Global Power Demand Is Soaring, IEA Expects 4% Growth in ’24 & ‘25

Coal powers growth in India & China, gas burn in U.S. sets new record as wind goes AWOL

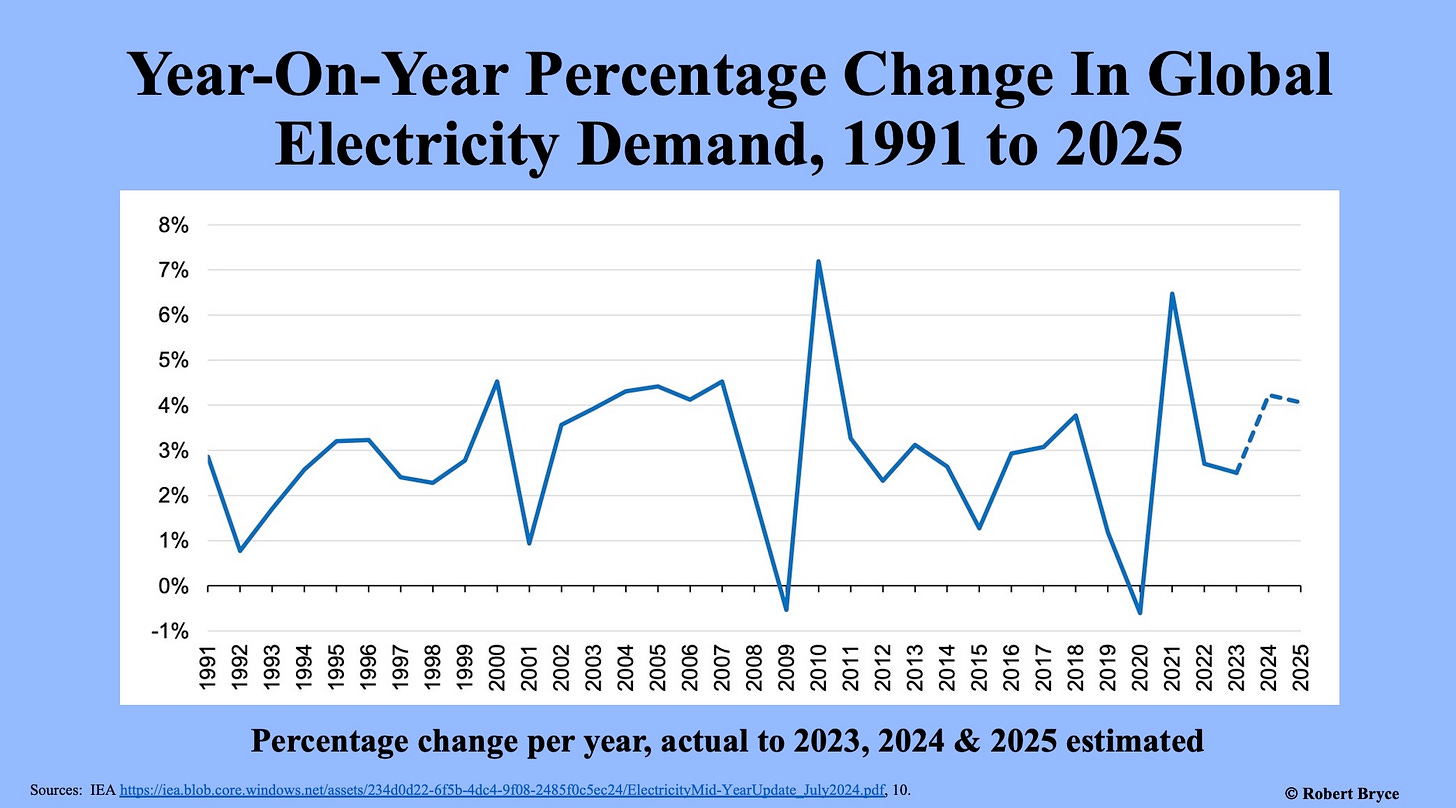

Electricity is the world’s most important and fastest-growing form of energy. More proof for that assertion came a few days ago when the International Energy Agency released its “Electricity Mid-Year Update.” The Paris-based agency expects global power demand to grow by 4% this year. That’s the fastest growth since 2007.

