Solar Energy Is Getting 200 Times More In Federal Subsidies Than Nuclear

And under the IRA, solar handouts could total $900 billion by 2060

If the bank robber, Willie Sutton, were alive today and working in the electric utility sector, he’d surely be a solar energy developer.

Born in 1901, Sutton spent most of his life in and out of prison. The FBI has a webpage on Sutton, who was among the first fugitives to be on the FBI’s Most Wanted list. Sutton was known for “his ingenuity in executing robberies in various disguises.” The FBI entry continues, “Although he was a bank robber, Sutton had the reputation of a gentleman; in fact, people present at his robberies stated he was quite polite. One victim said witnessing one of Sutton’s robberies was like being at the movies, except the usher had a gun…When asked why he robbed banks, Sutton simply replied, ‘Because that’s where the money is.’”

Sutton’s adage applies to the electric business. As I noted here on Substack last week in “Nuclear Now?,” the U.S. nuclear energy sector has atrophied over the past two decades due to a lack of capital and other factors. Meanwhile, solar installations are booming. Over the last 10 years, domestic solar capacity has grown 13-fold. Last year alone, it grew by 18.5%. The main driver of the solar boom is obvious: that’s where the money is.

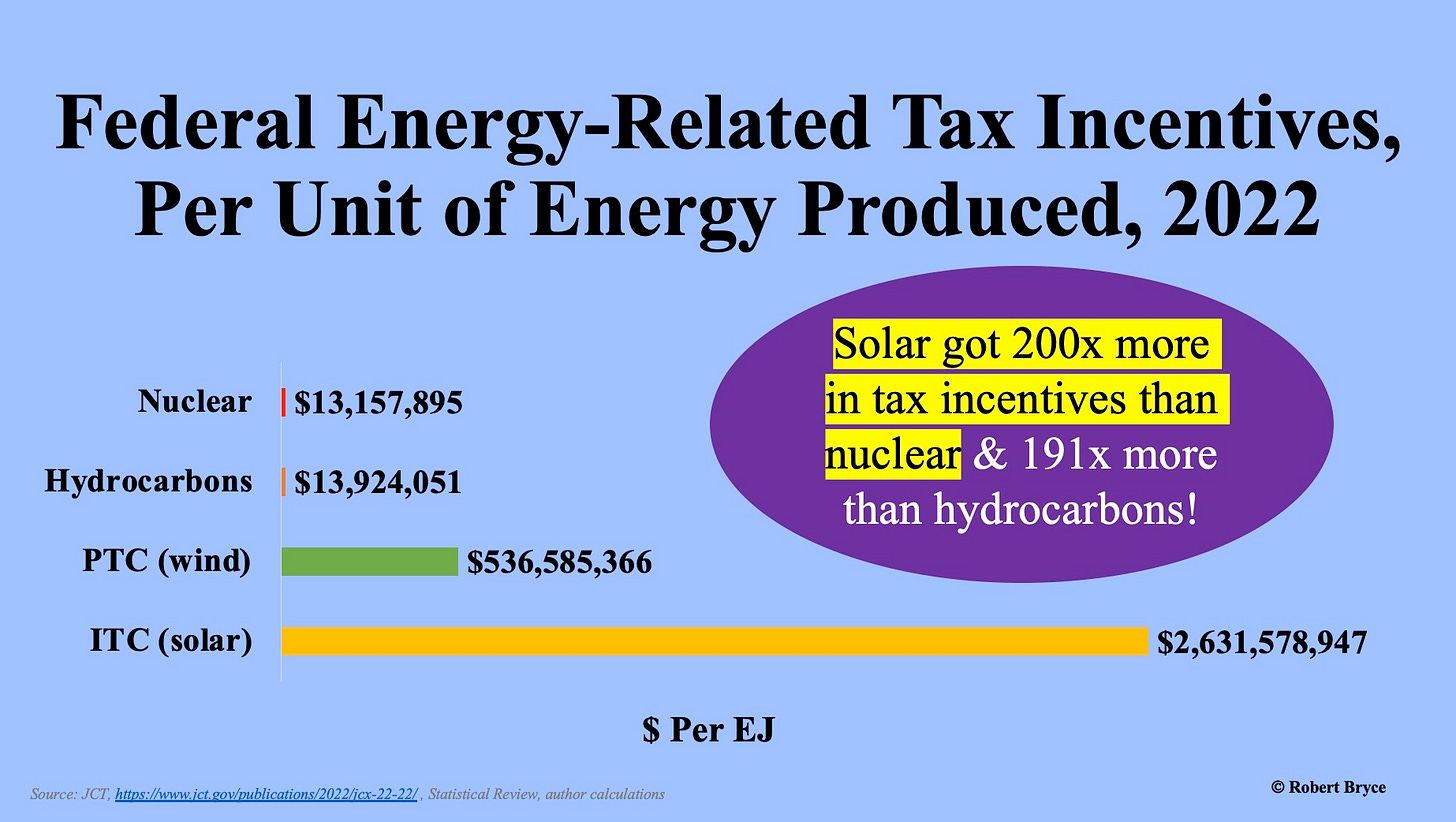

In 2022, when measured by the amount of energy produced, solar energy got 200 times more in federal tax incentives than nuclear. But that figure only reflects a fraction of the staggering amount of federal cash the solar sector stands to collect over the next three decades. According to estimates by Wood Mackenzie, under the Inflation Reduction Act, the solar industry could collect some $900 billion in federal tax incentives between now and 2060. I’ll dive into those numbers in a moment.

Before I do so, here are three reasons why you should be incensed by these solar giveaways.

