Drill, Baby, Drill

Exxon Mobil's purchase of Pioneer proves the Permian Basin is still the hottest hydrocarbon province on earth

In 1948, shortly after graduating from Yale with a degree in economics, George H.W. Bush moved to the Permian Basin to seek his fortune. He left the East Coast with his wife, Barbara, and their two-year-old son, George W., and settled in the windblown desert town of Odessa, Texas.

Odessa was booming. Over the preceding decade, the population had tripled to about 29,000 people. The town’s population would nearly triple again during the 1950s as drillers, laborers, bankers, and manufacturers flooded into the region to tap one of America’s most productive oilfields. Between 1948, when Bush began working as an equipment clerk for the International Derrick & Equipment Co., and the mid-1950s, oil production in the Permian more than doubled to about 1.2 million barrels per day. Over the next 20 years, oil production in the Permian would double again.

Today, the Permian produces nearly 6 million barrels of oil and 24 billion cubic feet of natural gas per day, and it’s the hottest hydrocarbon province on the planet.

I would gladly wager $100 that more oil and gas wells have been drilled within a 100-mile radius of Odessa than anywhere else in the world. And yet, the Permian Basin continues to produce staggering volumes of hydrocarbons and attract stunning amounts of capital. Proof of that came today when Exxon Mobil announced it was acquiring Pioneer Natural Resources in a deal worth $64.5 billion. In a press release, Exxon said the merger will result in a company with “an estimated 16 billion barrels of oil equivalent resource in the Permian. At close, ExxonMobil’s Permian production volume would more than double to 1.3 million barrels of oil equivalent per day (MOEBD), based on 2023 volumes, and is expected to increase to approximately 2 MOEBD in 2027.”

The purchase of Pioneer is Exxon’s largest acquisition since the late 1990s. The oil giant clearly believes that America will need hydrocarbons for many decades to come. The purpose of this article isn’t to argue the merits of this deal or the price Exxon paid. Instead, it’s to underscore the size and importance of the Permian Basin to U.S. energy supplies and domestic energy security.