The new electricity report — along with a new IEA report on coal, a July 24 article by Reuters saying that domestic wind energy production went AWOL last month, and a July 25 report from the Energy Information Administration saying that gas-fired generation in the U.S. hit a new record — shows that the global power sector will be relying on coal and natural gas for decades to come.

Let’s start with power demand. The IEA expects U.S. electricity use to increase by 3% this year. That’s a big jump, given that domestic power demand fell by about 1.6% last year due to milder weather.

The IEA report demonstrates that electricity use goes hand in hand with economic growth. The chart above, which uses a screen grab from the IEA electricity report, shows that electricity fuels economic development, and growing economies use more juice. That can be seen by noting the drops in electricity use after the 2008 financial crisis and the collapse in demand following the 2020 Covid lockdowns.

The IEA places particular emphasis on China and India. But those countries are only part of the story. Here’s a key segment from the IEA report:

The 4% growth expected for 2024 is the highest since 2007, with the exceptions of the sharp rebounds in 2010 after the global financial crisis and in 2021 following the Covid-induced demand collapse. The growth is driven by strong electricity demand in multiple regions and countries, especially in...China, India and the United States. We expect this demand trend to continue in 2025, with growth also at 4%. In both 2024 and 2025, the rise in the world’s electricity use is projected to be significantly higher than global GDP growth of 3.2%. In 2022 and 2023, electricity demand grew more slowly than GDP.

In other words, we aren’t decoupling economic growth from electricity demand. That’s particularly obvious in India. Here’s the IEA again: “India, the fastest growing major economy in the world, is forecast to post an 8% rise in electricity consumption in 2024, matching the rapid growth it saw in 2023.” What fuel will be used to meet that rising demand for power? Coal. The IEA expects India’s coal-fired generation to increase by 7% this year.

As seen above, coal-fired generation in North America and Europe may be declining, but it is soaring in Asia. That coal use is likely to continue. The IEA expects electricity demand in China “to increase by 6.5% in 2024, similar to its average rate between 2016 and 2019.” But here’s one of the most striking facts in the report:

Over the last three years, China has been adding on average roughly one Germany each year in terms of electricity demand and this trend is expected to continue through 2025.

That’s simply stunning. Germany has the world’s third-largest economy (after the U.S. and China.) In 2023, Germany generated about 518 terawatt-hours of electricity. Last year, China’s power generation jumped by 608 TWh! The IEA’s coal market report shows that China and India are the key drivers of global CO2 emissions and coal consumption. Here’s another key passage:

China dominates the global market for coal to a much greater degree than for any other fuel, accounting for 58% of world demand and driving growth through the 2010s. China’s electricity sector alone is responsible for over one‐third of global coal demand. China is also the largest coal producer by far, accounting for over half of global output, and is the largest coal importer...Demand for coal is beginning to flatten in China, but coal still accounted for around 60% of its energy supply and electricity generation in 2023. India is the second‐biggest single coal consumer, accounting for 12% of world coal demand. Like China, India has a population of around 1.4 billion people, but its per capita energy demand is one‐quarter that of China’s, reflecting lower GDP per capita. As in China, coal is the cornerstone of electricity generation in India, accounting for around three‐quarters of total generation. Together, China and India account for over two‐thirds of global coal demand. (Emphasis added.)

It’s unlikely that coal demand in India and China will slow down anytime soon.

