Shanghaied

A new IEA report spotlights China's stranglehold on supply chains for EVs, wind turbines, and solar panels.

On Sunday, Transportation Secretary Pete Buttigieg appeared on CBS’s “Face The Nation” to promote the Biden administration’s electric vehicle mandates and defend the tariffs the administration is imposing on Chinese-made EVs. During the interview, he said, “The most important thing is that the EV revolution will happen with or without us. And we've got to make sure that it's American-lead.” Buttigieg went on to make some claims that are — I have to use the right words here — complete and utter bullshit.

According to a transcript published by CBS, Buttigieg said:

That's what the president is focused on. We don't want China — look under the Trump administration, they allowed China to build an advantage in the EV industry. But, under President Biden's leadership, we're making sure that the EV revolution will be a made-in-America EV revolution, that is critically important.

Those claims bring to mind President John Adams’ famous line: “Facts are stubborn things.” And the facts are clear: Over the past three decades, China has built such a dominant role in the production of EVs — and the supply chains needed to manufacture them — that the U.S. cannot, will not, be able to catch up, not for decades to come. Indeed, China has Shanghaied the supply chains for everything from EVs and batteries to wind turbines and solar panels.

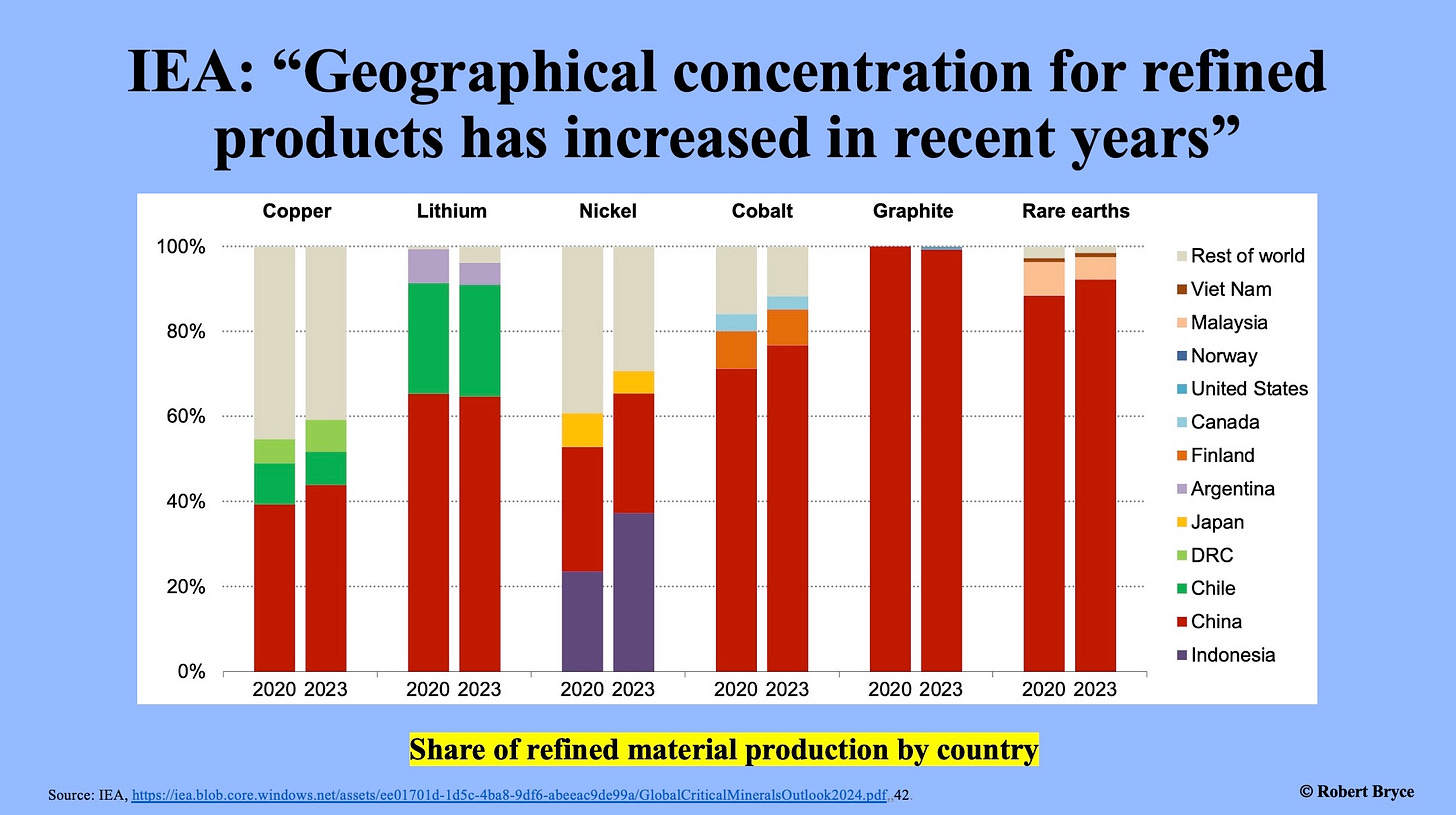

That’s not an opinion. It’s a stubborn fact. On May 17, just 10 days before Buttigieg appeared on Face the Nation, the International Energy Agency published a report called “Global Critical Minerals Outlook 2024,” which shows that China has a near-monopoly on the metals, minerals, and magnets needed for the over-hyped “energy transition.”

