My U.S. Senate Testimony On EPA's EV Mandates: "Unrealistic And Unattainable"

My written testimony to Senate Energy and Natural Resources Committee on EV hype, demand, and Chinese supply chains

Last week, I was contacted by a Senate staffer who asked if I would like to contribute written testimony for an Energy and Natural Resources Committee hearing on EVs. I was flattered to be asked. My testimony was published yesterday on the Senate website. Here it is:

Written Testimony of Robert Bryce[i]

To the Committee on Energy and Natural Resources United States Senate, for a hearing “to examine federal electric vehicle incentives including the federal government’s role in fostering reliable and resilient electric vehicle supply chains." January 11, 2024

Mr. Chairman and members of the committee, I am grateful for the opportunity to provide written remarks regarding electric vehicles and the future of EVs in the United States.

Before going further, please allow me to provide a bit of background. I am an independent journalist. I have published six books on the energy and power sectors and have been reporting on the energy industry for over 30 years. I have written extensively about EVs and have consistently been skeptical about them. In my fourth book, Power Hungry: The Myths Of “Green” Energy and the Real Fuels Of The Future, published in 2010, I devoted an entire chapter to EVs. I wrote:

There’s no question that electric vehicles have many positive attributes: low refueling costs, no air pollutants at point of use, and quiet operation. Despite their promise, the all-electric car continues to be hampered by the same drawbacks that have haunted it for a century: limited range, slow recharge rates, lack of recharging stations, and high costs, particularly when compared to conventional cars. In short, the problems today are the same as they were back in Thomas Edison’s day.

The same issues that I underscored 14 years ago remain true today. Those drawbacks are particularly relevant given the EPA’s proposed mandate that would require two-thirds of new vehicles sold in the U.S. to be all-electric by 2032.

In these remarks, I will make three points. First, I will show that EVs have never lived up to their hype. Second, I will discuss today’s EV market, why automobile dealers are pushing back against the Biden Administration’s mandates, and show that EV sales are concentrated in a very narrow segment of the U.S. population. Third, and most important for this hearing, I will discuss the EV sector’s near-total reliance on Chinese supply chains for metals, minerals, and high-coercivity magnets.

EVs have never lived up to the media hype.

The history of the EV is a century of failure tailgating failure. In 1901, in an article headlined “Edison's New Storage Battery,” the Los Angeles Times declared, “The electric automobile will quickly and easily take precedence over all other” types of motor vehicles. It said, "If the claims which Mr. Edison makes for his new battery be not overstated, there is not much doubt that it will make a fortune for somebody.”[ii] The media hype continued for the next 100 years:

In 1911, the New York Times reported that the electric car “has long been recognized as the ideal solution” because it “is cleaner and quieter” and “much more economical.”[iii]

In 1915, the Washington Post wrote that “prices on electric cars will continue to drop until they are within reach of the average family.”[iv]

In 1959, the New York Times claimed the “Old electric may be the car of tomorrow.” The story said EVs were making a comeback because “gasoline is expensive today, principally because it is so heavily taxed, while electricity is far cheaper” than it was in the 1920s.[v]

In 1967, the Los Angeles Times reported that American Motors Corporation was on the verge of producing an electric car, the Amitron, which would be powered by lithium batteries capable of holding 330 watt-hours of energy per kilogram. (That’s greater than the energy density of modern lithium-ion batteries.) Backers of the Amitron declared, “we don’t see a major obstacle in technology. It’s just a matter of time.”[vi]

In 1979, the Washington Post claimed General Motors had achieved “a breakthrough in batteries” that “makes electric cars commercially practical.” The new zinc-nickel oxide batteries will provide the “100-mile range that General Motors executives believe is necessary to successfully sell electric vehicles to the public.”[vii]

In 1980, the Washington Post claimed “practical electric cars can be built in the near future,” and that by 2000, the average family would own cars “tailored for the purpose for which they are most often used.” It went on to say that “In this new kind of car fleet, the electric vehicle could pay a big role – especially as delivery trucks and two-passenger urban commuter cars. With an aggressive production effort, they might save 1 million barrels of oil a day by the turn of the century.”[viii]

In 2014, Tony Seba, an author who is currently a lecturer in “entrepreneurship, disruption, and clean energy” at Stanford University, declared, “By 2025, gasoline engine cars will be unable to compete with electric vehicles.” He continued, claiming that internal combustion engine (ICE) vehicles “are toast.”[ix]

The facts show something different. The ICE vehicle isn’t “toast.” ICE automobiles continue their overwhelming dominance in the marketplace. In 2023, EVs accounted for about 9% of all new car sales in the U.S. While that percentage has increased significantly over the past few years, and EV sales are growing, it is also clear that EVs face substantial resistance from automobile buyers.

