What’s Good For Generac Is Bad For America. We Bought One Anyway

After multiple blackouts, we are installing a 22-kilowatt backup generator at our house

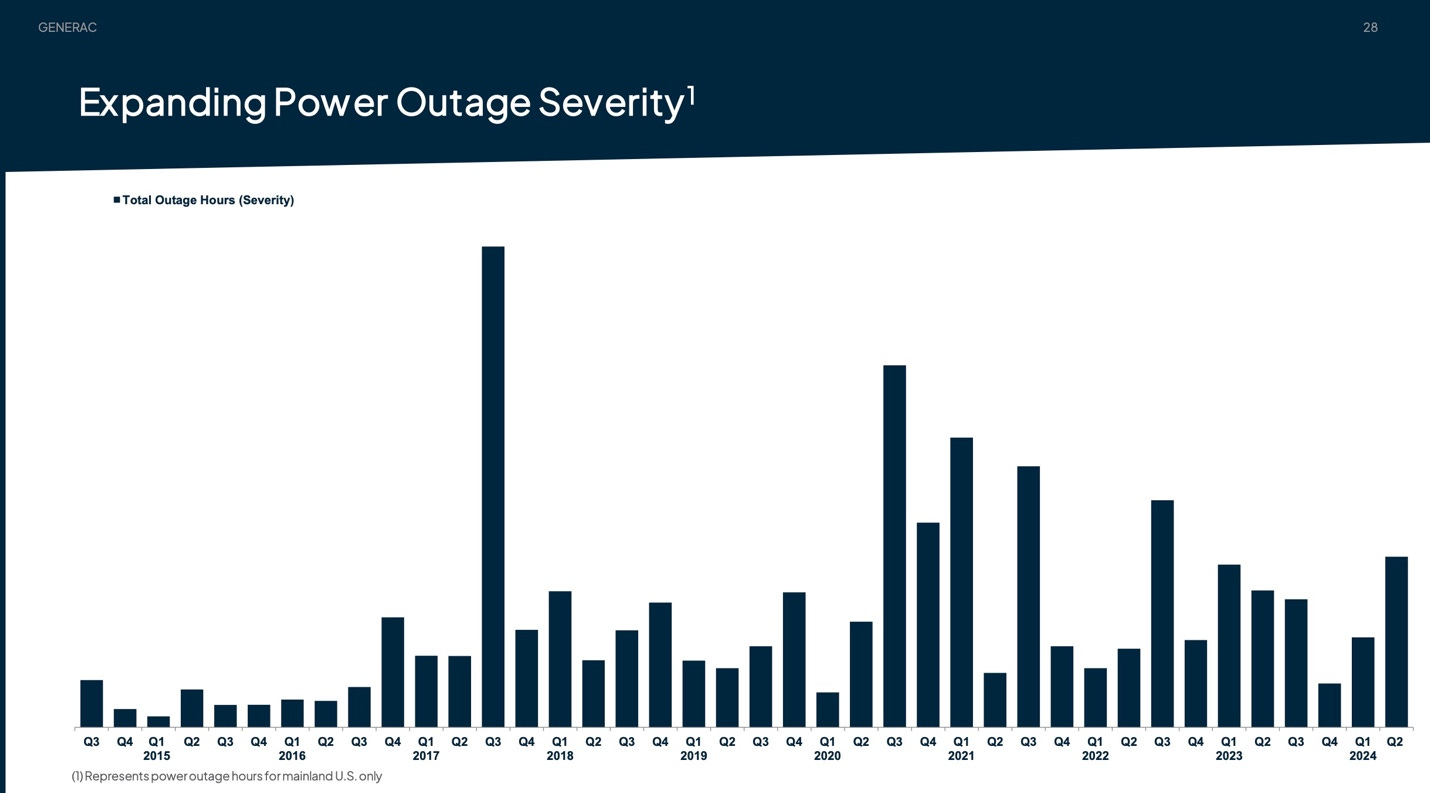

If you are in the business of selling standby home generators, hurricanes, severe weather, and blackouts are good for business. And as the frequency of blackouts across the country increases, companies like Generac are making bank on the declining reliability of the US electric grid.

