Tesla In Turmoil: The EV Meltdown In 10 Charts

The layoffs at Tesla (and the recall of the Cybertruck) are only part of the electric vehicle debacle

In 2014, Tony Seba, an author and lecturer in “entrepreneurship, disruption, and clean energy” at Stanford University, declared, “By 2025, gasoline engine cars will be unable to compete with electric vehicles.” He continued, claiming that internal combustion engine (ICE) vehicles “are toast.” In a 14-page presentation called “Clean Disruption of Energy and Transportation,” that was subtitled, “How Silicon Valley is making oil, nuclear, natural gas, coal, electric utilities and conventional cars obsolete — by 2030,” Seba claimed “solar, wind, electric vehicles, and autonomous (self-driving) cars will disrupt and sweep away the energy industry as we know it.” He also declared that “Transportation will never be the same again” and that “energy and transportation as we know it today will be history by 2030.”

A decade later, Seba’s predictions look rather, um, optimistic.

Yes, we have about five years left before Seba’s 2030 deadline, but as I noted in my last Substack, “Natty Nation,” U.S. natural gas production — and LNG exports! — are at record levels. As I have reported many times over the past decade, the solar and wind sectors are facing increasing friction in rural communities all over the world. (See my April 3 piece on Fox News for more.) Robot cars? Last week, policymakers in British Columbia banned self-driving cars. Oil use? On April 9, the Energy Information Administration reported that global oil consumption averaged 102 million barrels per day in 2023, an amount that was “a 2.0 million b/d increase from 2022.” The agency also predicted global oil use will be about 103 million b/d this year and about 104 million b/d in 2025.

We can already see that Seba’s prediction that “By 2025, gasoline engine cars will be unable to compete with electric vehicles” was dead wrong.

Yes, 1.2 million EVs were sold in the U.S. last year. That’s a record number. But after more than a century in the market, EVs accounted for just 7.6% of U.S. new car sales. And yes, Cox Automotive believes that EVs will account for about 10% of new car sales in 2024. That prediction may be too optimistic.

Understanding why that’s so only requires looking at the troubles at Tesla, which accounted for 55% of all U.S. EV sales last year. Tesla’s closest competitor last year was Ford, which accounted for just 6% of the U.S. EV market, and as I noted in February, FoMoCo lost nearly $65,000 for each of the 72,000 EVs it sold last year. Meanwhile, EV maker Rivian lost a whopping $107,000 for every vehicle it sold. (Rivian’s stock has fallen by more than half this year.)

Put simply, Tesla is the bellwether for the EV business, and it’s in trouble. Last week, the company announced it was laying off more than 10%, or about 14,000, of its employees. The move comes after a quarter during which the company missed delivery expectations and just before it reveals its quarterly profits on Tuesday. Here’s what Wired wrote last Thursday about Tesla’s situation: “Demand is dropping for electric cars in the U.S. and Europe, just as competition in China intensifies and workers revolt in Europe. Investors are worried.” Wired continued, saying Tesla is contending with:

Ongoing worker strikes in Sweden, and even sabotage by German climate activists. Earlier this month, the company warned investors to expect a lower rate of growth this year, blaming interest rate hikes for dampening demand... Shareholders will get a chance to give their blessing at a vote in June, when they will be asked to ratify Musk’s $50 billion pay package and approve the company’s move to Texas.

The bad news continued on Friday when the National Highway Traffic Safety Administration ordered the company to recall nearly all of the Edsels, oops, I mean all of the Cybertrucks, it has produced at its factory here in Austin. About 3,900 Cybertrucks must be repaired because an accelerator pedal could get stuck in the down position.

Tesla’s stock is down 41% so far this year. The company faces so many challenges that Brad Munchen, an auto analyst who writes the Motorhead column here on Substack, posted an excellent piece on Friday asking, “Could Tesla Go Bankrupt? The Odds Are Rising.” The money line: “Things crash hard and loud in the auto industry and I’ve never seen a carmaker in as dangerous of a position as Tesla currently is in.”

I have been a skeptic about EVs for more than 14 years. Tesla’s problems are only part of the broader issues facing the entire EV sector. Here are 10 charts that help explain the situation.

Chart 1

There is nothing new about EVs. The history of the EV is a century of failure tailgating failure.

Chart 2

It’s a good time to be an auto mechanic. Why? People are keeping their vehicles longer. High interest rates are hurting new car sales. Plus, new car prices have been rising steadily. The result: fewer buyers are in the market, which means fewer potential buyers for EVs.

Chart 3

Michael Jordan famously said, “Republicans buy sneakers, too.” That may be true. But few of them are buying EVs.

