Wind Blows

Excellent news for ratepayers, birds, bats, landscapes, and whales as offshore and onshore wind projects get scuttled

The only thing dumber than onshore wind energy is offshore wind energy. The good news for ratepayers, taxpayers, birds, bats, landscapes, viewsheds, and the critically endangered North Atlantic Right Whale, is that both sectors are getting hammered by market forces that make their projects uneconomic.

On Monday, Avangrid, a subsidiary of the Spanish utility Iberdrola, announced that it was abandoning the 804-megawatt Park City Wind project offshore Connecticut because the project was “unfinanceable.” In a statement that includes a marvelous but unintended pun, the company blamed:

Unprecedented economic headwinds facing the industry including record inflation, supply chain disruptions, and sharp interest rate hikes, the aggregate impact of which rendered the Park City Wind project unfinanceable under its existing contracts.

Avangrid will pay a $16 million penalty to cancel the contract to sell electricity from the offshore wind project to Connecticut. The move is the latest blow to the Biden Administration’s plans to construct 30,000 megawatts of offshore wind on the East Coast over the next several years. In August, Shell and Ocean Winds North America agreed to pay $60 million to cancel contracts to sell power to Massachusetts from the proposed 2,400-megawatt SouthCoast Wind project. In July, Avangrid agreed to pay $48 million to cancel its contract with Massachusetts to sell power from the proposed 1,200-megawatt Commonwealth Wind project. Also in July, Rhode Island Energy announced it was canceling a power purchase agreement with Ørsted and Eversource on the 884-megawatt Revolution Wind project because the power from the offshore facility was too “too expensive for customers to bear.”

This news shouldn’t be surprising. Offshore wind energy has always been insanely expensive. Indeed, the only method of generating power that’s more expensive than offshore wind is by burning currency in a power plant’s boiler. One of the main reasons offshore wind is so expensive (aside from the corrosive effects of salt water) is its high resource intensity. As I noted in my August 13 Substack, “The Power Of Power Density,” offshore wind requires vast amounts of copper, manganese, zinc, and other critical metals and minerals.

Although the companies developing offshore wind on the East Coast claim that they will rebid the projects sometime in the future, that’s not certain. In August, Bloomberg New Energy Finance reported that the cost of producing electricity from offshore wind has soared over the past two years:

The levelized cost of electricity of a subsidized US offshore wind project has increased to $114.20 per megawatt-hour in 2023, up almost 50% from 2021 levels in nominal terms, according to BloombergNEF calculations. Increases in capex and opex have added $16.90/MWh to the LCOE. The higher cost of capital, thanks to interest rate hikes, has increased levelized costs by another $27.20/MWh, assuming project owners continue to expect to make a 5-percentage-point premium over their cost of debt.

Further, BNEF pointed out that even “a 40% investment tax credit benefit” due to the Inflation Reduction Act will only help “offset a minor share of these cost increases.” The article included the graphic below on the soaring cost of capital.

The cancellations of these offshore wind projects are welcome news for conservationists and commercial fishermen, who have been fighting offshore wind plans for years. About five dozen whales have washed ashore on the East Coast this year alone. Those whale deaths have coincided with the increased boat activity and high-decibel sonar mapping in the region being performed by offshore wind developers. As I reported here in January, the locations for the offshore wind projects are often on top of, or adjacent to, known habitat for the critically endangered North Atlantic Right Whale (Eubalaena glacialis). In that article, I published a pair of maps. I wrote:

The maps clearly show that the offshore wind projects being approved by the Biden Administration could be built right on top of the habitat of the North Atlantic Right Whale, a species that is seeing huge population losses. Over the past decade or so, the whale’s population has plunged by about 26% and there are only about 70 breeding females left.

I also noted that last year, a top NOAA official warned his counterpart at the Bureau of Ocean Energy Management about the impact that offshore wind development could have on the whales:

“Additional noise, vessel traffic and habitat modifications due to offshore wind development will likely cause added stress that could result in additional population consequences to a species that is already experiencing rapid decline.” The author of the letter was Sean Hayes, the chief of the protected species branch at the NOAA’s National Northeast Fisheries Science Center. Hayes said that disturbance to the whales’ foraging areas “could have population-level effects on an already endangered and stressed species.”

For more on the whale story, I highly recommend you watch the new film, Thrown To The Wind, which stars my friend, Lisa Linowes. (Lisa has been on the Power Hungry Podcast twice. Her most recent appearance was in June.) Acoustician Robert Rand also plays a prominent role in the film. His recordings of whale noises and the subsea noise being created by the ships doing high-decibel sonar mapping for the wind industry, are among the key moments in the film.

The documentary, directed and produced by Jonah Markowitz, is about 28 minutes long. It’s well-shot and edited. Author Michael Shellenberger and his colleague at Public, Leighton Woodhouse are the executive producers. The film shows how federal officials and NGOs have repeatedly ignored the danger offshore wind development poses to whales. And they’ve done so in order to facilitate massive federal tax giveaways to the mostly foreign companies, like Avangrid, who have been pushing offshore wind projects.

