Ford's EV Bloodbath Continues

FoMoCo lost $47,585 for each EV sold in Q2, GE Vernova calls offshore turbine blade failure a “manufacturing deviation”

The losses keep coming. As I reported here in February, Ford Motor Co. lost $4.7 billion on its EV business in 2023, or about $64,731 for each EV it sold. Today, the company reported that over the first two quarters, it has lost nearly $2.5 billion on its Model e segment, meaning Ford’s EV losses are on track to total $5 billion in 2024. While the company’s per-vehicle losses declined somewhat during the second quarter, they are still stunning. Let’s take a quick drive through the results.

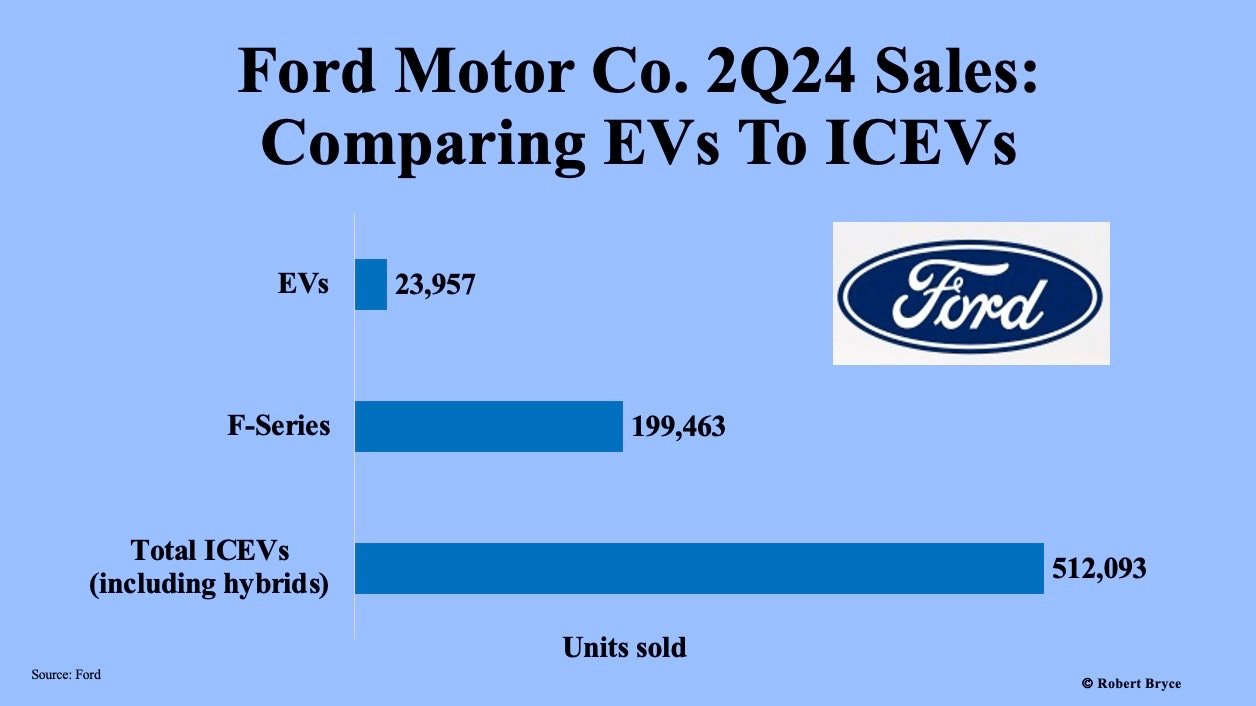

On July 3, the company published its second-quarter sales numbers. Its EV sales totaled 23,957 units, up 61% from the same period in 2023.

But the money numbers were published today, and they are sobering. Yes, the company sold 23,957 EVs during the quarter, but it lost $1.14 billion while doing so. Thus, Ford lost $47,585 for each EV it sold. In a press release, the company said it incurred the loss “amid ongoing industrywide pricing pressure on first-generation electric vehicles and lower wholesales. Those factors more than offset about $400 million in year-over-year cost reductions in the segment.”

In plain English, the company is saying that its cost-cutting efforts aren’t enough to make up for the price cuts it is being forced to make to attract buyers. To put that $47,585 per-EV loss in perspective, a Ford dealer in Austin currently has more than 20 Mustang Mach-E vehicles in stock selling for less than $47,000.

