COP28 Gets Coal In Its Stocking

Two weeks before Christmas, the Dubai climate confab ends with a thud as global coal demand continues to increase

Last week, during the COP28 meeting in Dubai, U.S. climate envoy John Kerry said, “There shouldn't be any more coal-fired power plants permitted anywhere in the world.”

China, India, and a bunch of other countries didn’t get that memo.

While the backdrop to the meeting in Dubai was oil (the United Arab Emirates is a member of OPEC and exports about 2.7 million barrels of oil per day), the hydrocarbon looming over COP28 was coal. Yes, there was some promising news out of Dubai, including a long-overdue pledge by 22 nations to triple the amount of nuclear energy capacity by 2050. But the meeting will end without an agreement to “phase out” hydrocarbons. Coal didn’t have many friends at COP28, but it continues to be an indispensable fuel for generating electricity. That means it’s going stick around. That’s true in Asia and Europe. It’s also true here in the United States. (More on that in a moment.)

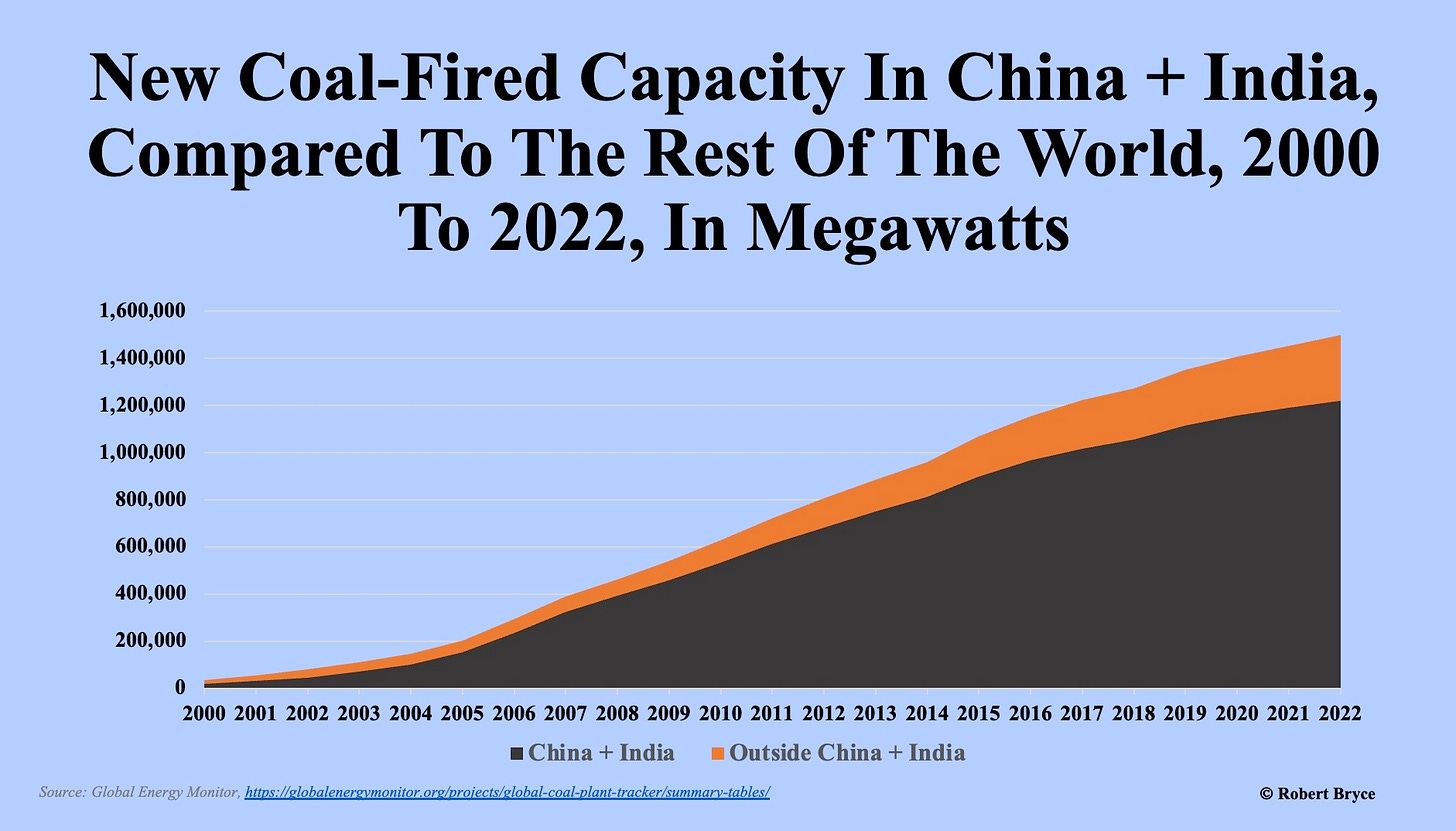

In July, the International Energy Agency predicted global coal use will set another new record of about 8.4 billion tons this year. The agency also predicted coal consumption will remain at or above that level in 2024. “China will continue to account for more than half of the world’s coal use, with the power sector alone consuming one-third,” said the IEA. “If we add India, the global share rises to about 70%, meaning that China and India together consume double the amount of coal as the rest of the world combined.”

