Unplugged: Ford Lost $72,762 For Every EV It Sold In Q2

“Moment of truth” hits as EV sales fall, costs soar.

A few weeks ago, Mark Fields, the former CEO of Ford Motor Company, during an interview on CNBC, said that the "moment of truth" for electric vehicles was arriving. Fields, who headed the Dearborn-based automaker from 2014 to 2017, said that "it's harder for consumers to charge your vehicle than to fill up a tank of gas right now, and that's weighing heavily.”

On Thursday afternoon, Fields’s prediction was confirmed when Ford reported a $1.08 billion operating loss on its EV business during the second quarter. During that span, Ford sold 14,843 EVs. That means Ford lost about $72,762 for each EV it sold. That’s an even bigger loss than what the company saw during the first quarter and they portend even bigger losses ahead. Ford lost $2.1 billion in its EV business in 2022. And as I explained here in May:

Ford’s 2022 losses were only a warm-up lap. Yesterday afternoon, Ford reported a $722 million loss on its EV business over the first three months of 2023. During that span, Ford sold 10,866 EVs, meaning it lost $66,446 for every EV it sold. For perspective, Ford lost the equivalent of a brand-new Mercedes-Benz E-class sedan on every EV it sold during the first quarter. (An E 450 4Matic has an MSRP of $66,700.)

During the second quarter, the company’s per-unit EV losses jumped by another $6,316. But the bad news at Ford isn’t limited to the fact that it’s losing scandalous amounts of money on its EVs. Ford is also predicting even bigger losses ahead and its EV sales are falling at the very moment the company is spending $50 billion to dramatically expand its EV production.

Why should you care? Ford’s getting a big chunk of that $50 billion from taxpayers. More on that in a moment.

Of course, Ford is trying to slap a smiley-face bumper sticker on its EV troubles. In a press release, Ford’s CEO, Jim Farley, said the shift to “breakthrough EVs is underway and going to be volatile, [sic] so being able to guide customers through and adapt the pace of adoption are big advantages for us.” From there, the spin went into 8-speed overdrive, with Farley saying “The near-term pace of EV adoption will be a little slower than expected, which is going to benefit early movers like Ford...we’re making smart investments in capabilities and capacity around the world; and, while others are trying to catch up, we have clean-sheet, next-generation products in advanced development that will blow people away.”

Ford may be an early mover. But as the old saying goes, the early bird might get the worm, but the second mouse gets the cheese.

In March, the company warned that it will lose some $3 billion on its EV business this year. But on Thursday, Ford upped the ante, saying its EV-related losses this year will be a whopping $4.5 billion. The company blamed “the pricing environment, disciplined investments in new products and capacity, and other costs.”

If you ignore the EV business, Ford had a solid quarter. It sold 531,662 vehicles, an increase of 10% compared to the second quarter of 2022 and 12% more than the 475,906 vehicles it sold in the first quarter. Ford's internal combustion engine (ICE) vehicle sales grew by 10%. Ford’s cash machine, its F-series trucks, saw a huge increase in sales, jumping 34%, year over year. Hybrid vehicle sales climbed 15.7%, year over year, to 34,589.