A bit more background on the company’s sales helps illustrate the scale of Ford’s faltering EV business. During the second quarter, Ford sold 199,463 F-Series trucks. Further, it sold more than half a million internal combustion engine vehicles (ICEVs). Thus, as seen above, the Dearborn-based auto giant sold 21 times more ICEVs than EVs.

The ongoing disaster in EVs has (finally) awakened Ford’s leaders from their money-losing stupor. Last Thursday, the company announced it would spend $3 billion to expand production capacity for its super-profitable F-Series line. In a July 18 press release, it said to meet “customer demand for one of its most popular and profitable vehicles,” it will add “initial capacity for 100,000 F-Series Super Duty trucks, including future multi-energy technology, at Oakville Assembly Complex in Ontario, Canada.” The press release also contains some telling words from the company’s COO, Kumar Galhotra:

This investment will benefit Ford, our employees in Canada and the U.S., and especially our customers who want and need Super Duty for their lives and livelihoods... It is fully consistent with our Ford+ plan for profitable growth, as we take steps to maximize our global manufacturing footprint, and our investments will have a fast payback. (Emphasis added.)

In other words, Ford has decided profitability matters. Rather than continue pouring money into its money-burning EV business, it will expand the production of the vehicles that keep the lights on, which means producing more F-150s and other vehicles that burn dino juice.

One final note that gives more proof that the EV craze is running out of steam: On Tuesday, General Motors CEO Mary Barra told Wall Street analysts that her company is deferring investments in EVs to ensure, as the Wall Street Journal put it, “the company doesn’t get ahead of demand.”

GE Vernova’s Wind Turbine Orders Plummet, CEO Calls Blade Failure “Manufacturing Deviation”

In the annals of corporate gobbledygook, Scott Strazik, the CEO of GE Vernova (GEV), surely deserves a prize for using the phrase “manufacturing deviation” to explain the July 13 disintegration of a turbine blade at the Vineyard Wind project in Massachusetts waters offshore Nantucket.

Yesterday, during an investor call to discuss the company’s second-quarter financials, Strazik addressed the disintegration of the turbine blade. As you may recall, that blade failure sent tons of debris into the ocean, forcing the temporary closure of beaches on Nantucket Island during the height of the summer tourist season. The turbine blade disaster also led to a suspension of construction on the 800-megawatt offshore project, which is owned by two foreign companies, Avangrid, and Copenhagen Infrastructure Partners, while investigators try to figure out what happened.

During the call, Strazik explained the blade was made in a factory in Canada and that “our investigation to date indicates that the affected blade experienced a manufacturing deviation.”

What, exactly, does that mean? The MV Times reported that “GE Vernova later issued an email statement that the manufacturing issue was due to ‘insufficient bonding,’ although they didn’t offer further explanation. Vernova — whose offices are in Cambridge — has not returned multiple calls to offer an explanation.”

GE Vernova’s second-quarter results revealed the slow-rolling train wreck now underway in the wind industry. While the company announced an increase in revenue and profits, it also revealed that its wind-related order book decreased “primarily due to a large Offshore Wind equipment order in the second quarter of last year that was canceled in the fourth quarter.”

The press release continued, noting that orders for new wind turbines plummeted 44%, and wind segment revenues fell 21% during the quarter. The company’s wind segment was the only one to lose money during the quarter. While the power segment made $613 million in EBITDA and the electrification segment made $129 million, the wind segment lost $117 million.

As I noted earlier this week in “Breaking Wind,” the wind industry faces lots of pain. More proof came last Friday when Level Ten Energy reported that power purchase agreement prices for new wind projects jumped by 13.5% year-on-year. Solar prices increased by about 3%. Thus, Big Wind is not only seeing lots of turbine failures onshore and offshore and a growing backlash across America — where local governments and landowners are rejecting the encroachment of their monstrous landscape-destroying-wildlife-killing-whale-endangering-and-property-value-shredding machines — it is also losing price competitiveness in the market.

Before you go

Please do me a favor by clicking that ♡ button, sharing, and subscribing. Thanks.

This would not be a problem if OUR government had not spent OUR taxes to distort markets for OUR electricity. Jail the "green grifters"

Jim Farley and Mary Barra are beginning to look like national politicians; they go from f**kup to F**kup without accountability or consequences. The boards of both companies need to be replaced.