Chart 4

The latest Gallup numbers show that fewer people (Democrat or Republican) are interested in buying an EV.

Chart 5

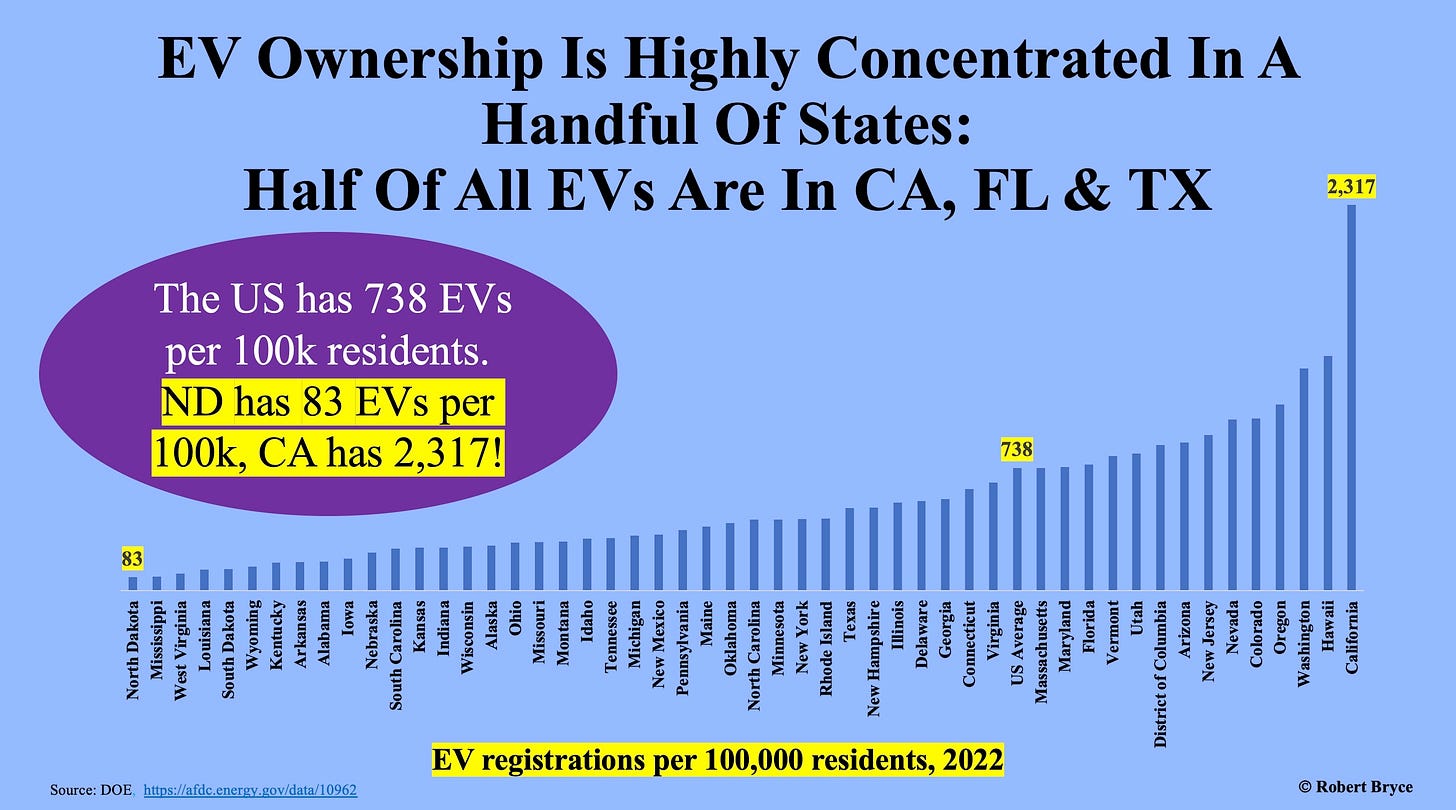

Class, ideology, and geography all contribute to EV ownership trends. Over the past eight months, I’ve given speeches in North Dakota and Mississippi. I didn’t see a single Tesla in either place.

Chart 6

Amid all the hype about EV sales, too little attention is being put on how those cars will be recharged. In 2019, Southern California Edison, one of the biggest investor-owned utilities in California, estimated the amount of juice needed to electrify transportation in the state. The utility found that trying to do so “will increase electric load by nearly 130 terawatt hours — representing more than one-third of the grid-served load” by 2045. The same report estimated the state will need to add at least 80 gigawatts of new zero-carbon electricity generation capacity over the next two decades. But as seen in this chart, California’s electricity use is falling. Some of that decline is due to people and industry leaving the state. The other factor may be the high cost of power in the state. Further, California will not add 80 GW of new generation capacity over the next 20 years. The permitting process is far too long, and the costs of trying to do so are too high.

