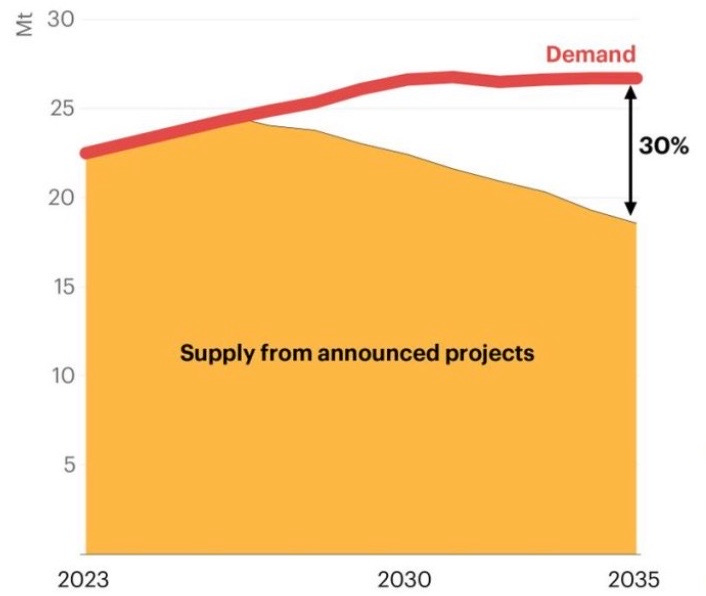

In that article, Birol published the chart above, which claims that based on today’s project pipeline, “the world could see a 30% copper supply deficit by 2035.”

“Doctor Copper” has long been a barometer for the overall health of the economy. Rising copper prices indicate a growing economy, and falling prices suggest a contraction. But can the world’s copper mines ramp up copper production by 30% in just 10 years? Or, as Yergin and his colleagues claimed, could demand for the metal double by 2035?

Those questions provide the backdrop to President Trump’s announcement on Tuesday that he plans to slap a 50% tariff on copper imports. The copper market quickly reacted, with futures prices jumping by as much as 15% to all-time highs of about $5.50 per pound. Copper prices have increased by nearly 40% this year.

I’ve been thinking about the global copper market since last fall, when I went to Chile to do a speaking engagement to employees and customers of Sigdo Koppers, a Santiago-based company that supplies the global mining industry. The questions I had when I was in Chile are similar to the ones I have now. Is the surge in copper prices temporary? Will demand grow as fast as the analysts are claiming? Can ordinary investors make money on copper?

Here’s a close look at the copper sector, with 11 charts.

Keep reading with a 7-day free trial

Subscribe to Robert Bryce to keep reading this post and get 7 days of free access to the full post archives.