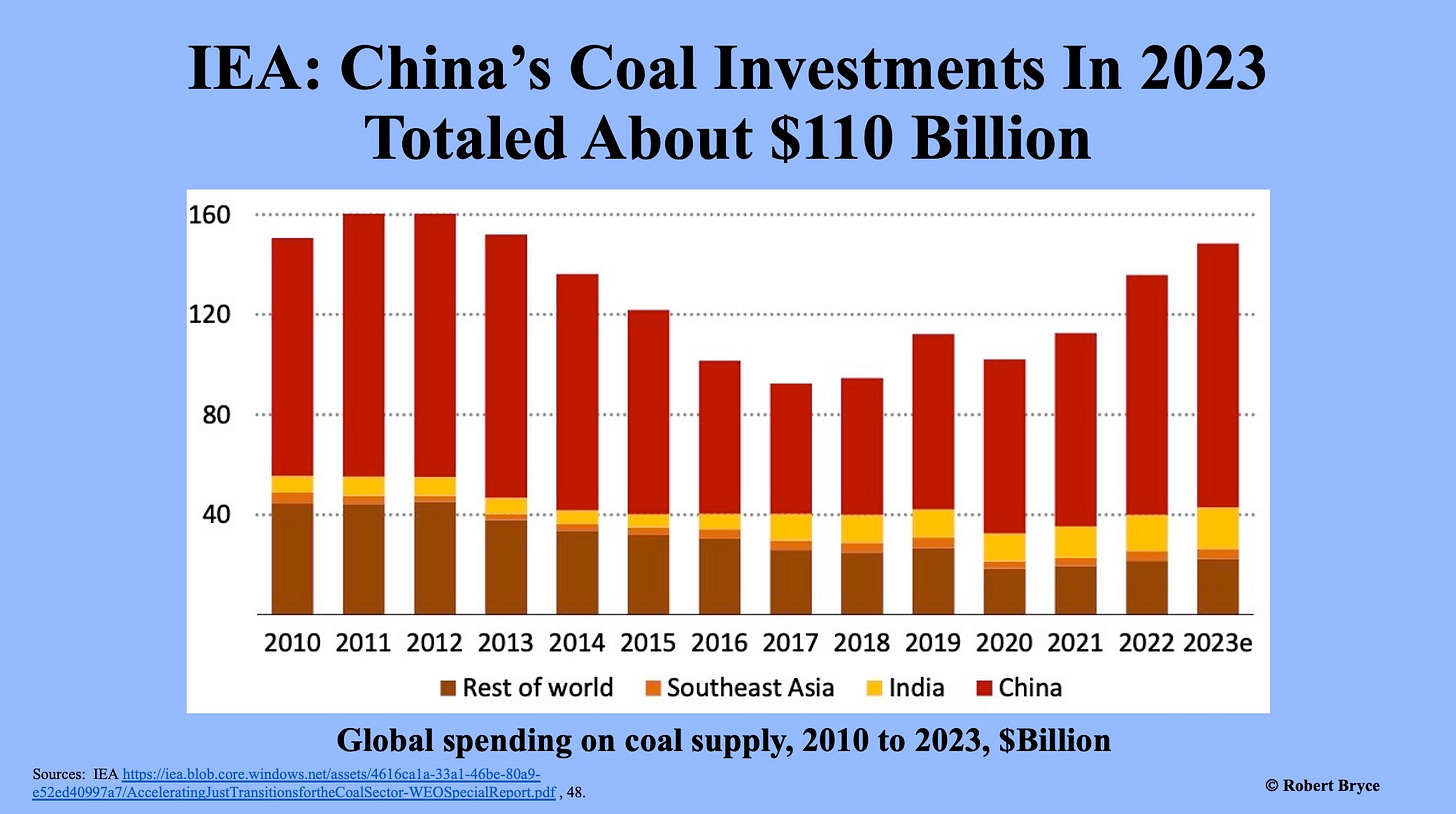

As seen in the chart above, which uses a screen grab from the IEA’s coal report, China’s investments in new coal supply are approaching the records set a decade ago. In 2023, those investments totaled about $110 billion. Here’s another segment from the IEA coal report:

Power generation remains the biggest driver of global coal demand, making up two‐thirds of the market. Although low‐emissions sources of electricity generation as a group have recently overtaken it, coal is still the single largest source of electricity, meeting 36% of total generation. The share of coal in the generation mix has been declining slowly in recent years, while the share of electricity in total energy has been steadily increasing: since 1980, global total energy supply has increased by less than 2% per year on average whereas electricity demand has risen by almost 4% per year. The decline in the share of coal in electricity generation has been slower than the increase in electricity generation, and the output of coal‐fired electricity has continued to increase. The global fleet of coal‐fired power plants is relatively young, particularly in developing Asia, following a surge of capacity additions since the beginning of the century.