On November 27, three days before the opening of the meeting in Dubai, Global Energy Monitor released a report showing that some 204,000 megawatts of new coal-fired capacity is now under construction around the world. Of that 204,000 MW, about 67% is in China. To put that massive amount of new capacity in perspective, the U.S. currently operates about 205,000 MW of coal-fired power plants. (The generating capacity of the entire U.S. grid is about 1.3 terawatts, or 1.3 million MW.) In addition to the huge amount now being built, another 353,000 MW of coal-fired capacity has been announced, pre-permitted, or permitted. Of that 353,000 MW in the queue, about 72% is in China.

While Kerry and others like to deride coal, the alt-energy technologies being heavily subsidized by Western countries are helping fuel the growth of Asia’s coal-fired capacity. From Indonesian nickel needed to build electric vehicles to Chinese solar panels, the “energy transition” is stoking demand for industrial electricity in Asia. And the overwhelming majority of that new demand is being met by coal-fired power plants.

Coal has dominated the electric sector since the days of Edison despite its many downsides, including high CO2 emissions, air pollution, and significant amounts of solid waste. Coal still accounts for the largest share of global electricity production — 35% in 2022 — for several reasons. First and foremost, coal is cheap. Second, its price is not affected by any OPEC-like entities. Third, the technology for building and operating coal-fired power plants is well developed. Fourth, the fuel is easy to store. And finally, the global coal market is mature, liquid, and has numerous exporters and buyers.

The hard reality is that until we can replace large amounts of coal-fired generation with nuclear power (or natural gas), global coal demand will remain robust because the fuel is needed to meet soaring electricity demand. And while China dominates the thermal and metallurgical coal markets, other countries are also ramping up their coal use.

In 2022, coal use in Indonesia soared by about 36% to 201 million tons, making it the fifth largest coal consumer after China, India, the U.S. and Russia. Much of the coal demand in Indonesia comes from power plants fueling refineries that supply nickel to EV companies, including Tesla. In February, Reuters reported, “Indonesia is making itself indispensable for the electric vehicle industry, which uses the metal extensively.” Indonesia has the world's largest reserves of nickel but it bans the export of nickel ore. That means the country must refine the ore, which requires enormous amounts of power. Reuters explained:

In just three years, Indonesia has signed more than a dozen deals worth more than $15 billion for battery and electric vehicle production in the country with manufacturers including Hyundai Motor, LG Group and Foxconn. Indonesia's exports of processed nickel then swelled to more than $30 billion in 2022 from about $1 billion in 2015.

Tesla is among the biggest buyers of Indonesian nickel. Reuters reports the Austin-based company “has signed nickel sourcing contracts worth about $5 billion from companies in Indonesia.” Indonesia will be burning lots more coal to feed Tesla’s EV business. According to data compiled by Global Energy Monitor, the country has 14,500 MW of coal capacity under construction. It also has announced, pre-permitted, or permitted 4,750 MW of new coal capacity.

France is keeping its coal plants open. In August, the French government announced that it was extending a measure that allows them to use more coal-fired power this winter. As reported by Oil Price, “the move comes as utility major EDF warned that nuclear power output will likely be below normal during the winter months as it is still fixing the problems that put several reactors temporarily out of commission last year.

In early October, the German government announced it was bringing three mothballed coal plants back online to help ensure adequate electricity supplies are available this winter. The plants include the Neurath lignite power plant in Grevenbroich.

On November 29, the day before the meeting in Dubai started, Reuters reported: “India aims to add 17 gigawatts of coal-based power generation capacity in the next 16 months, its fastest pace in recent years, to avert outages due to a record rise in power demand, according to government officials and documents.” According to Global Energy Monitor, India has about 32,000 MW of capacity under construction and nearly 36,000 MW that has been approved, pre-permitted, or permitted.

As for China, the growth in coal-fired capacity over the past few years, and the expected increase in capacity, is nothing short of gobsmacking. According to Global Energy Monitor, the country has 136,000 MW under construction. It has another 255,000 MW of coal-fired capacity that has been approved, pre-permitted, or permitted.