The IEA’s 282-page report details China’s dominance of markets for nickel, graphite, copper, lithium, polysilicon, and neodymium-iron-boron (NdFeB) magnets. In a remarkable bit of timing, the report came out almost exactly one month after Biden’s EPA published a new mandate in the Federal Register called the “Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium-Duty Vehicles.” The mandate, published on April 18, is facing numerous legal challenges. If enacted, it will wreck the U.S. auto sector. As the Wall Street Journal explained last week, the EPA rule will:

Effectively require that EVs and plug-in hybrids make up roughly 70% of auto-maker sales by 2032, up from about 9% last year. Companies will have to produce one to two electric trucks for every gas-powered one in 2027, and closer to four to one by 2032...The EPA’s quotas will also result in higher prices for gas-powered cars, as auto makers seek to offset EV losses.

Those losses are already gobsmacking. As I reported here a few weeks ago, Ford Motor Co. lost over $65,000 for every EV it sold during the first quarter. In 2023, Ford lost more money on EVs than it made in net profit. In addition, there’s clear evidence that the market for EVs is small. As I explained last October, “EVs have long been a niche-market product, not a mass-market one. Further, that niche market is primarily defined by class and ideology.” I pointed to a study published last fall by researchers at the University of California, Berkeley, which concluded that “about half of all EVs went to the 10% most Democratic counties, and about one-third went to the top 5%.”

Buttigieg can hype EVs all he likes, but sales are declining. Last month, Volkswagen reported that its EV sales in Europe fell by 24% during the first quarter, and Mercedes-Benz reported an 8% drop in EV sales. Last week, Ford told its dealers to halt EV-related investments until after the company completes a “review” sometime next month.

The new IEA report shows that U.S. automakers cannot build EVs without depending, wholly or in large part, on Chinese suppliers. The report says demand for “energy transition minerals is set to expand significantly across all scenarios,” over the next few years, with demand for commodities like nickel, cobalt, and rare earths showing “robust growth, increasing by 65 to 80% by 2040.” It continues, noting the market for transition minerals is:

Concentrated, with China claiming nearly 50% of the market value in 2030. China also sees a rise in market value for mined materials as the country's production of copper, lithium, and rare earth elements undergoes rapid expansion...Global mineral supply chains are not well diversified, and recent progress on diversifying supply sources has been limited...These high levels of supply concentration raise risks of potential supply disruptions due to physical accidents, geopolitical events or other developments in a key producing country, with major potential implications for the speed of energy transitions.”