Auto dealers call EV mandates “unrealistic;” Half of EV sales are happening in heavily Democratic counties.

While the federal government can mandate automakers to build EVs, it cannot — at least not yet — force consumers to buy them. The result is that some of America’s biggest automakers are losing staggering amounts of money on the EVs they sell. Other automakers are throttling back plans to produce them. As I reported on Substack in October:

Ford reported an operating loss of $1.3 billion in its EV division during the third quarter. That translates into a loss of $62,016 for each of the 20,962 EVs it sold during the period. That’s a smaller loss than the company recorded in the second quarter, when it lost $72,762 for each EV and the $66,446 it lost per EV during the first quarter. In a press release, the company said the $1.3 billion loss was “attributable to continued investment in next-generation EVs and challenging market dynamics.” It also cited “EV price pressure.” Those “market dynamics” and price pressures are resulting in knee-buckling losses. The third-quarter loss on the EV business of $1.3 billion, combined with a $1.1 billion second-quarter EV loss and a first- quarter EV loss of $722 million, means that FoMoCo has already lost about $3.1 billion on its EV business this year. As I noted in these pages in July, the company said it expected to lose $4.5 billion on its EV business in 2023.[x]

Also in October, Reuters reported that Honda and General Motors “were ending a $5 billion plan to develop lower-cost EVs together just a year after announcing the effort.” The article continued, noting that GM said it “would focus near-term EV efforts on meeting demand rather than hitting specific volume targets.”

In November, nearly 3,900 automobile dealers from across the country sent a letter to President Biden telling him that EV demand is “not keeping up with the large influx of BEVs arriving at our dealerships prompted by the current regulations. BEVs are stacking up on our lots." The letter, which has now been endorsed by some 4,467 dealerships, continued, saying EVs are “not selling nearly as fast as they are arriving at our dealerships — even with deep price cuts, manufacturer incentives, and generous government incentives. While the goals of the regulations are admirable, they require consumer acceptance to become a reality. With each passing day, it becomes more apparent that this attempted electric vehicle mandate is unrealistic based on current and forecasted customer demand.”[xi]

The hard reality is that EVs have long been a niche-market product rather than a mass-market one. Further, that niche market is primarily defined by class and ideology. Some 57% of EV owners earn more than $100,000 annually, 75% are male, and 87% are white.[xii] Last March, Gallup reported, “a substantial majority of Republicans, 71%, say they would not consider owning an electric vehicle.”

Last October, researchers at the University of California, Berkeley, released a remarkable study that found “counties with affluent left-leaning cities” like Cambridge, San Francisco, and Seattle “play a disproportionately large role in driving the entire national increase in EV adoption.”[xiii] The researchers found that over the past decade, about half of all the EVs sold in the U.S. were sold in the most heavily Democratic counties in the country. The summary of the study deserves quoting at length:

The prospect for EVs as a climate change solution hinges on their widespread adoption across the political spectrum. In this paper, we use detailed county-level data on new vehicle registrations from 2012-2022 to measure the degree to which EV adoption is concentrated in the most left-leaning U.S. counties. The results point to a strong and enduring correlation between political ideology and U.S. EV adoption. During our time period about half of all EVs went to the 10% most Democratic counties, and about one-third went to the top 5%. There is relatively little evidence that this correlation has decreased over time, and even some specifications that point to increasing correlation. The results suggest that it may be harder than previously believed to reach high levels of U.S. EV adoption. (Emphasis added.)

The study concluded that EVs are, despite their long history, still a niche product:

Many new technologies start off as niche products, appealing only to a relatively small subset of households. But it has now been 14 years since Nissan introduced the Leaf, and 16 years since Tesla introduced the original Roadster. Moreover, there are now over 100 different EV models for sale in the United States. Enough time has passed — one might have thought — for the U.S. EV market to have broadened considerably. Yet we find a strong and enduring correlation between political ideology and U.S. EV adoption. About half of all EVs still go to the 10% most-Democratic counties, and despite dramatic growth in the overall size of the market, the correlation in 2022 is actually higher than the correlation in 2012. Thus, overall, we do not find evidence that the U.S. EV market is broadening across the political spectrum. (Emphasis added.)