China’s solar sector is power hungry. Last month, the consulting firm Wood Mackenzie reported that China will dominate the solar energy market for the next decade. The firm said China will have more than 80% of the world's solar manufacturing capacity through at least 2026 and that it will be able to meet the majority of global demand for years after that. According to Reuters, China has invested more than $130 billion in the solar industry this year, which “will bring more than a terawatt of solar wafer, cell and panel capacity online by 2024. That's enough to meet annual global demand through 2032.” Wood Mackenzie also estimates that solar modules made in China cost half as much as those made in Europe and are 65% cheaper than ones made in the U.S. One of the reasons China’s solar products are so cheap is that they are being made with coal-fired electricity. (Another reason is that much of that solar stuff is being made with Uyghur slave labor, but that’s another story.)

Coal isn’t just an essential fuel for power plants in Asia and Europe. The U.S. electric grid needs it, too.

Two years ago, Evergy announced that it would be closing its 566 MW coal-fired power plant near Lawrence, Kansas, by the end of 2023. But in July, the investor-owned utility reversed course and said it would keep the plant operating until at least 2028. What happened? EVs happened.

Panasonic is building a new factory in DeSoto where it will manufacture batteries for Tesla. According to the Kansas City Star, the plant’s electricity demand will be “double that of Evergy’s current largest customer in the state and require two new substations, upgrades to three current substations and work on 31 miles of transmission lines.” To supply the factory, Evergy said it will continue to burn coal at its Lawrence power plant until at least 2028 because the new battery facility needs some 250 MW of power.

Last year, 12.6 GW of coal plants across the U.S. were shuttered. According to data published by the American Public Power Association, by 2027, some 41.3 GW of coal fired capacity will be shuttered along with some 24.7 GW of gas-fired capacity. This is a recipe for disaster.