Chart 7

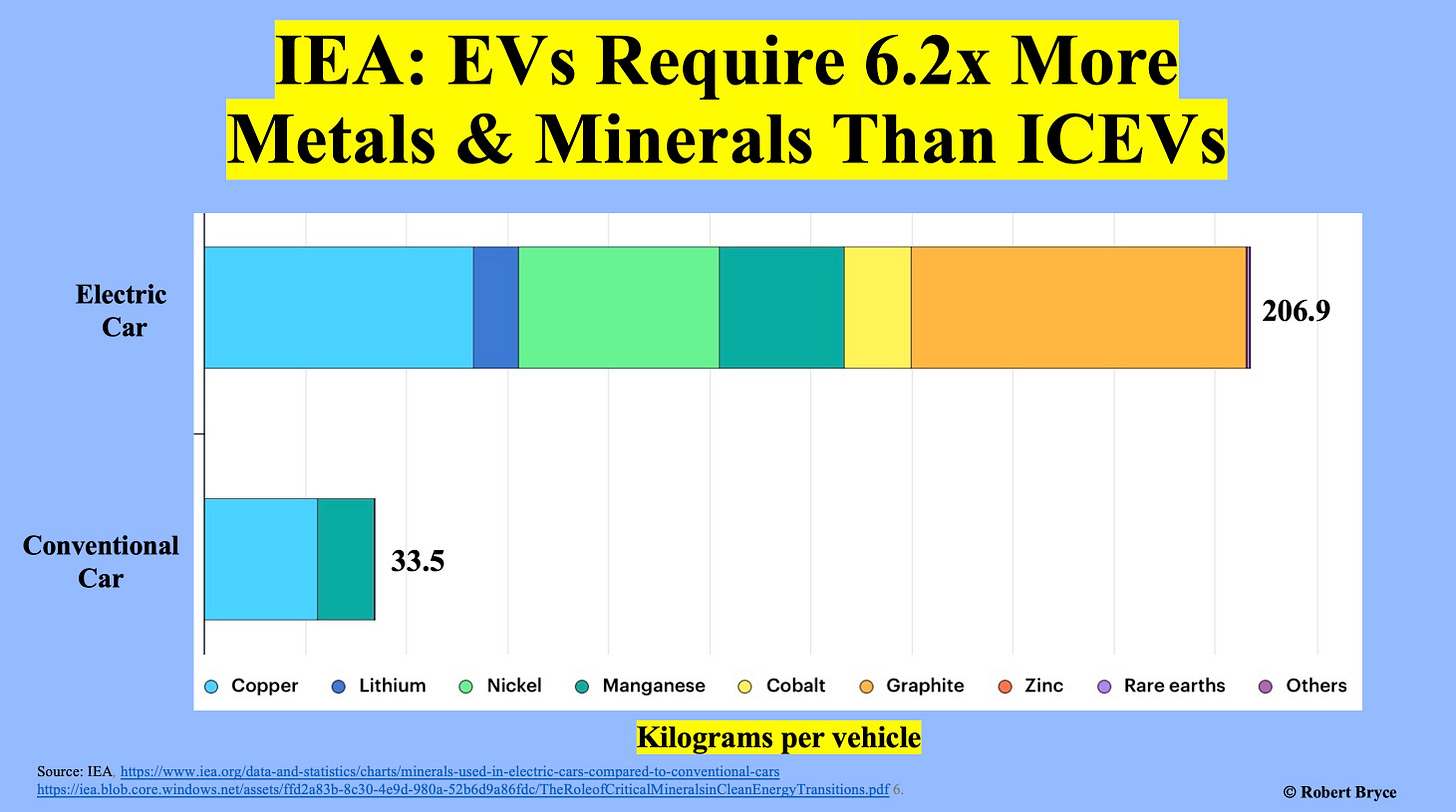

EVs require massive amounts of metals, minerals, and magnets. This chart uses a screengrab from a 2021 report by the International Energy Agency called “The Role of Critical Minerals in Clean Energy Transitions.”