Note that last line: the fleet of coal plants is “relatively young, particularly in developing Asia.” That helps explain why emissions from China and India continue to grow.

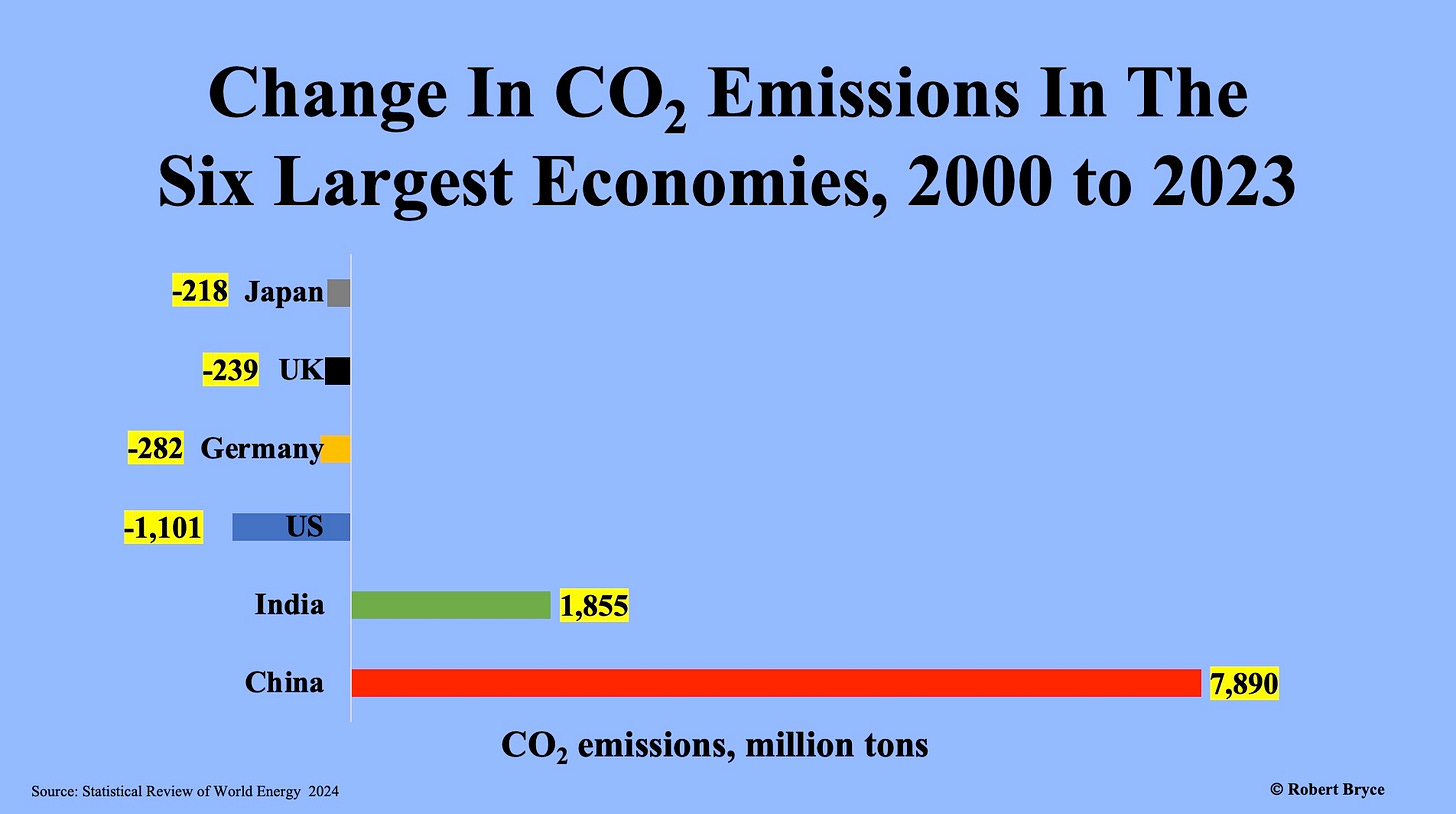

As seen in the chart above, the decarbonization efforts in the U.S. and Europe are being swamped by the massive increases in emissions from China and India. Those two countries have 2.8 billion people, roughly 30% of the global population, and they are not going to slow their economic development to appease Western elites. (See: Roger Pielke’s Iron Law of Climate Policy.)

Indeed, the growing use of coal for electricity generation in India and China exposes the Western conceit about climate change and decarbonization. Yes, the U.S. can spend (and is spending) hundreds of billions of dollars to subsidize things like offshore wind energy, tutti-frutti-colored hydrogen, and carbon capture and sequestration. But to claim that those efforts will make a significant difference in the trajectory of global emissions and, therefore, global temperature, ignores reality.