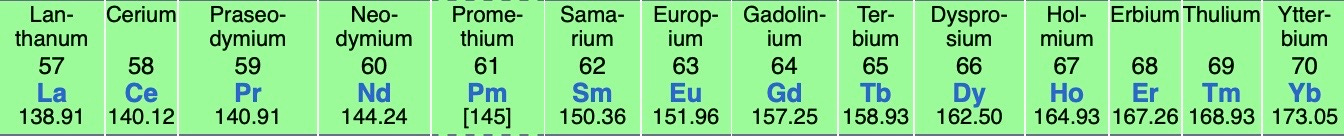

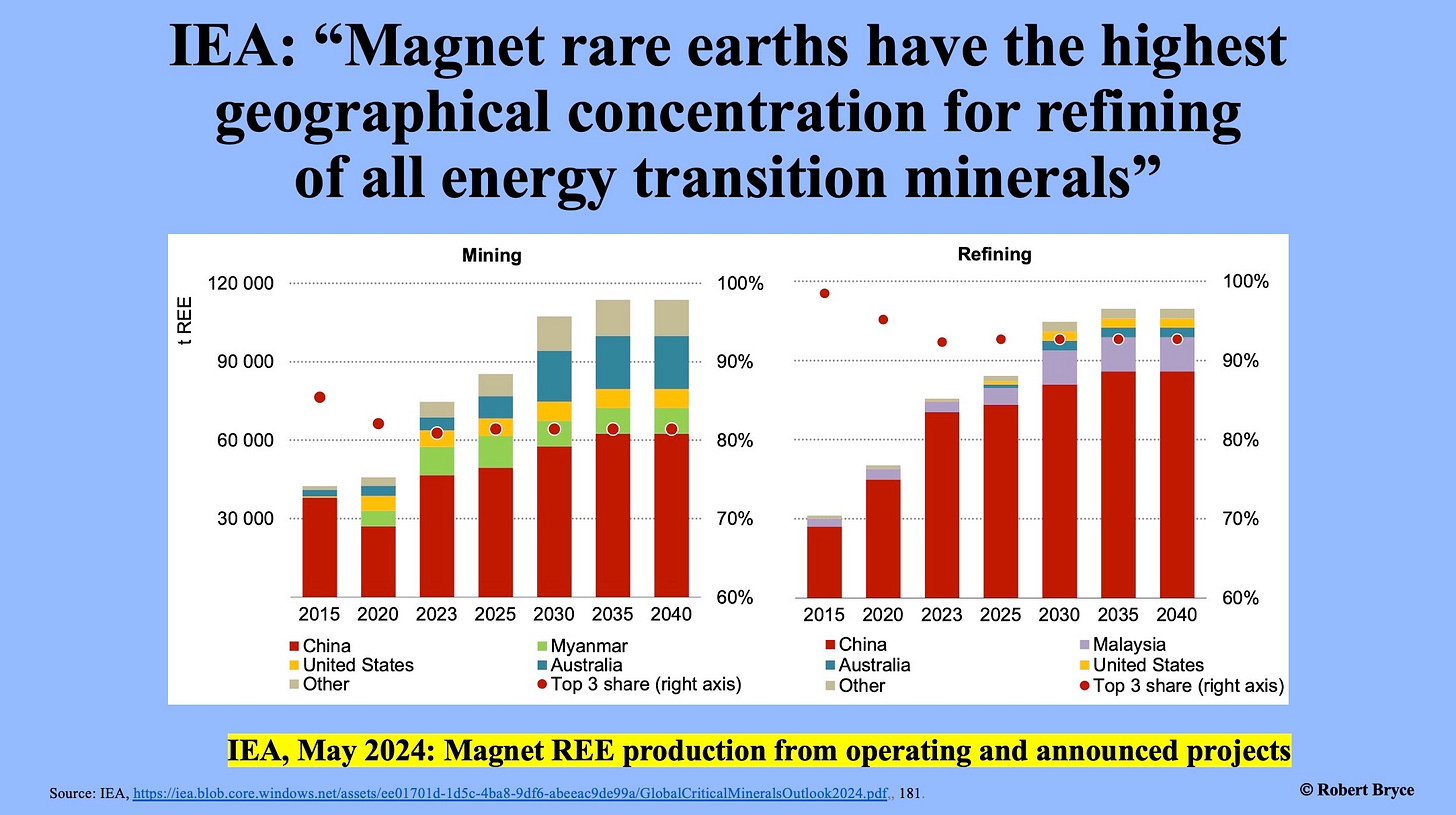

The report underscores China’s dominance in EVs, which require six times more metals and minerals than internal combustion vehicles. This chart is derived from an IEA report published in 2021.