Generac is profiting from people like me. Back in 2021, during Winter Storm Uri, we lost power for two days. At that time, I thought the Texas grid would recover and all would return to normal. That hasn’t happened. Over the past 12 months, we have lost power at our house in central Austin three times, and in each instance, the outage lasted eight hours or more. Plus, ERCOT has repeatedly warned about looming power shortages.

Given all that, we are installing one of Generac’s whole-house standby generators. The cost: about $15,000 for a 22-kilowatt, gas-fired, air-cooled system that will automatically turn on when the lights go out. Our contractor is Current Power Technologies, a new company based in San Antonio. Grant Winston, the company’s founder and owner, told me business is “booming.” During a phone interview on Monday, he said, “I’m opening a division in Houston.” He’s also doing a lot of business in the custom home sector. As the number of blackouts in Texas has risen, standby generators are “becoming more of a standard appliance in new homes throughout the state.”

As the photo above shows, our generator has been delivered and the switches and wiring are installed. We are now waiting for a gas line connection from Texas Gas Service and we will be ready for the next blackout.

Our decision to buy a standby generator is part of a broader trend. Wisconsin-based Generac is the country’s biggest producer of home generator systems, and it sees a fertile market ahead. In its latest 10-K filing, Generac notes:

The North American Electric Reliability Corporation has labeled significant portions of the United States and Canada as being at high risk of resource adequacy shortfalls during normal seasonal peak conditions in the 2024-2028 period due in part to these supply/demand dynamics. We are seeing increasing evidence that warnings of potential resource inadequacies are driving incremental consumer awareness of the need for backup power solutions. We believe utility supply shortfalls and related warnings may continue in the future, further expanding awareness of deteriorating power quality in North America. Taken together, we expect these factors to continue driving increased awareness of the need for backup power and demand for Generac’s products within multiple categories. (Emphasis added.)

In its second-quarter earnings release, published on July 31, the company reported revenues of $1 billion, and it issued new guidance, saying sales will increase by 4 to 8% this year. In addition, it noted that Hurricane Beryl, which slammed Texas in July:

Highlighted the rising threat of severe and volatile weather as millions of Texans experienced power outages in the aftermath of the storm. This major power outage event is expected to drive incremental demand for home standby and portable generators in the current year, while also driving higher levels of awareness for backup power longer-term as home and business owners seek protection from future power outages. With only approximately 6% penetration of the addressable market of homes in the U.S., we believe there are significant opportunities to further penetrate the residential standby generator market as the clear leader in this category. (Emphasis added.)

But what’s good for Generac is bad for America. The money being spent on home standby generators reflects the declining reliability of our power grid. Essayist Emmet Penney nailed it in 2021 when he declared that, “there is no such thing as a wealthy society with a weak electrical grid.”

The electric grid is the Mother Network. It’s the energy network that fuels all of our critical systems: lights, GPS, communications, traffic lights, water, and wastewater treatment. And yet, lousy policy and malinvestment are weakening the Mother Network. The result is what Generac calls an “increasingly imbalanced electric grid.”

Three things are weakening the grid. The most significant factor is the headlong rush to add intermittent alt-energy sources such as wind and solar. As seen above, Generac names “increasing intermittency” as one of the factors for “supply reliability deteriorating.” If we are facing more extreme weather conditions due to climate change, it’s beyond idiocy to make our most important energy network dependent on the weather. Our grid should be weather resilient, not weather dependent.

Second, too many coal and nuclear plants that provide baseload power are being prematurely shuttered.

Third, policymakers have bought the notion that electricity is a commodity instead of an essential service. This notion is, in part, a legacy of Enron, a company that wanted to trade electricity in the same way that it traded natural gas and other physical commodities. Perhaps the best example of this misunderstanding of electricity can be traced to 1999 when the Texas Legislature debated a bill that would deregulate the Texas electricity market, a measure that Enron was pushing. (The bill passed.)