First, these numbers prove, yet again, that the alt-energy sector continues to be fueled by corporate welfare. For years, advocates for wind and solar energy have claimed that their schemes are cheaper than traditional forms of electricity generation. Last year, John Kerry, the Biden administration’s climate envoy, claimed that “Solar and wind are less expensive than coal or oil or gas. They just are less expensive.” If that were true, and solar energy is too cheap to meter, then the industry shouldn’t need tax credits.

But thanks to climate corporatism, some of America’s biggest corporations, including NextEra Energy and MidAmerica Energy, a subsidiary of Berkshire Hathaway, are collecting billions of dollars in tax credits and they stand to collect untold billions more in the coming years thanks to the IRA.

Second, it’s evident that President Joe Biden and members of his administration misled the American public about the cost of the IRA. On August 22, 2022, Biden gave a speech at the White House during which he said, “The Inflation Reduction Act invests $369 billion to take the most aggressive action ever — ever, ever, ever — in confronting the climate crisis and strengthening our economic — our energy security.” Biden’s defenders might argue that the president didn’t know exactly how much the IRA would cost taxpayers. But ignorance is no excuse. (Nor is old age.)

Third, this solar corporate welfare could add hundreds of billions of dollars to the national debt at the very time we cannot afford more debt. On Monday, the national debt surpassed $33 trillion, a milestone that the New York Times noted provides “a stark reminder of the country’s shaky fiscal trajectory.”

That description — “shaky fiscal trajectory” — is an understatement. Very soon, the interest on the national debt will exceed $1 trillion per year, a sum that will match or exceed the amount we spend on national defense. Michael Peterson, the CEO of the Peter G. Peterson Foundation, summed up America’s fiscal mess saying, “With more than $10 trillion of interest costs over the next decade, this compounding fiscal cycle will only continue to do damage to our kids and grandkids.”

And now, thanks to corporate welfare for the solar sector, the U.S. could add another $900 billion in debt to our already-perilous fiscal situation.