In addition to the concentration of EV sales in liberal cities, there is a vast disparity in EV adoption among the states. In 2022, according to the Department of Energy, about 37% of all the EVs in the country were in California.[xiv] Thus, out of 2.4 million EVs on American roads at the end of 2022, more than 900,000 were in just one state. Furthermore, about 1.4 million EVs, or roughly 58% of the entire domestic EV fleet, were in just five states: New Jersey, Washington, Texas, Florida, and California.

Figure 1

Those numbers show that federal EV policy is slanted to benefit a handful of large, predominantly urban states. And that focus is coming at the expense of lower-income states like Mississippi. In 2021, just 0.09% of all the EVs in the country were in Mississippi.[xv] In 2022, again, according to federal data, California had 29 times more EVs per capita than Mississippi.

Figure 2

The punchline here is obvious: Ford and the other big automakers have been spending billions of dollars to cater to the whims of a tiny segment of the overall car market — a segment heavily concentrated in a handful of liberal counties. That’s a lousy business strategy. But it is an even worse strategy for federal policymakers who must be responsive to the transportation needs of every American, not just those who live in liberal cities and large, wealthy states.

EV mandates will make the auto industry dependent on China.

The EPA’s mandates could make the U.S. auto sector reliant on China, which has a stranglehold on the metals, minerals, and magnets needed to produce EVs.

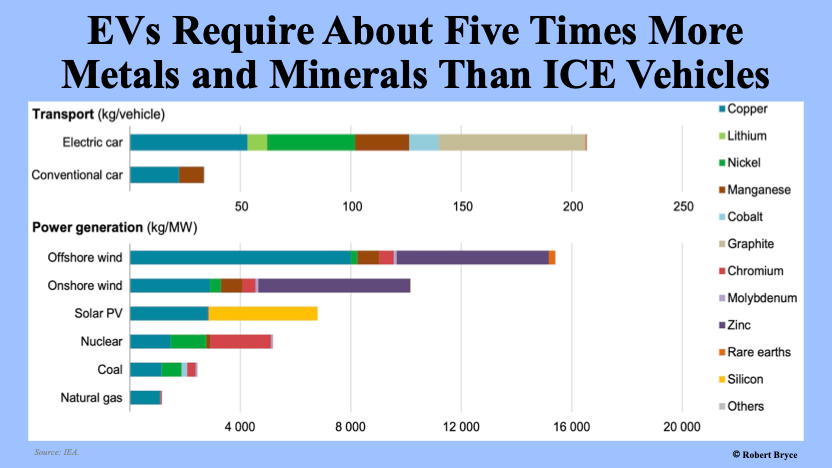

In 2021, the International Energy Agency issued a report detailing China’s stranglehold on those commodities. The report includes several vital graphics, including one reproduced in Figure 3, which shows that the resource intensity of EVs is roughly five times greater than what ICE vehicles require.[xvi]

Figure 3

The same report includes a graphic, shown in Figure 4, that illustrates China’s dominance of the global processing market for copper, lithium, nickel, cobalt, and rare earth elements. The IEA also reports that the production of lithium, a key ingredient in batteries, “is highly concentrated in a small number of regions, with China accounting for 60% of global production.”[xvii]

Figure 4

In addition, China dominates nearly all of the components needed to make EVs. The graphic in Figure 5 tells the story.

Figure 5

Forcing EVs into the market will also make the U.S. reliant on China for neodymium-iron-boron (NdFeB) magnets. Those magnets are critical components in electric vehicles, wind turbines, and military applications like ship propulsion systems and guided-missile actuators. (They’re also used in numerous consumer products, including water pumps, loudspeakers, phones, and refrigeration compressors.)

In the 2021 report, the IEA notes that over 90% of EVs rely on permanent-magnet synchronous motors due to their “high efficiency, compact size, and high power density.” The report continues, saying that due to their use of rare earth elements, “such as neodymium, praseodymium, dysprosium, and terbium — upwards of 1 kilogram per motor — raises concerns given the geographical concentration of raw material and processing in China.”[xviii]

While the EPA claims the U.S. needs to ramp up EV production due to concerns about climate change, the Departments of Energy and Commerce have been issuing stark warnings about the national security implications of relying on Chinese magnets. In February 2022, the Department of Energy issued a report titled “Rare Earth Permanent Magnets: Supply Chain Deep Dive Assessment.” It said, “Nearly all supply chain stages are concentrated in China and the chemistry associated with processing rare earths is challenging, expensive, and hazardous. Furthermore, substitution is difficult through the supply chain due to the unique characteristics and technical advantage of rare earth magnets.”[xix]

The image in Figure 6 comes from the DOE’s 2022 report. China controls more than 90% of the global market for NdFeB magnets. It also controls 100% of the market for dysprosium (Dy) and terbium (Tb), which are needed to make the magnets operate efficiently in high temperatures.