Meanwhile, NextEra Energy has seen its stock price hammered. The Florida-based company, the world’s largest producer of renewable energy, has used hardball legal tactics against rural communities across rural America as part of an effort to force those communities to accept wind projects. Its stock price plummeted after its subsidiary, NextEra Energy Partners LP, slashed its annual growth target. Over the past month, NextEra Energy Partners’ stock price has fallen by more than half and the parent company’s stock is down by about 22% over the past ten days.

On Monday, the Wall Street Journal reported that “rising interest rates are challenging wind and solar developers and blunting a tidal wave of government subsidies for green proejcts. Wind, solar, and other renewable projects involve high upfront expenditures, making them extremely sensitive to borrowing costs.” The article continued, “NextEra is a bellwether holding for clean-energy investors.” On Tuesday, Bloomberg’s Liam Denning wrote a piece headlined, “NextEra’s Rout Spells Trouble For Renewables.” And to borrow Avangrid’s phrase, more “economic headwinds” are ahead.

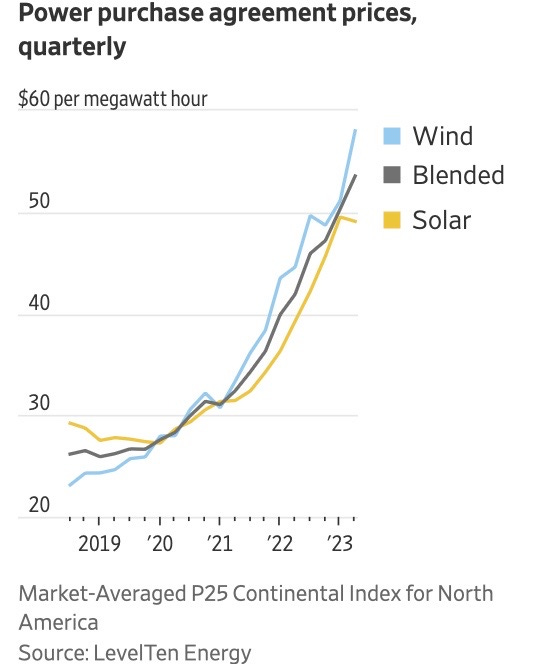

In June, the International Energy Agency reported that the cost of large-scale solar and wind power jumped by about 20% last year. As seen in the graphic above, LevelTen Energy recently found that the agreed price on power purchase agreements for wind and solar projects more than doubled between 2020 and the second quarter of 2023. Last month, the British government got no bids for new offshore wind projects. According to the BBC, the government blamed a "global rise" in inflation impacting supply chains had "presented challenges for projects."

Who knew that inflation and high interest rates were good for whales, birds, bats, seascapes, and rural landscapes?

J.D. Power Finds EVs Are Expensive

In other news, water is still wet, and Pope Francis is a Catholic

In what may be the least surprising analysis of 2023, J.D. Power has found that, wait for it...EVs are being bought by the Benz and Beemer crowd. Last week, the detroitbureau.com’s Larry Printz covered the report in an article headlined, “Are EVs Affordable? Only If You’re A Luxury Buyer.” The subhead included a fact that has been obvious for a long time: “EVs are very much a plaything of the wealthy.” The article explains:

Mainstream EV buyers are being priced out of the market, according to a new study by J.D. Power. While electric vehicles (EVs) now account for 8.4% of the retail new-vehicle market, 76% of sales come from the luxury market... buying an EV costs the typical mass-market brand consumer $60,736, which is $9,259 or 18% more than an ICE vehicle.

These findings shouldn’t shock anyone. EVs have been too expensive for a very long time. In 2013, as reported at the time by Torque News, “J.D. Power says that EV buyers generally pay $10,000 more for an EV versus a comparable gas-powered car. The company goes on to say it can take too long in the eyes of customers to recoup that premium.”

Also, recall that in 1915, the Washington Post declared, “Prices on electric cars will continue to drop until they are within reach of the average family.” And yet here we are, 108 years later, and EVs are still too expensive for the average family.

A final note: Ford Motor Company has big problems in its EV business. This week, the company canceled stock orders for its Lightning EV pickup due to the need to perform “additional quality checks.” The company had planned to make the EV trucks at an annualized run rate of 150,000 units. That won’t happen. The company will report its third-quarter EV sales in the next few days. Expect more huge losses.

Please click that ♡ button. And don’t forget to subscribe and share.

Remember to check out the Power Hungry Podcast.

Thanks.

Yes, the Production Tax Credit makes wind turbines viable. Buffet told an audience in Omaha, Nebraska recently. "For example, on wind energy, we get a tax credit if we build a lot of wind farms. That's the only reason to build them. They don't make sense without the tax credit." Here in Texas in 2005 the CREZ bill was passed directing ERCOT to plan and install transmission lines to connect west Texas where the wind turbines were being erected to the big cites of the state. It took until 2015 to finish the grid extensions so the wind turbine investors were not curtailed and could pocket the generous federal PTC. Us rate payers picked up the estimated 8 billion dollar cost of these "extension cords" in our electric bills. Lately there has been lots of dicussion about crazy ways to recycling the blades but what happens to the foundations lots of cocrete and rebar which as far as I know become a large wind turbine grave stone. May they RIP.

"Headwinds" lmao