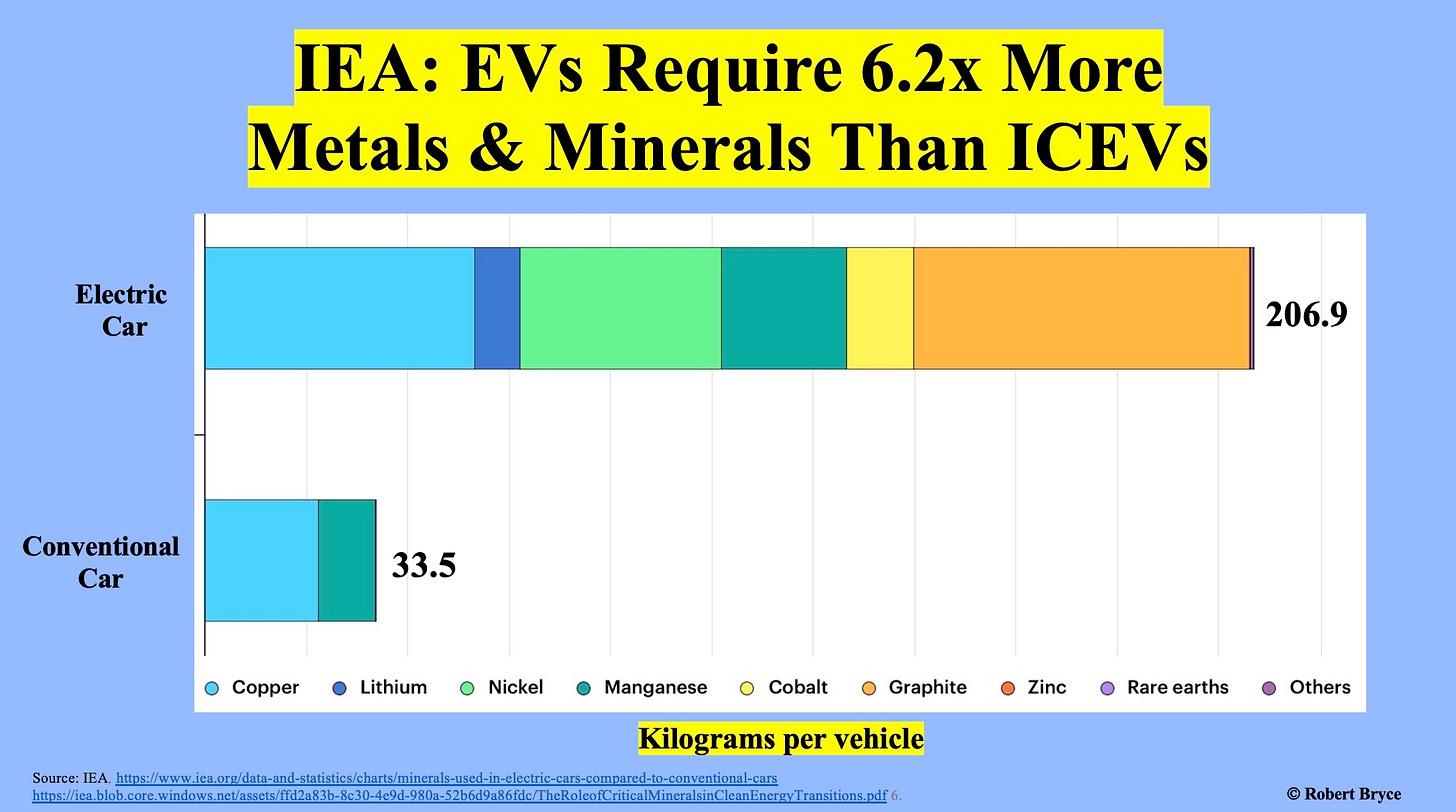

The chart below includes a screen grab from the IEA’s May 17 report.

