China Is The Big Winner Of North American EV Policies

My article from Wednesday’s Financial Post. Plus, a revealing quote from the CEO of the Energy Institute: "Arguably, the transition has not even started.”

About two weeks ago, Terence Corcoran, the veteran Canadian journalist at the Financial Post, asked me to write a short piece about China’s dominance of EV supply chains. Given that I have written extensively about that issue, I gladly accepted. The text of that piece is below. You may read the original piece online here. My article appeared alongside a sharp piece written by economist Ross McKitrick, titled “EV mandates don’t make economic sense.” McKitrick, an economics professor at the University of Guelph, explains that Canada’s EV mandates will raise the cost of conventional vehicles, but those higher prices “won’t cover the losses on the EV side, so the industry will go into overall losses by the late 2020s.” He concludes by saying that the EV mandate “will destroy the Canadian auto industry.”

The EV mandates in the U.S. and Canada are a giant loser for industry and motorists. As I noted here in February, Ford Motor Co. lost more money on EVs in 2023 ($4.7 billion) than it made in net profit ($4.3 billion.) As for consumers, the Biden administration’s effort to force the electrification of the transportation sector will result in massive costs that will be borne by drivers and ratepayers. How much will it cost? A recent report by economist Jonathan Lesser for the National Center for Energy Analytics estimated that upgrading the electric grid and other infrastructure needed for an all-EV system will cost between $2 trillion and $4 trillion.

Now, here’s my piece from the FP:

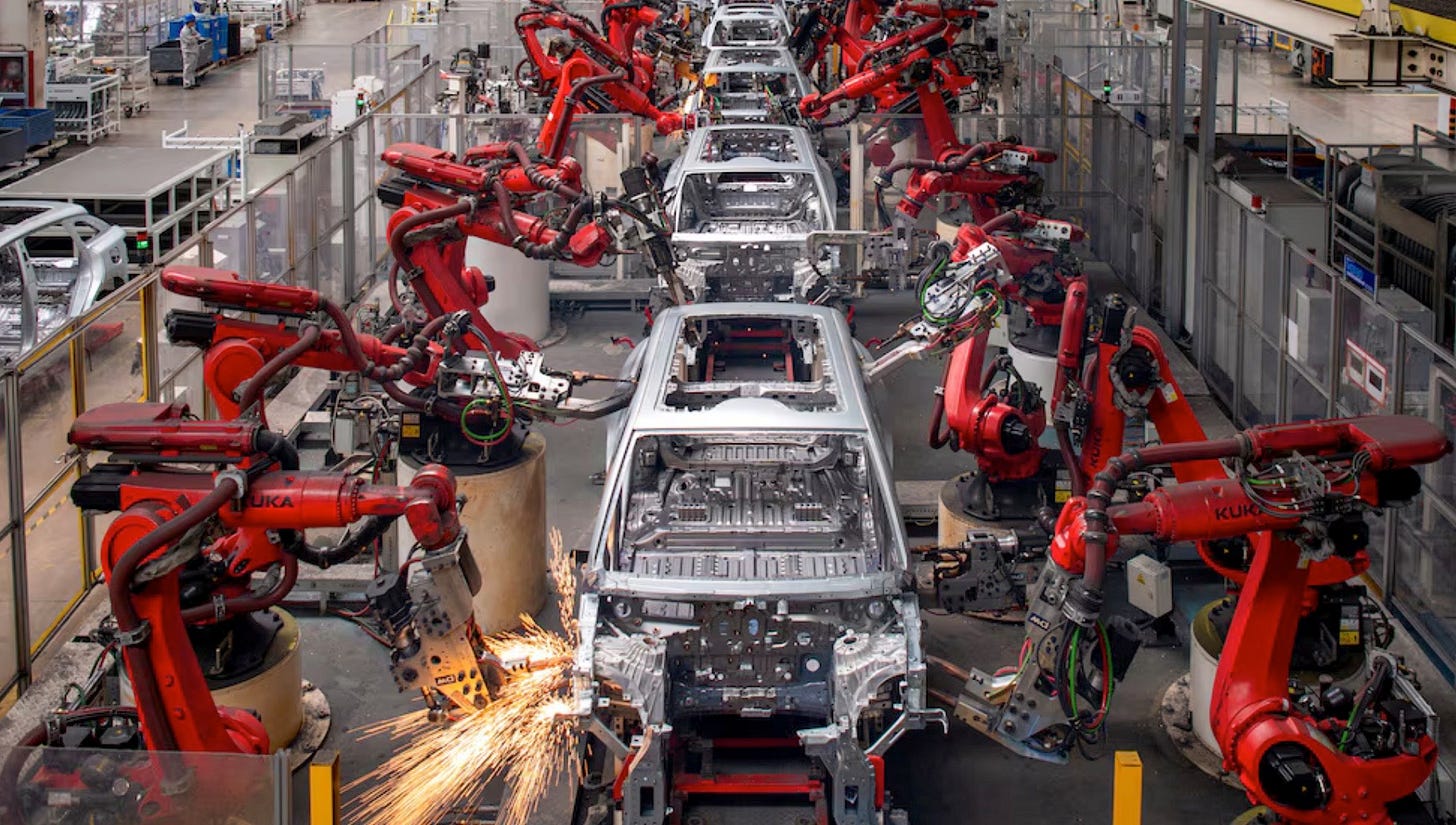

The mandates requiring the rapid adoption of electric vehicles in Canada and the U.S. will have a clear winner: China.