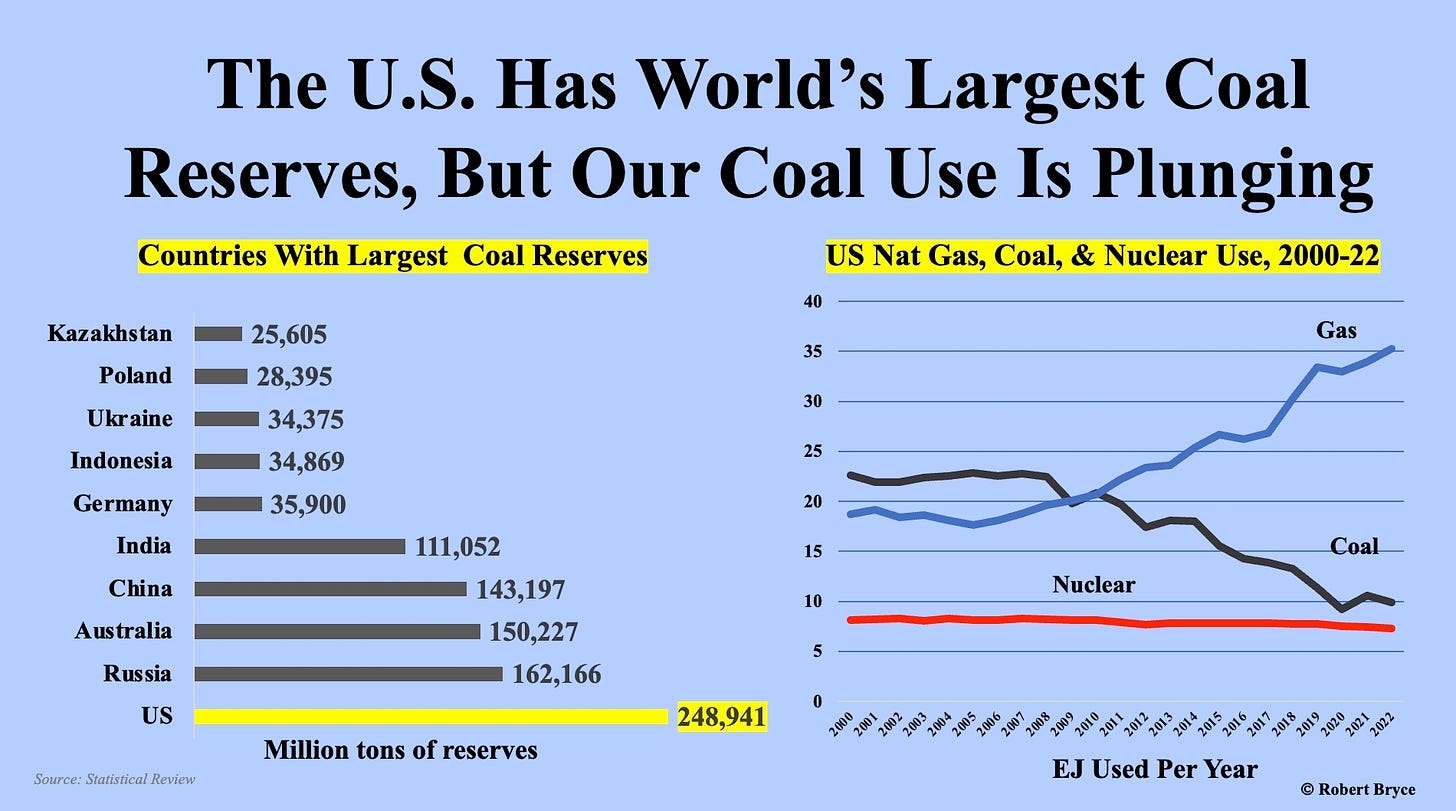

The U.S. is the Saudi Arabia of coal. As can be seen in the graphic below, we have more coal reserves than any other country on the planet, nearly 250 billion tons. We should not be quitting coal because of fashion, particularly at a time when China and our global competitors are burning more of it.

I am pro-natural gas, but the U.S. grid is becoming too dependent on it. Gas has many positive attributes, but it can only be delivered just-in-time. As I reported here on November 25 in “Bone-Chilling,” that can create problems during extreme weather events because there may not be enough gas in the system to meet demand.

Despite the risk, gas has become the dominant fuel on the U.S. grid. Between August 2022 and August 2023, gas’s share of total electric generation jumped from about 36% to 40.4%. Reuters noted, “That increase in gas's share of the generation mix eclipsed the growth seen in electricity generated from clean power sources, including nuclear, solar, wind and hydro power.” Meanwhile, “generation from coal declined by 21% through Aug. 20 from the same period in 2022, demonstrating continued cuts to coal use by power producers to reduce pollution from the sector.”

Although coal plants are being prematurely shuttered, the black fuel was critical in keeping the air conditioners running during last summer’s withering heat wave. It is also needed to assure reliability. As I noted in “Bone-Chilling,” PJM Interconnection, the nation’s largest grid operator, is warning about grid reliability due to the looming closure of a coal plant in Maryland. PJM cautioned that:

the premature shutdown of Maryland’s largest coal plant, Brandon Shores, will hurt grid reliability. As Fox News Digital reported earlier this week, an analysis by PJM “showed that the deactivation of the Brandon Shores units would cause severe voltage drop and thermal violations across seven PJM zones, which could lead to a widespread reliability risk in Baltimore and the immediate surrounding areas." Why is Brandon Shores closing? The short answer: in 2020, the plant’s owner, Talen Energy, agreed to shutter it as part of a deal it made with, wait for it...the Sierra Club. The punchline here is obvious: America’s critical energy networks are nearing catastrophic breaking points due to underinvestment in reliable sources of fuel and generation, and by that, I mean pipelines, nuclear plants, and coal- and gas-fired power plants.

In an October 3 letter to the Federal Energy Regulatory Commission, a PJM official said the grid operator “rejects assertions regarding the retirement of Brandon Shores generating units.” It went on to underscore the need to keep the plant online (emphasis added):

there is no existing technology that can cure the reliability problems that Brandon Shores will create when it deactivates other than transmission. Brandon Shores is a spinning-mass generator that provides certain physical attributes, such as inertia, that are necessary for electricity to get from point to point. The retirement of Brandon Shores results in nearly 600 reliability violations because the area is simply lacking in bulk electric system infrastructure.

There is plenty more to write about coal use around the world and here in the U.S. But I will conclude with this: It’s easy for Kerry and the Sierra Clubbers to demonize coal and wish it would go away. But the reality, like it or not, is that King Coal won’t be dethroned for a long while to come.

Please click that ♡ button, subscribe, and share.

If you are so inclined, have a listen to the interview I did last week on the Americano Podcast, with my friend Freddy Gray from the Spectator. You can listen to that here.

Thanks.

Only energy cheaper than coal will stop this growth in CO2 emissions. Developing nations care about their own peoples' prosperity aspirations, not reducing CO2. Economics trumps politics. Nuclear power plants delivering ample, reliable electricity at 3 cents/kWh can be cheaper than coal-fired plants. That's why ThorCon has been working in Indonesia to supply shipyard-produced 500 MW molten salt reactor power plants that will check CO2 emissions by offering energy cheaper than coal. Economics trumps politics. ThorConPower.com/news

Wow. I have always focused on the amount of materials needed to bring about the green revolution. Mines mines and more mines, and the energy and methods needed to extract that material. It never dawned on me the energy required to smelt and process and build out the Green infrastructure. What is the actual carbon footprint of a Solar Panel made with coal fired energy not to mention the metals and minerals needed to produce it?