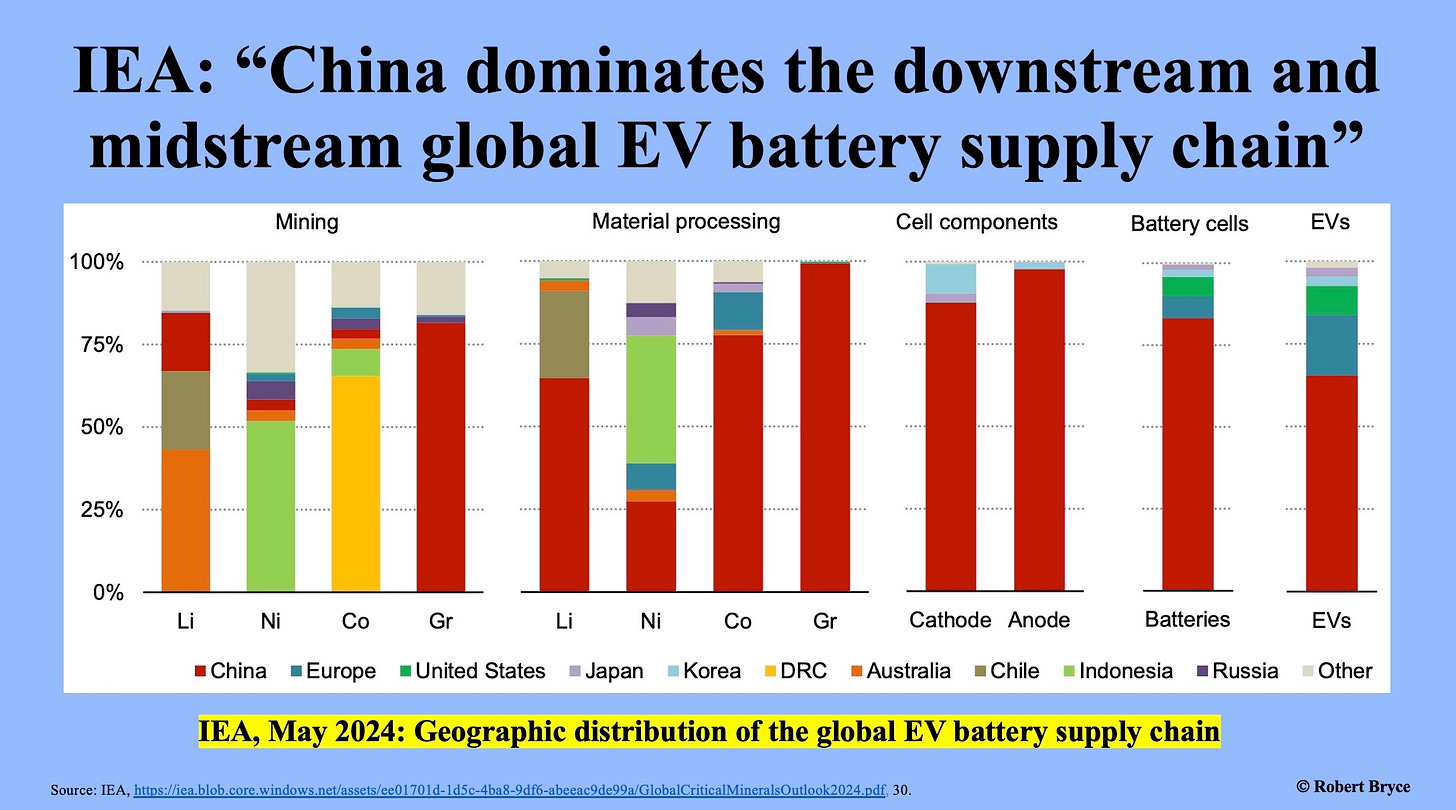

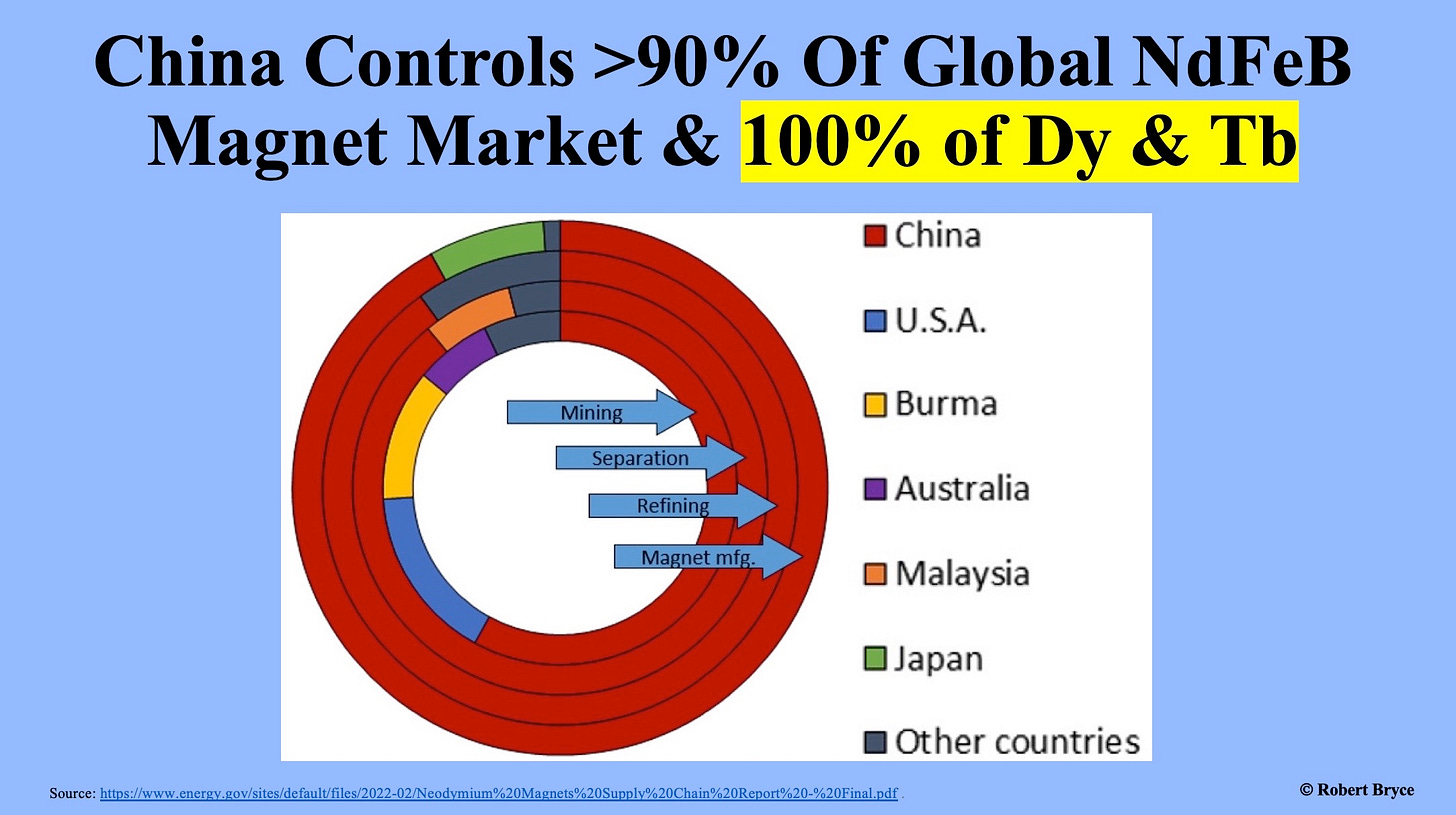

The new IEA report also spotlights China’s monopoly over the high-strength magnets in wind turbines and EVs. It said that magnet rare earths — that is, praseodymium, neodymium, terbium, and dysprosium — “have the highest geographical concentration for refining of all energy transition minerals.” Those elements are essential ingredients in the NdFeB magnets used in wind turbines, EVs, military weaponry, and a panoply of consumer goods.