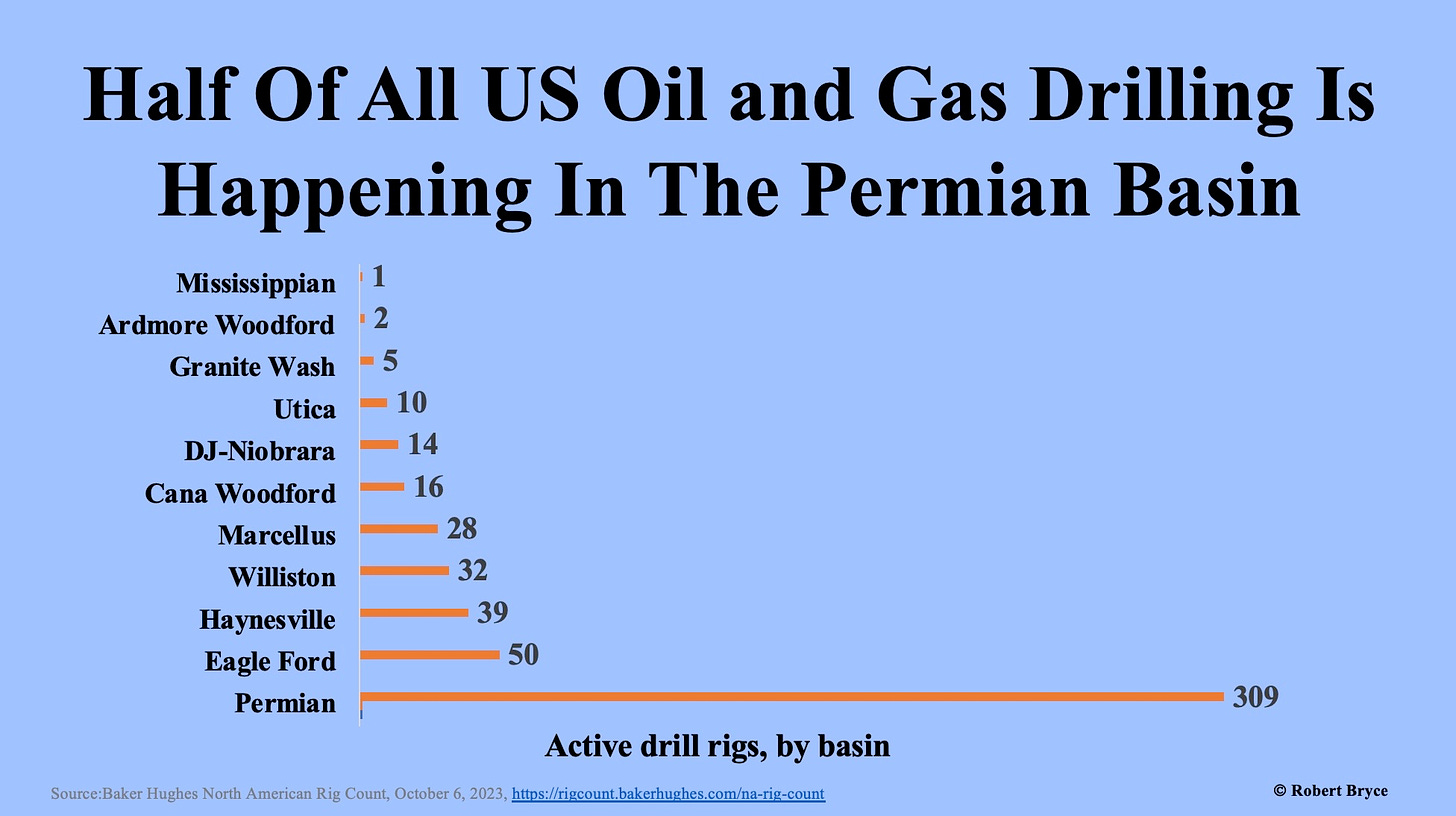

According to the latest Baker Hughes drilling report, about 619 drilling rigs are operating in the United States. Of that number, half, or 309, are drilling in the Permian. Further, as seen in the graphic above, the Permian has six times more active drilling rigs than the next basin, the Eagle Ford, which is also in Texas.

The rumors about the Exxon-Pioneer merger started in April, shortly before I had Pioneer’s CEO, Scott Sheffield, on the Power Hungry Podcast to discuss his company’s operations in the Permian. When I asked Sheffield why the Permian has been so prolific for so long, he said, “It’s all about the source rock.” He said Pioneer had been targeting conventional deposits for years and was focused on drilling vertical wells. But over time, Pioneer and other companies realized that the Permian is like a “layer cake with several zones.” Over several years, with lots of trial and error, upstream companies got better at drilling and completing wells. They figured out how to get more sand into the well bores. In doing so, they found the more sand they could get into the well bore, the more oil and gas they could produce. They also began drilling longer horizontal segments, called laterals. A few years ago, companies were drilling laterals of about 5,000 feet. Today, laterals are three or four times that length. Sheffield told me that of the 500 wells that Pioneer will drill in 2023, more than 100 will have laterals of 15,000 feet or more.