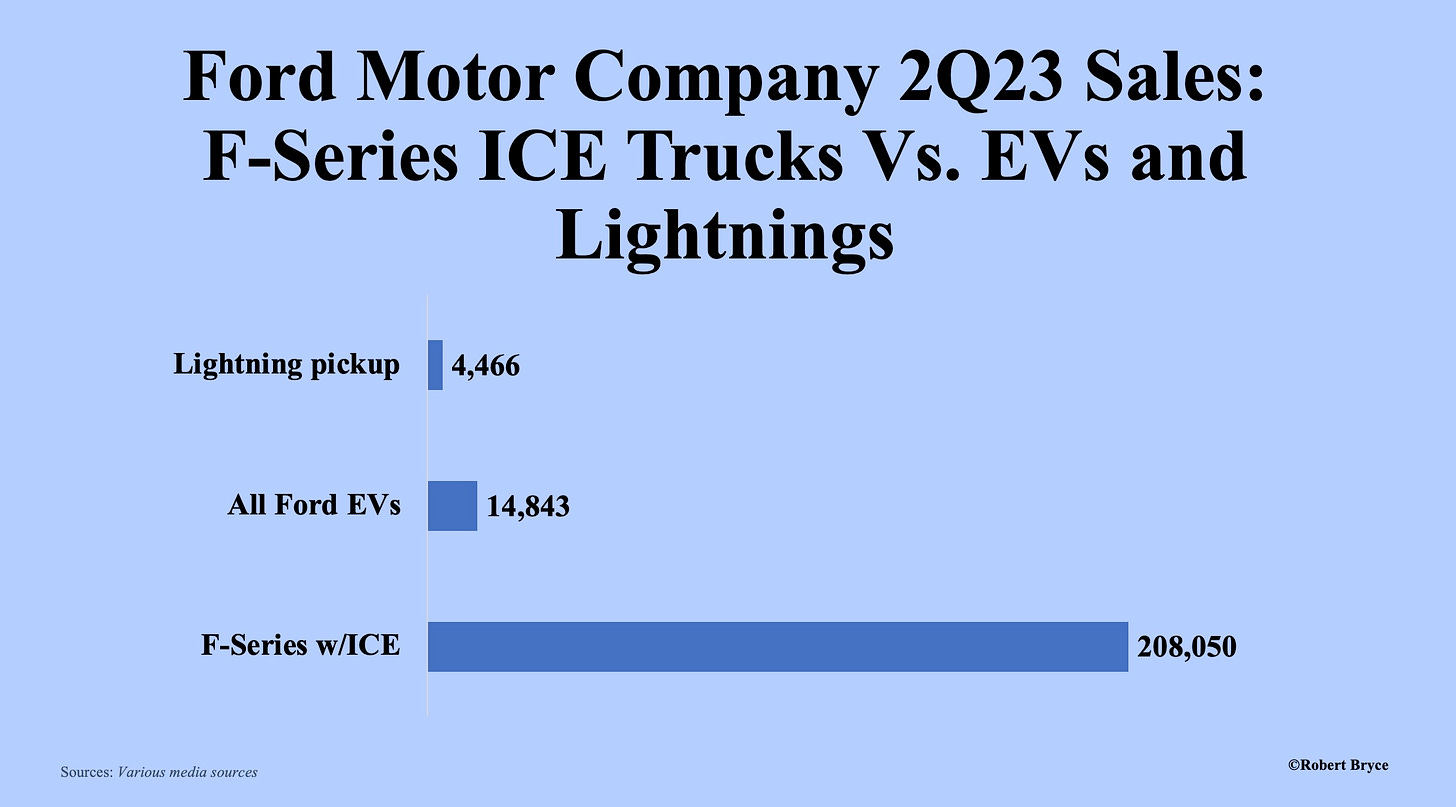

In all, Ford sold 212,516 F-Series pickups including Lightning EVs, in the second quarter. (Lightning sales totaled 4,466.) For comparison purposes, I backed out the electric trucks from the F-Series total. As can be seen in the graphic above, during the second quarter, Ford sold about 47 times more F-series ICE pickups than it did electric ones. While that may not be a fair comparison given that the Lightning is new to the market, it gives a sense of the scale of Ford’s massive truck business and the amount of ground the company will have to cover if it hopes to make a dent in Tesla’s dominance of the EV market.

Here’s more from the Thursday press release: “Farley said that Ford now expects to reach a 600,000-unit EV production run rate during 2024.”

That’s an ambitious target given the company’s flaccid EV sales. Remember, at the current sales rate, Ford is moving about 60,000 EVs per year. Thus, Ford will have to see a 10-fold increase in its EV sales in the next 18 months to justify a run rate of 600,000 EVs per year. That’s a particularly difficult objective given that Ford’s EV sales aren’t growing, they’re falling.

In the second quarter of last year, the company sold 15,527 EVs. Ford sold just 14,843 EVs during the second quarter of this year. Furthermore, sales of the Mustang Mach-E, the company’s flagship sedan, fell 21.1% year-over-year. And as Electrek noted, that “decline comes after Mach-E sales were down 20% in the first three months of the year. Year-to-date sales of the electric SUV are down 20.6%.”