According to a report on critical materials published last year by the Department of Energy, about 30% of new wind turbines use NdFeB magnets. A 3-megawatt wind turbine can contain up to 2 tons of the magnets. The DOE also noted that NdFeB motors are found in about 98% of all EVs, and those “percentages [are] likely to stay above 50% through 2040.” (Emphasis added.) And as the chart below shows, the IEA expects China’s share of the refining market for magnet rare earths to increase between now and 2040.

Although the U.S. and other countries are talking about reducing their dependence on China, the IEA report shows that China’s dominance of the alt-energy supply chain isn’t declining, it’s increasing.

If the chart below looks familiar, you may have seen it in a piece I published last May called “The EPA’s China Syndrome.” The graphic is derived from a 2022 DOE report on NdFeB magnets.

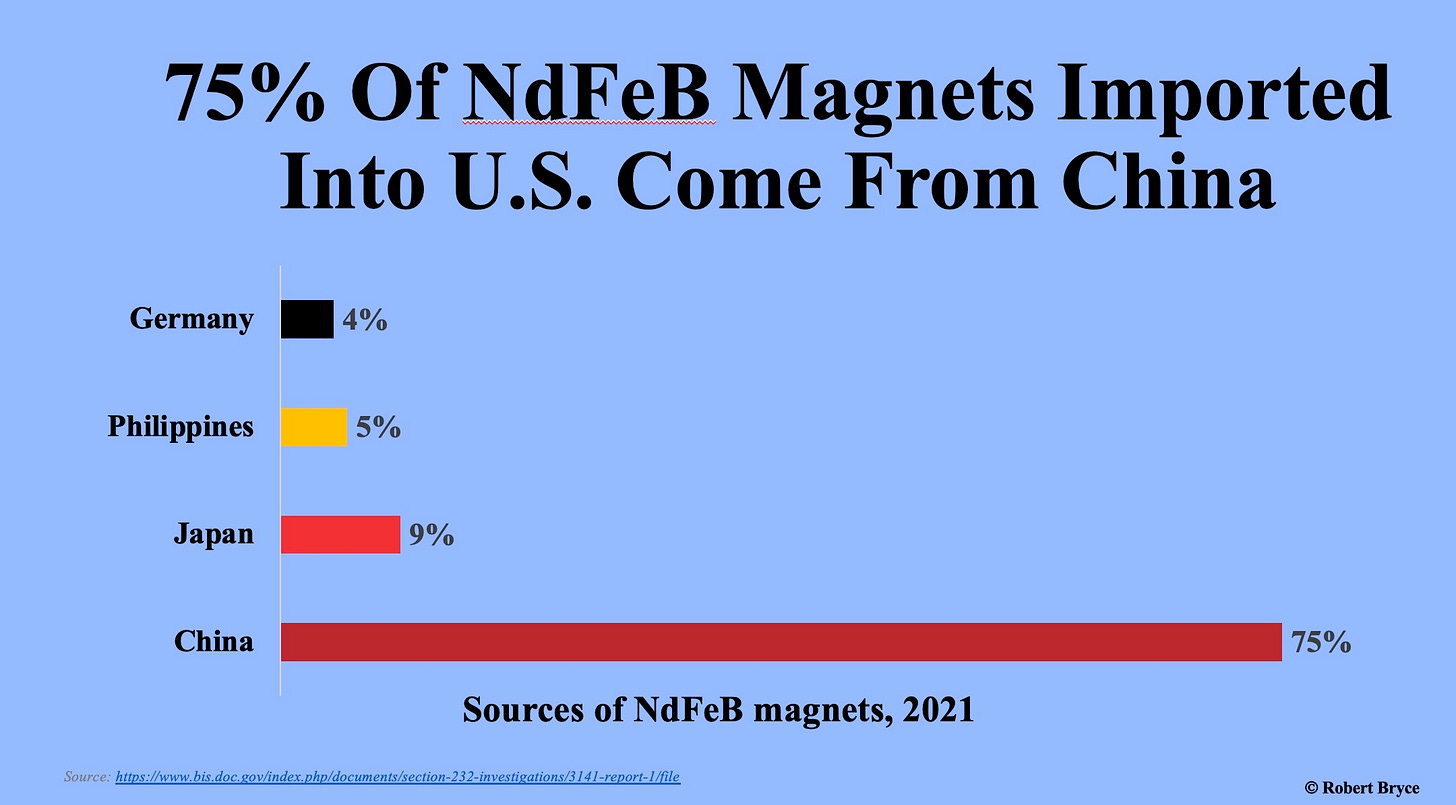

As I explained in that piece, our vulnerability to Chinese supplies of NdFeB magnets must be seen as a national security concern. In 2022, the Commerce Department published a heavily redacted report that contains this key sentence: “Based on the findings in this report, the Secretary