Figure 6

In September 2022, the Commerce Department issued another report, which was even more dire than the one from the Energy Department. The agency projected that U.S. demand for NdFeB EV magnets would quintuple between 2020 and 2030 to 10,000 tons per year. It further estimated it would hit 23,000 tons per year by 2050. The report also found that America’s dependence on imported NdFeB magnets meets the statutory definition of threatening national security.[xx]

Here’s the key sentence: “Based on the findings in this report, the Secretary concludes that the present quantities and circumstances of NdFeB magnet imports threaten to impair the national security as defined in Section 232 of Trade Expansion Act of 1962, as amended.”[xxi]

It continued, noting that the U.S. “has extremely limited capacity to manufacture NdFeB magnets and is nearly one hundred percent dependent on imports to meet commercial and defense requirements. In 2021, the United States imported 75 percent of its sintered NdFeB magnet supply from China, with nine percent, five percent, and four percent coming from Japan, the Philippines, and Germany, respectively.” Despite that finding, as the law firm Mayer Brown noted, the Commerce Department “stopped short of recommending the imposition” of tariffs on magnet imports and instead offered “recommendations to develop and promote a US- and ally-driven supply chain for NdFeB magnets.”

As I explained last May on Substack:

The reason the Biden administration didn’t impose tariffs is obvious: Doing so would have raised the cost of EVs at the same time that the climate activists in the administration were pushing for more EV production. But that’s only part of the story. The Commerce Department’s report clearly shows that it will take years, or even decades, before the U.S. and its allies will be able to produce enough magnets to escape China’s de facto magnet monopoly. Page 8 of the Commerce report lays out the situation in stark terms: “China dominates all steps of the global NdFeB magnet value chain. In 2020, China controlled about 92 percent of the global NdFeB magnet and magnet alloy market. China also dominated the 2020 upstream value chain steps, controlling about 58 percent of the rare earth mining market, 89 percent of the oxide separation market, and 90 percent of the metallization market.” It then provides a telling mention of terbium and dysprosium: “China controls an even higher percentage of the heavy rare earth mining market, including dysprosium and terbium, which are critical for high-performance NdFeB magnets.”[xxii] (Emphasis added.)

The Commerce Department report must also be quoted at length:

China’s dominant position in the global NdFeB magnet value chain enables it to set prices at levels that can make production unsustainable for firms operating in market economies. China is the only country with operations in all steps of the NdFeB magnet value chain including upstream (mining, carbonates production, and separation to oxides) and downstream (metal refining, alloy production, and final magnet production) markets. All other countries maintain operations in only some steps of the upstream or downstream magnet value chain...The NdFeB magnet value chain’s fragmentation means that even countries which produce NdFeB magnets remain dependent in part on Chinese inputs. (Emphasis added.)

In conclusion, the EPA’s proposed rule on EVs ignores history. It also ignores the tepid demand for EVs in the marketplace. More crucially, the EPA rule ignores the enormous challenge of ramping up EV production. In 2023, the U.S. manufactured about 15.5 million cars and light trucks.[xxiii]

Without so much as a by-your-leave from Congress, the EPA wants to require domestic carmakers to stamp out 10 million EVs per year, and do so in less than a decade. For perspective, that’s roughly equal to all of the EVs that were sold globally in 2022. There is simply no way U.S. automakers can achieve that goal. And even if the target were to be hit, it is obvious that there’s not enough consumer demand.

Finally, the EPA rule ignores the impact it would have on automakers’ supply chains. China is not our friend. Given the rising tensions with China over Taiwan, North Korea, human rights, and other issues, it makes no sense for the U.S. to make its auto sector dependent on Chinese metals, minerals, and magnets.

The hard reality is that the Biden Administration’s EV mandates are bad for U.S. energy security and national security. The mandates are unrealistic and unattainable. They will give China control over critical supply chains and increase costs for consumers and taxpayers. The EPA’s EV mandates should be scrapped.

Thank you.