Now, back to the subsidy numbers. My analysis of the 2022 tax incentives for solar relied on numbers published by the Joint Committee on Taxation in a report called “Tax Expenditure Estimates By Budget Function, Fiscal Years 2022–2026.” I combined the JCT’s tax numbers with 2022 energy production data from the Statistical Review of World Energy. According to the JCT, solar producers collected some $5 billion in federal tax incentives in 2022, a year in which they produced about 1.9 exajoules (EJ) of energy. Meanwhile, the nuclear sector collected $100 million in incentives while pumping out 7.6 EJ of juice. Thus, the solar sector collected about $2.6 billion per EJ, while the nuclear producers got some $13.1 million per EJ. Therefore, solar producers got 200 times more federal tax love per EJ than nuclear producers.

The subsidy picture for the landscape-blighting, bird-bat-and-whale-killing wind industry is only slightly less depressing. According to the JCT, the wind sector collected about $2.2 billion in federal tax subsidies in 2022. Last year, the domestic wind sector produced 4.1 EJ of energy. That means the wind sector got roughly $537 million per EJ, or about 41 times more than what was given to the nuclear sector.

To be clear, the 2022 subsidy numbers, while outrageous, are simply a continuation of the lavish subsidies the solar sector has been getting for years. As I reported in Forbes three years ago, solar got 250 times more in federal tax incentives per unit of energy produced, than nuclear in 2018.

What about hydrocarbons? The JCT figures show that federal tax incentives for the hydrocarbon sector totaled about $1.1 billion last year. According to the Statistical Review of World Energy, domestic hydrocarbon production last year totaled about 79 EJ. Thus, the hydrocarbon sector got only slightly more federal tax love than the nuclear sector: about $13.9 million per EJ. That means that solar energy got about 191 times more per EJ produced than what was given to hydrocarbon producers in 2022.

While the 2022 solar subsidy numbers are stunning, the avalanche of federal cash for solar is only beginning. Earlier this month, Travis Fisher, a sharp-eyed analyst at the Cato Institute, reminded us that many of the tax credits in the IRA don’t have expiration dates. “The subjective nature of modeling the IRA’s fiscal cost highlights how little we know about what these energy credits will cost the taxpayer,” he wrote. Fisher went on to explain that the alt-energy provisions of the IRA, a measure that was pushed through the Senate by a single vote (cast by Vice President Kamala Harris), won’t cost $369 billion as Biden claimed last year. Instead, the IRA’s alt-energy schemes could cost close to $3 trillion.