concludes that the present quantities and circumstances of NdFeB magnet imports threaten to impair the national security as defined in Section 232 of Trade Expansion Act of 1962, as amended.” It continued, noting that the U.S. “has extremely limited capacity to manufacture NdFeB magnets and is nearly one hundred percent dependent on imports to meet commercial and defense requirements. In 2021, the United States imported 75 percent of its sintered NdFeB magnet supply from China, with nine percent, five percent, and four percent coming from Japan, the Philippines, and Germany, respectively.”

As I explained last Friday, environmentalism in America is dead. It has been supplanted by climatism and renewable energy fetishism. And no object in the alt-energy kink closet has been fetishized more than the photovoltaic solar panel. (As Ken Girardin of the Empire Center recently noted, offshore wind probably runs a close second.)

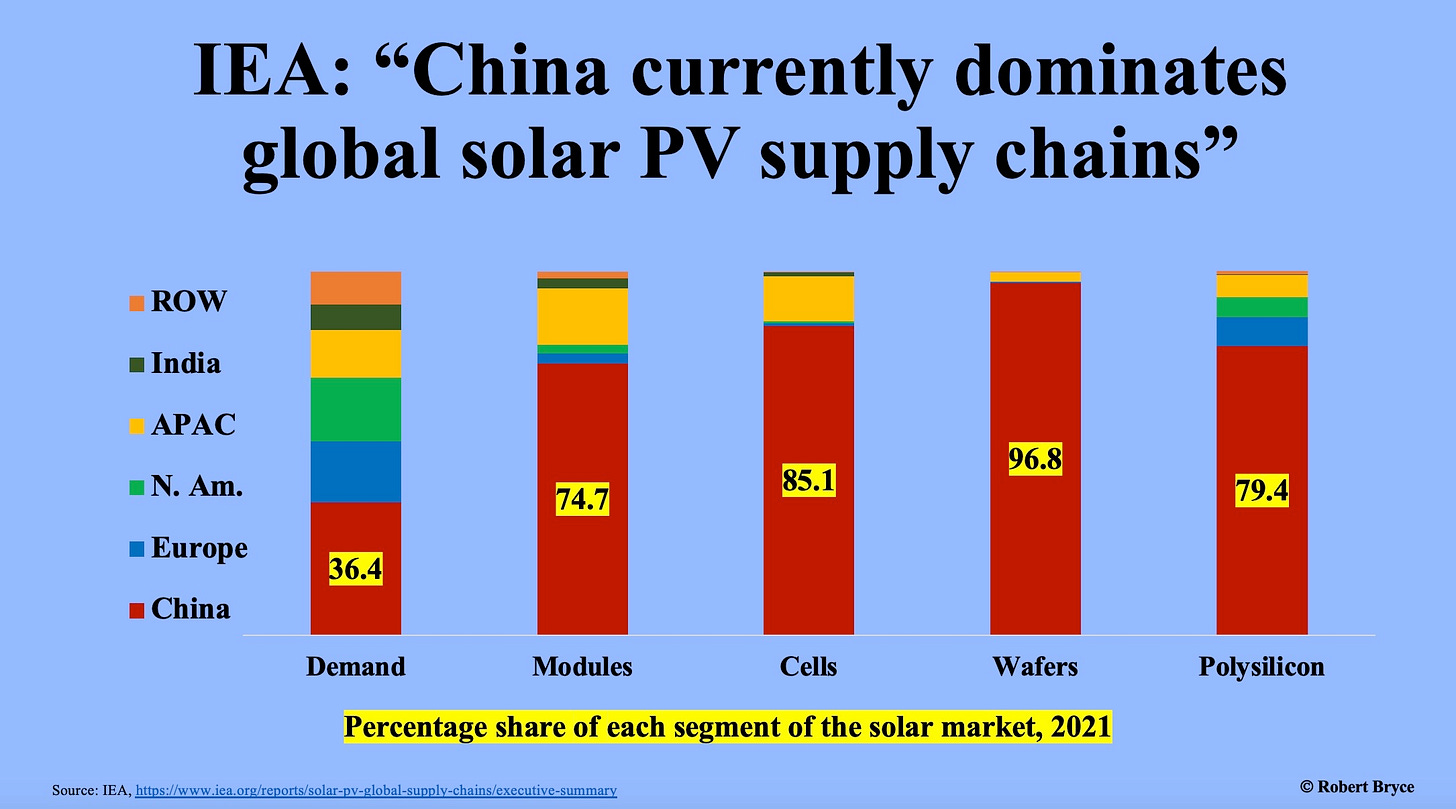

Solar PV fetishism depends on Chinese suppliers. The new IEA report says, “China’s share of solar-grade silicon grew from 27% in 2010 to over 80% today.” I created the chart below using numbers from a 2022 IEA report on solar supply chains.