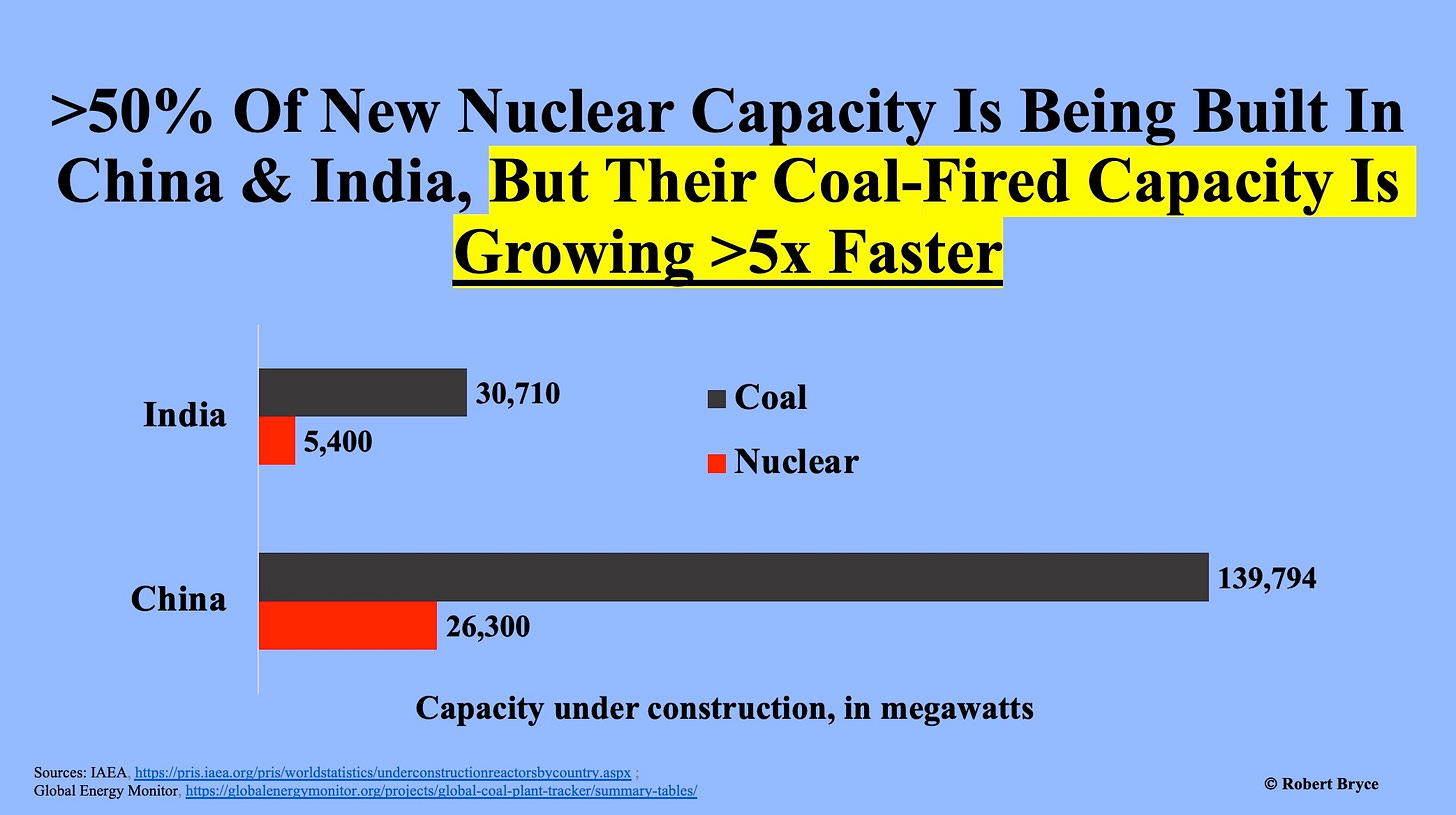

Yes, China and India are building more nuclear capacity, a lot more. But the buildout of their nuclear fleet is a fraction of the coal-fired capacity now under construction.

The chart above uses numbers from the International Atomic Energy Agency and Global Energy Monitor, an anti-coal group.

Meanwhile, why can’t the U.S. turn up all those wind turbines? (Hat tip to fellow Substack writers, Energy Bad Boys.) Reuters reported that wind energy output in the U.S. “fell to a 33-month low” on July 22. The wind lull forced “power generators to crank up natural-gas fired plants to keep air conditioners humming during a hot summer day.” The article continued:

Wind power in the Lower 48 states produced about 335,753 megawatt hours (MWh) on July 22, the lowest since Oct. 4, 2021, according to preliminary data from the U.S. Energy Information Administration (EIA). When the wind did not blow, power companies usually burn more gas because it is the only big source of power they can turn to quickly to provide more energy to maintain reliability. Wind farms are on track to produce an average of just 4% of power generation this week, down from 7% last week, 12% so far in 2024 and 10% in 2023. Gas-fired power plants are producing an average of 48% of generation this week, up from 46% last week, 40% so far in 2024 and 41% in 2023. (Emphasis added)

None of this should be surprising. As I reported here a few months ago, despite adding 6 GW of new wind capacity, wind energy production fell by about 2% last year. Why? The wind didn’t blow as hard as it had in previous years.