That’s not an opinion. A report issued last month by the International Energy Agency on the critical minerals needed to achieve the over-hyped “energy transition” spotlights China’s near-monopoly on the metals, minerals, and magnets needed to build EVs and other alt-energy technologies.

The report says, “China dominates the downstream and midstream global EV battery supply chain.” The IEA explains that “China holds 85% of battery cell production capacity and 90% of cathode and 98% of anode material production capacity globally.” In addition, over half of global lithium and cobalt processing occurs in China, and as the IEA notes, it has “increased its market share since 2021.”

This situation won’t change anytime soon. China has spent decades building the industrial capacity needed to make millions of EVs per year. (China produced 6.7 million EVs in 2023,) Further, the IEA explains that China is in the midst of a “rapid expansion” of its ability to produce copper, lithium, and other critical minerals. (An average EV uses five times more copper than a conventional vehicle.)

Why does China’s dominance matter? The IEA explains that global supply chains for metals and minerals are “not well diversified, and recent progress on diversifying supply sources has been limited...These high levels of supply concentration raise risks of potential supply disruptions due to physical accidents, geopolitical events or other developments in a key producing country, with major potential implications for the speed of energy transitions.”

Perhaps most concerning is China’s dominance in rare earths, the “green” elements used in EVs, wind turbines, military weapons, and consumer goods. Mining and refining rare earths, including neodymium, dysprosium, and terbium, is critical to producing the high-strength magnets used in EVs. The IEA says magnet rare earths “have the highest geographical concentration for refining of all energy transition metals.” In 2023, the IEA estimated China was refining about 83% of all those rare earths. The graphic below, which uses data from the IEA report, shows that China’s share of the refining market for magnet rare earths will increase between now and 2040 to about 90%.

Those magnets are critical. According to a report published last year by the U.S. Department of Energy, those magnets are found in about 98% of all EVs, and those “percentages [are] likely to stay above 50% through 2040.”

The West could eventually challenge China’s dominance of rare earths. In January, Sweden announced the discovery of a large rare earth deposit. Another big deposit has been found in Wyoming. And Norway announced a huge deposit earlier this month. But turning those deposits into productive mines and finished metals requires enormous amounts of capital. Further, S&P Global recently reported that the “average mine lead time continues to trend upward, reaching 17.9 years for mines coming online in 2020-23 compared with 12.7 years for mines that started up 15 years ago.”

Some history is relevant here. After the 1973 oil crisis, Western leaders decried the world’s dependence on oil from OPEC-member countries. Today, in the name of climate change, the U.S. and Canada are imposing mandates that will make their auto sectors almost wholly dependent on a single country – China – for critical metals and magnets. And they’re doing so at the same time that China and the West are increasingly at odds over the origins of COVID-19, human rights abuses, which include the use of Uyghur slave labor in Xinjiang Province to produce polysilicon for solar panels, Taiwan, and navigation in the South China Sea.

In the early 1990s, Chinese leader Deng Xiaoping declared, “The Middle East has oil. China has rare earths. We must take full advantage of this resource.”

That’s exactly what China has done. And now, the U.S. and Canada are driving full speed straight into Beijing’s hands.

A Follow-Up To “Numbers Don’t Lie”

On Sunday, I published “Numbers Don’t Lie,” which has been one of my most popular pieces on Substack. However, I missed a comment that Nick Wayth, the CEO of the Energy Institute, made when the Statistical Review of World Energy was released. In a moment of candor, he told a group of reporters:

At the global level, today’s new data provides little encouragement in terms of global climate change mitigation. Clean energy is still not even meeting the entirety of demand growth and therefore at a global level not displacing fossil fuels. Arguably, the transition has not even started.” (Emphasis added.)

Wyath said the quiet part out loud. Good for him. No amount of spin will change the numbers in the Statistical Review, and those numbers show that the “energy transition” is a Western conceit, a conceit that has been relentlessly promoted by the NGO-corporate-industrial-media-climate complex.

Media Hits

I was on Yaron Brook’s podcast on Monday. We talked about the new docuseries, “Juice: Power Politics & The Grid” (which I co-produced with Tyson Culver), electric cars, Puerto Rico’s fragile grid, nuclear power, and much more. Please give it a listen here.

I was also on Brad Swail’s Texas Talks podcast. We discussed Winter Storm Uri, monopoly utilities, and the challenges we face in making the electric grid more reliable. You can watch it here.

Before you go, please do me a favor by clicking that ♡ button. And by all means, share and subscribe. Thanks.

Manufacturing a good that nobody wants is, in my view, not a good business to be in, as European and US car makers are now belatedly discovering. So China is a big winner of what exactly?

Stand by for a huge federal bailout of Ford and other American auto makers in the near future. Their request for the money will include the phrase " you guys made us do it".