Recall that three years ago, the Biden administration determined that China’s solar sector was connected to the repression of Uyghurs in Xinjiang province. Last September, the Biden administration issued an addendum to the 2021 advisory on doing business in Xinjiang, saying it contains new information “about the ongoing, widespread, and pervasive risks in supply chains posed by state-sponsored forced labor and other human rights abuses in Xinjiang.” In December, the State Department updated Congress on the sanctions imposed on Chinese suppliers under the Uyghur Human Rights Policy Act.

Since the 1973 Arab Oil Embargo, American policymakers have decried our dependence on foreign oil. But in 1973, the U.S. only imported about a third of the oil it used. And that oil came from several different countries, including members of OPEC.

Today, in the name of climate change, top U.S. policymakers are making rules that will make our transportation and alt-energy sectors almost wholly dependent on a single country — China — for numerous critical commodities. Furthermore, it will be reliant on Chinese suppliers at the same time that the U.S. and China are increasingly at odds over the origins of COVID-19, human rights abuses, which include the use of Uyghur slave labor in Xinjiang Province to produce polysilicon for solar panels, Taiwan, and navigation in the South China Sea.

In other words, by trying to force automakers to produce EVs, Buttigieg and the EPA want to trade reliance on domestically produced gasoline and diesel fuel for near-total reliance on Chinese metals, minerals, and magnets.

It’s difficult to imagine a more foolish trade.

Please click that ♡ button. And please subscribe and share. Thanks.

Before you go:

I’m proud to remind you that our new five-part docuseries, “Juice: Power, Politics & The Grid,” has had over 3 million views. If you haven’t done so, please watch it and share it. It’s terrific, it’s free, and it’s on YouTube.

My friend David Blackmon invited me to his podcast last week. You can listen to it on David’s Substack or YouTube.

Finally, this Substack is free and will remain free for a while. I make my living by doing speaking engagements. If you want me to speak at your event, please contact me.

This was an excellent commentary. China has "cornered the supply chain" by simply being the least environmentally regulated. China is the refiner of REE mined in the United States because we have regulated the mining operations and refining almost out of existence, not because the resources do not exist in the United States.

What I find most frustrating about the debate over mineral resources, and especially rare earth minerals (which are not rare) is that the primary reason the US has lost its capacity to produce these minerals is regulatory. For a time, and probably still now, most rare earth ores mined in the US had to be exported to China for refining. It was impossible to get permits to refine the ore here. I have followed the saga of the Mountain Pass rare earth mine in California for many decades, have visited the site, and even invested in it in the past (and eventually lost my money). The previous owner was driven into bankruptcy by the EPA. The mine has been revived, as a new company, that now has 8% ownership by the Chinese government (the irony of that). A small operation has begun mining rare earths in Texas, Texas Mineral Resources (full disclosure I have visited and am a small investor), free from some of the Federal and State restrictions that limit Mountain Pass, but they still cannot yet refine it beyond a pilot plant project. China is essentially the only place where REE can be refined at commercial scale, and this is because of regulatory restrictions, not capability, but this fact seems to be missed in all the discussions of Rare Earth minerals, and mining projects in general. The US has destroyed its own ability to utilize mineral resources, forcing us to depend on China, Russia, Africa, South America, and the Middle East, where restrictions on natural resource recovery operations are limited or non-existent (Canada and Australia have resources but are also burdened by government restrictions). I always like to point out to people who hate US oil production that when there is an oil spill on a pipeline in Russia, they first let it leak all winter waiting for better weather, and then plow it under the soil to get rid of it- that is what they consider full remediation.

Mining and producing petroleum, natural gas, and coal are one of the main ways that society creates new wealth. The materials that come out of the ground have value that was never part of our economy until added by a miner or driller. The true source of most of the wealth of the United States has been natural resources. Few understand that today, thinking that a search engine or a cell phone is more valuable to our economy than REE brought out of the ground. The ones that actually create the wealth that we all enjoy are miners and engineers recovering raw materials out of the ground. If you can't grow it, you have to mine it. You can't build a car or a wind turbine or even a toilet with just an cell phone, a search engine, and Amazon delivery. You are going to need stuff that comes out of the ground.

Buttigieg is so typical of the utterly incompetent fools that make up the Biden administration, CARB, and the EPA. He has zero experience in anything but somehow he is supposed to make strategic decisions on transportation and energy. Granholm is no different. What a clown show.