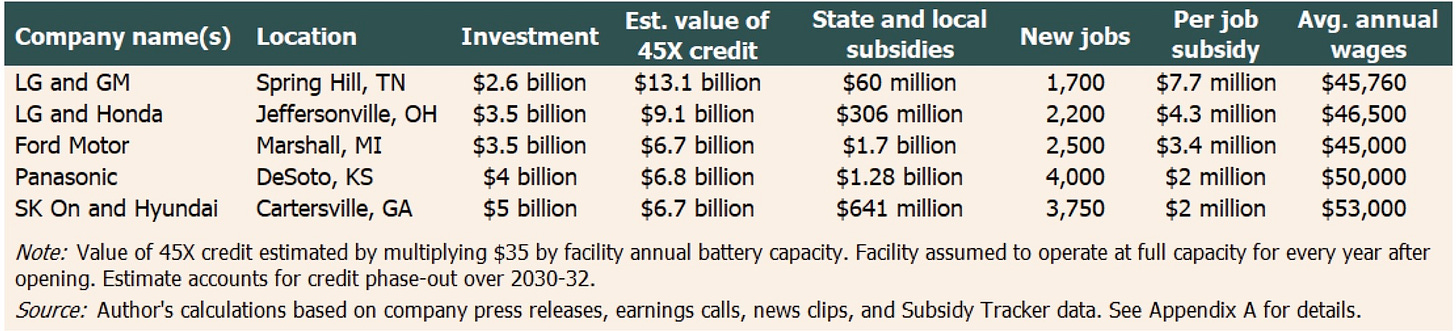

For a business segment that’s supposed to represent Ford’s future, having — in Farley’s words — adoption that’s “a little slower than expected” is terrible news. That slower-than-expected adoption could be particularly bad news for U.S. taxpayers. Last month, the Department of Energy announced it would give Ford a $9.2 billion low-interest loan to build additional battery factories, two in Kentucky and one in Tennessee. Further, as I reported on July 18, Ford stands to collect about $6.7 billion in federal tax credits for a battery factory it is building in Marshall, Michigan. When adding the state and local subsidies of $1.7 billion, each of the 2,500 “green” jobs at the new Ford plant will cost taxpayers $3.4 million.

As can be seen in the chart above, which was produced by Good Jobs First, Ford isn’t the only company luxuriating in the climate corporatism that’s being funded by the Inflation Reduction Act. Nevertheless, its EV business is one of the most obvious examples of corporate rent-seeking in recent memory. If Ford believes in EVs, why isn’t it spending its capital on the business instead of taxpayer money? That’s a relevant question given that Ford’s EVs are piling up on dealer lots. As I reported on July 18:

There are plenty of Mach-Es here in Austin. A search on Cars.com found 75 of them within 20 miles of my house. To confirm this, I stopped by a large Ford dealer yesterday afternoon. The dealer had 23 Mach-Es in stock. Most were selling for more than $50,000. The dealer also had six F-150 Lightnings in stock, the cheapest of which was selling for $73,000.

On Thursday, ten days after I did the reporting for that article, I did a similar search on Cars.com. The supply of new Mach-Es had increased by 13 vehicles, with 88 available within 20 miles of my house. I also did an online check of the inventory at the dealership that I visited on July 17 and got a similar result: Over that 10-day period, the inventory of Mach-Es on the lot had grown from 23 to 29. The supply of Lightnings hadn’t changed. The dealer still had six available, the cheapest of which cost $73,000.

The summary here is obvious: Ford’s EV sales are falling at the same time that the cost of making EVs is soaring. The moment of truth that Mark Fields warned about appears to be arriving. It could be an ugly collision.

Before you go, please click that ♡ button.

If you haven’t done so, please subscribe (and share). Thanks.

Thank you for highlighting this waste of shareholder resources. I’m trying to think of a historic analog for such capital misallocation, but am struggling.

Ford’s employees and suppliers will pay the bill for 21st century Edsel.

It’s particularly sad because Ford would have saved a lot more CO2 by meeting demand for the hybrid Maverick rather than attempting to bottle a bit of eau de Musk.

The Laws of Physics, Thermodynamics, and Economics are ultimately not on the side of EVs or "renewables".