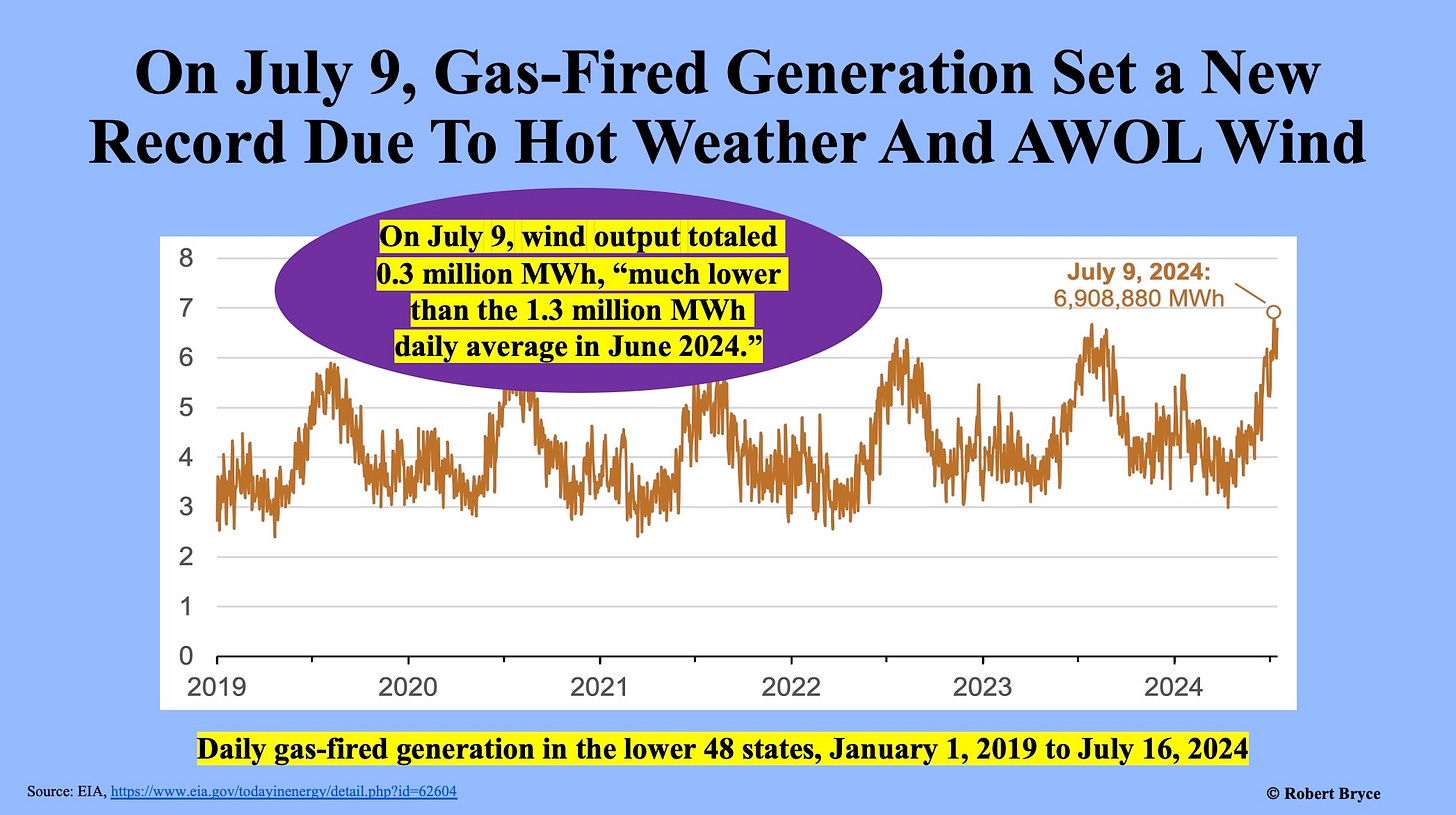

As seen in the chart above, which uses a screengrab from the EIA, July’s wind drought had to be made up by gas-fired generators. The EIA explained, “The spike in natural gas-fired generation on July 9 was because of both high temperatures across most of the country and a steep drop in wind generation.” It continued, noting, “Temperatures were particularly high on the West Coast and East Coast...Wind generation in the Lower 48 states totaled 0.3 million MWh on July 9, 2024, much lower than the 1.3 million MWh daily average in June 2024.”

In other words, we can’t depend on the vagaries of the wind. Regardless of how many wind turbines are built to blight rural landscapes, reduce property values, kill avian wildlife, and ruin our viewsheds, the electric grid will still need enough dispatchable generation capacity (read: nuclear plants, or gas-, coal-, or oil-fired generators) to keep the lights on.

I’ll end with an observation that I’ve made before: If we are facing more extreme weather — hotter, colder, or more extreme temperatures for extended periods — then it’s the height of foolishness to make our most important energy network, the electric grid, dependent on the weather.

We should be building power systems that are weather resilient, not weather dependent. And as I’ve been saying for 15 years, the path forward is obvious: N2N, natural gas to nuclear.

Before you go

You will do me a favor if you click that ♡ button. I’d also appreciate it if you share and subscribe. Thanks much.

"I’ll end with an observation that I’ve made before: If we are facing more extreme weather — hotter, colder, or more extreme temperatures for extended periods — then it’s the height of foolishness to make our most important energy network, the electric grid, dependent on the weather."

perfectly said!

So, why is the West decarbonising for heaven’s sake?

We know CO2 is good for us. We should thank China and India!

We know that at present CO2 concentrations the GHG efficiency is already close to 0 and it will be even less with further increasing concentration. Decarbonising is a costly attempt to cooling down and is guaranteed to achieve nothing. I call it a crime against humanity.