During that debate, state Senator David Sibley, a Republican from Waco, stood up on the floor of the Texas Senate and declared that after deregulation, people will “be able to shop” for electricity. “If they don’t like the electric provider they’ve got, they can switch. If the price of a can of beans goes up 10 cents, people shop somewhere else. If the price of electricity goes up, people for the first time will have a choice on what they’re going to do. It’s no more business as usual.”

Shop ‘til you drop, Senator, but electricity ain’t beans.

Ever since the days of Edison and Insull, regulators have correctly viewed the electricity business as a natural monopoly. But in the name of free markets and capitalism, policymakers on the left and right have tried to make electricity fit the notion that it can be treated like any other commodity, including cans of legumes.

That has led to the current situation where no one is responsible for the electricity system’s reliability. As Isaac Orr and Mitch Rolling noted here on Substack earlier this year, electricity prices are soaring, in part, due to the addition of massive amounts of solar and wind capacity to the grid, regardless of their impact on cost and reliability. They included a link to an excellent 2017 piece by Travis Kavulla, which said, “There is no free market for electricity, and there may never be.”

The declining reliability of the grid is adding a tax to the overall economy. Yes, the money we are spending on the generator is helping support factory workers in Wisconsin and a cadre of local electricians, plumbers, and skilled laborers. But our $15,000 Generac is a huge addition to our power bill that may — or may not — pay dividends over the coming years. Austin Energy (and ERCOT) have shown they can’t provide our home with reliable power. Thus, we are buying an expensive insurance policy.

The soaring price of electricity and the declining reliability of the grid are also class issues. Extreme weather events generally kill far more poor folks than rich ones. Lower-income people tend to live in substandard housing with less insulation and inadequate heating and cooling systems. Lower-income people aren’t buying Generacs or solar panels. As seen in the image above, a screen grab from Generac’s latest investor presentation, the company’s target demographic is buyers whose homes are worth $500,000 and have household incomes of $135,000 or more per year.

To put that in perspective, the median household income in the US in 2022 was $74,580. Thus, a Generac-buying household has nearly two times more income than the US median household.

I’ll conclude with a few points. I am not blaming Generac for how they are marketing their products. They are responding to a need in the marketplace with a good product and making a profit by doing so. Good for them. (I don’t own any shares in the company, nor am I planning to buy any.) But Generac’s success, as seen above in the company’s soaring growth, shows that our grid is being weakened by bad policy. The company says its goal is to “increase power reliability through onsite generation and storage solutions that provide resiliency for homes, businesses, and communities.”

Generac has a clear vision for the company, its workers, and its shareholders. I just wish fewer Americans felt compelled to buy what the company is selling.

Before you go, please do me a favor:

Click that ♡ button, share, and subscribe.

As a 44 year veteran of the natural gas industry, I think we should be worried about more than just the electric grid.

I am very concerned about a trend that I’ve witnessed developing where utility natural gas providers, primarily investor owned utilities (IOU’s), refuse to invest in the necessary natural gas pipeline infrastructure supply needs to guarantee, residential, commercial and industrial demand on a peak day. They justify this to themselves by saying they can’t invest in “fossil fuel infrastructure” while having simultaneously pledged to a “net zero on carbon” fantasy future. That inevitably cold future precludes natural gas.

Apparently, they don’t see fit to provide their mandatory utility commission prescribed “duty-to-serve” on a peak day as they did many years ago. Progressive-leaning State Utility Commissions support that behavior by looking the other way.

You’re fortunate Mr. Bryce, that you don’t have the type of freezing temperatures we do here in Colorado. I worry about the day when despite having a Generac parked in your backyard residential customers of those IOU’s might do without electricity AND NATURAL GAS as a result of the lack of concern utilities (and Utility Commissions) seem to have as it relates to demand on a peak day.

You might want to back up that Generac-back-up generator with a wood-burning stove .

You can’t make electricity both expensive and intermittent and expect to run a first world economy with world-competitive industrial activity. That is all.