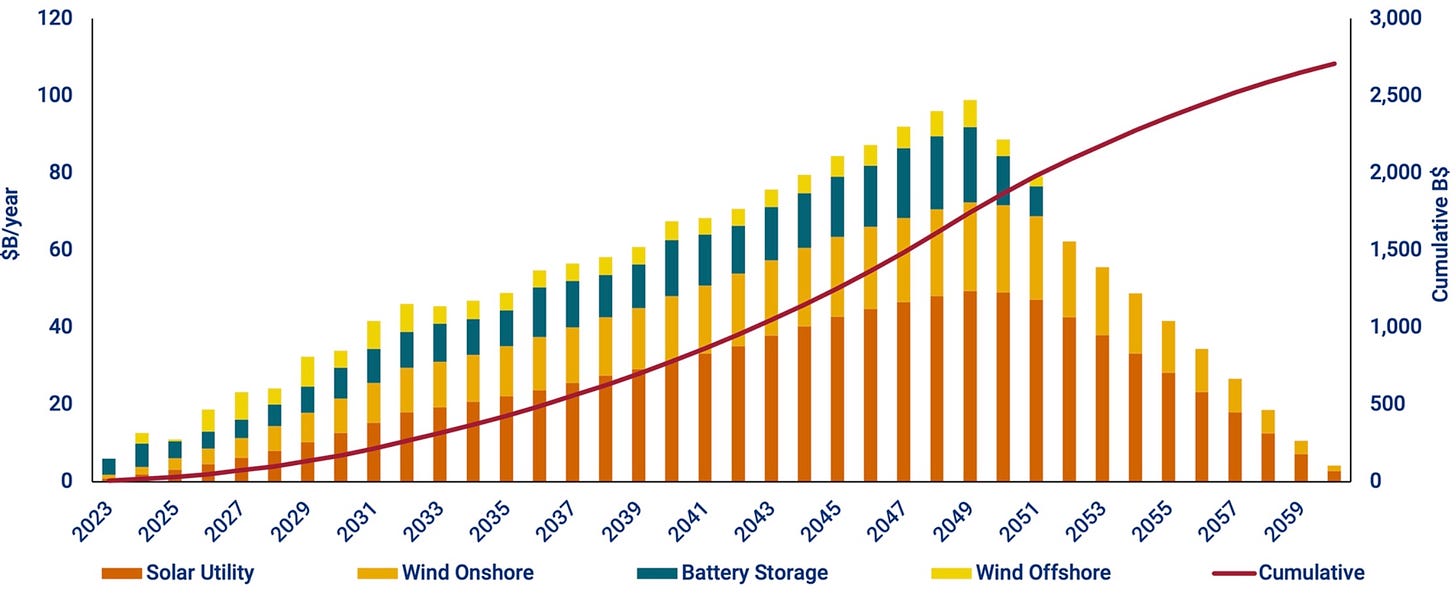

In his article, Fischer highlighted an overlooked March 8 analysis by Ryan Sweezey, an analyst at the energy consulting firm Wood Mackenzie. Sweezey’s piece includes a graphic (see above) that laid out the “estimated IRA-enabled new PTC/ITC value for utility-scale renewables and storage.” It estimates the subsidies for solar, onshore wind, offshore wind, and storage. The solid red line shows the cumulative cost hitting about $2.7 trillion by 2060. Sweezey explained that a “common misconception” is that the renewable tax credits “are only extended through 2032.” That’s not the case. Sweezey explained:

Based on the language in the IRA, our view is that these tax credits will be extended for substantially longer than 2032 — perhaps even 30-40 years. Absent IRA repeal, this means that instead of several hundred billion dollars in tax credits for new renewables and storage through 2032, the real money on the table is on the order of trillions of dollars over multiple decades. (Emphasis added.)

I used Sweezey’s work to produce the graphic above. As can be seen, unless the IRA is repealed or reformed, by 2029, solar subsidies could be costing the federal treasury some $10 billion per year, or double the amount doled out in 2022. And by 2049, they could hit a staggering $50 billion per year.

Two more points. First, these massive tax credits are dumping napalm on the land-use conflicts that are raging across rural America over wind and solar projects. And with tens of billions of dollars in new tax credits at stake, there’s plenty of reason to believe these conflicts will intensify over the coming years.

The Renewable Rejection Database now shows 52 rejections or restrictions of solar energy in 2022 alone, and that number is too low, as I haven’t updated the database for several weeks. Since 2017, there have been 172 rejections or restrictions of solar projects across the country. In fact, the rural backlash against wind and solar has been so fierce that in heavily Democratic states, including Illinois, New York, and California, state bureaucrats have passed measures that allow state-level bureaucrats to override local zoning and force local communities to accept projects they don’t want. I’ll be writing more about these conflicts in the coming weeks.

Finally, these solar subsidy figures show, yet again, that federal policymakers are spending too much money on weather-dependent sources of generation. If we are serious about addressing climate change and making our energy and power systems more resilient, the last thing we should be doing is making our most important energy network — the electric grid — dependent on the weather.

Our grid should be weather resilient, not weather dependent. That means we should be developing low-carbon energy sources that are resilient, scalable, affordable, and ready for deployment. That means N2N: natural gas to nuclear.

Please click that ♡ button. And don’t forget to subscribe and share.

Thanks.

Great article Robert, although any full cost analysis of the IRA has to include the subsidies for batteries manufacturers and EV buyers to understand the scale of the what that monstrosity of a bill will actually be.

In the meantime the CEO of JP morgan recommend we seize private land for renewable construction under immanent domain. https://www.foxnews.com/media/jp-morgan-ceo-suggests-government-seize-private-property-quicken-climate-initiatives