[i] Author, journalist, film producer, and host of the Power Hungry Podcast. Bryce’s latest book is A Question of Power: Electricity and the Wealth of Nations. His new documentary is Juice: How Electricity Explains the World. For more, see: robertbryce.substack.com

[ii] Los Angeles Times, “Edison's New Storage Battery,” May 19, 1901, 8.

[iii] New York Times, “Foreign Trade in Electric Vehicles,” November 12, 1911, C8.

[iv] Washington Post, “Prophecies Come True,” October 31, 1915, E18.

[v] Joseph C. Ingraham, “Old Electric Car May Be the Car of Tomorrow,” New York Times, July 26, 1959, X19.

[vi] Bob Thomas, “AMC Does a Turnabout: Starts Running in Black,” Los Angeles Times, December 17, 1969, K10.

[vii] Jerry Knight, “GM Unveils Electric Car, New Battery,” Washington Post, September 26, 1979, D7.

[viii] Washington Post, “Plug ‘Er In?” June 7, 1980, A10.

[ix] Tony Seba, “Clean Disruption of Energy and Transportation,” Clean Planet Ventures, April 28, 2014, https://tonyseba.com/wp-content/uploads/2014/05/book-cover-Clean-Disruption.pdf

[x] Robert Bryce, “Ford Lost $62,016 For Every EV It Sold In 3Q,” robertbryce.substack.com, October 27, 2023, https://robertbryce.substack.com/p/ford-lost-62016-for-every-ev-it-sold

[xi] EV Voice of the Consumer, “Letter to the President, https://evvoiceofthecustomer.com

[xii] Inspire Advanced Transportation, “Who Owns EVs Today? EV Ownership Trends and Changes 2021 EV Consumer Behavior Report Rundown,” January 2, 2023, https://inspireadvancedtransportation.com/industry/who-owns-evs-today-ev-ownership-trends-and-changes-2021-ev-consumer-behavior-report-rundown/

[xiii] Lucas Haas, Jing Li, and Katalin Springel, “Political Ideology and Electric Vehicle Adoption,” Energy Institute at Haas, October 2023, https://haas.berkeley.edu/wp-content/uploads/WP342.pdf

[xiv] Department of Energy, Alternative Fuels Data Center, undated, https://afdc.energy.gov/data

[xv] Scooter Doll, “Current EV registrations in the US: How does your state stack up and who grew the most YOY?” Electrek, August 24, 2022, https://electrek.co/2022/08/24/current-ev-registrations-in-the-us-how-does-your-state-stack-up/

[xvi] IEA, “The Role of Critical Minerals In Clean Energy Transitions,” 2021, https://iea.blob.core.windows.net/assets/24d5dfbb-a77a-4647-abcc-667867207f74/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf, 6.

[xvii] Ibid, 133.

[xviii] Ibid., 108.

[xix] Department of Energy, “Rare Earth Permanent Magnets,” February 24, 2022, https://www.energy.gov/sites/default/files/2022-02/Neodymium%20Magnets%20Supply%20Chain%20Report%20-%20Final.pdf , v111.

[xx] Department of Commerce, “Effects of Imports of Neodymium-Iron-Boron (NdFeB) Permanent Magnets on the National Security,” September 2022, https://www.bis.doc.gov/index.php/documents/section-232-investigations/3141-report-1/file

[xxi] Ibid., 12.

[xxii] Robert Bryce, “The EPA’s China Syndrome,” Substack, May 20, 2023, https://robertbryce.substack.com/p/china-syndrome

[xxiii] Nathan Gomes, “GM leads US auto sector as industry concludes best year since pandemic,” Reuters, January 3, 2023, https://www.reuters.com/business/autos-transportation/us-auto-sales-likely-jumped-2023-new-year-be-challenging-2024-01-03/

Click that ♡ button or Doomberg will make you buy one of the 20,000 Teslas that Hertz is dumping.

And while you are clicking, please subscribe and share.

In Alberta Canada today -36 degrees Celsius.

We have 4400 megawatts of potential wind and direct from Alberta regulator website we are getting a smoking 47 megawatts.

If we did not have 9000 megawatts of natural gas generation we would be freezing in the dark.

Of course the 1400 megawatts of potential solar is 0;at 845 am in the morning.

Comprehensive, compelling, factual. Unfortunately, the intended Congressional audience lacks both the intellectual capacity and the willingness to consider these points.

Besides, Greta would not approve. Facts have no place in Green Religion.

Of course, America could always take a radical approach and allow consumers to make their own decisions as to how to spend their own money, absent governmental sticks and carrots (carrots supplied by taxpayer dollars).