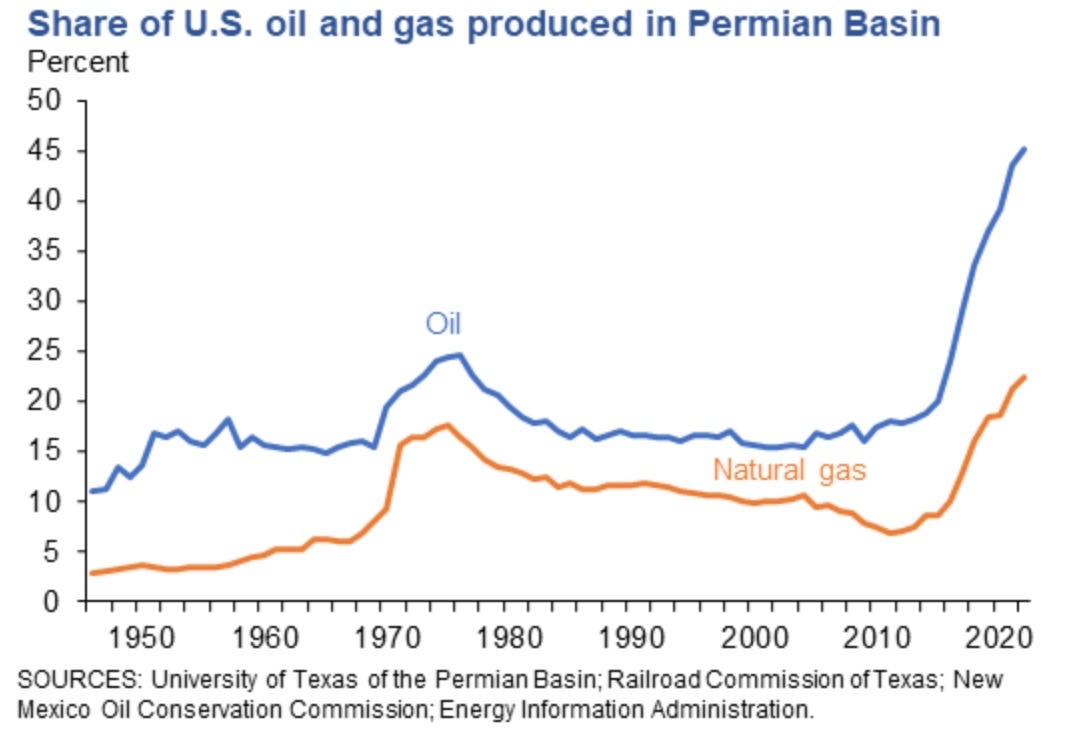

The combination of the Permian Basin’s favorable geology and continuing improvements in drilling and completions has resulted in enormous increases in oil and gas production. As seen in the graphic above, published by the Federal Reserve Bank of Dallas, since 2010, hydrocarbon production in the Permian has increased by a factor of four.

Indeed, the surge in production over the past decade has been nothing short of astonishing. As seen above, the Permian now accounts for more than 40 percent of U.S. oil production and about 20% of U.S. gas production.

The Permian also holds an almost mythic stature in Texas history. The University of Texas System has collected billions of dollars in royalties from oil and gas production on University Lands in the Permian Basin. The history goes back to a well called the Santa Rita No. 1, drilled in Reagan County in 1923. The gusher of oil from that well helped ignite interest in the Permian. The University of Texas owns more than 2 million acres of land in West Texas. Its endowment now totals more than $42 billion, much of which came from royalties it collects from hydrocarbon production in the Permian.

To be sure, oil and gas producers in the Permian Basin face many challenges. I talked about those issues with Sheffield back in April. The region doesn’t have enough electricity to run its rigs, pumps, and processing plants. There’s a continuing need for water to do hydraulic fracturing. There are myriad challenges in handling the enormous volume of produced water that comes out of oil and gas wells in the Permian. The disposal of that produced water has caused seismicity problems in the region. Sheffield told me that Pioneer alone produces about 1.4 million barrels of water per day. That means the company is producing more than two barrels of water for every barrel of oil it pulls out of the ground.

All of those challenges loom large. But Exxon’s purchase of Pioneer shows that more consolidation of the domestic oil industry will likely happen over the coming months, particularly in the Permian Basin.

As always, please click that ♡ button.

Don’t forget to subscribe and share.

Check out the Power Hungry Podcast, including my latest interview with Patrick T. Brown of the Breakthrough Institute.

Thanks.

Thank you, Robert Bryce for this very informative article!

How can I subscribe? I clicked on subscribe, but it said I can’t subscribe from this app. I like being informed about this topic of production of natural gas and fuel.

I think the lefts idea of “green energy” is really stupid and radical and we cannot rely on Socialist and Communist countries to supply our entire country.

Good news! I had heard your podcast with Mr. Sheffield back in April and found it very informative. I am pleased that Exxon is not being hamstrung by the many law suits being brought on by the climate activists whose mission is to stop the production of hydrocarbon fuel. I hope these activists realize their misguided vilification of the fossil fuel industry. Our lives are much better for them!

Focusing on the supply of hydrocarbons will do little to reduce greenhouse gas emissions, while making them more expensive and disproportionately hurt the impoverished. Where is social justice in that?