Chart 8

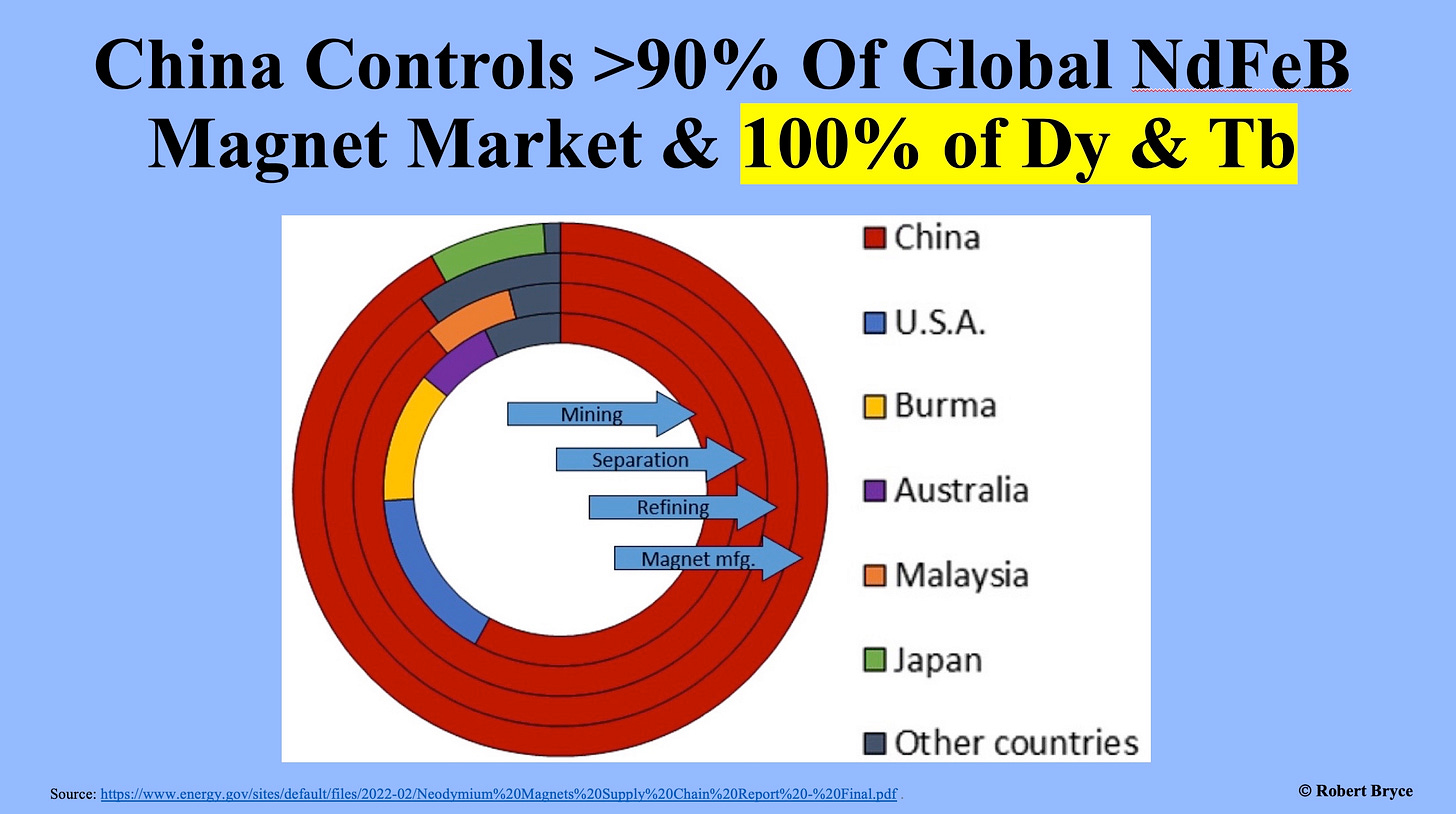

Last month, the Biden Administration finalized rules requiring U.S. automakers to slash the number of internal combustion-engined vehicles they produce. By 2032, about 60% of the cars they sell must be fully electric. Why, in the name of Jesus, Mary, and Joseph, is the Biden crowd so eager to make our auto sector dependent on Chinese supply chains?

Chart 9

Last May, in “The EPA’s China Syndrome,” I explained how the proposed mandate on EVs would make the U.S. dependent on China for “neodymium-iron-boron (NdFeB) magnets. Those magnets are critical components in electric vehicles and wind turbines as well as in military applications like ship propulsion systems and guided-missile actuators.” The EPA has completely ignored the magnet supply issue. In fact, the word “magnet” doesn’t appear one time in the agency’s 1,200-page final tailpipe rule.

This is pure foolishness. In 2022, the Commerce Department issued a heavily redacted report on Chinese magnets and the threat they pose to our security. As I wrote last May, the report found:

America’s dependence on imported NdFeB magnets meets the statutory definition of threatening national security. Here’s the key sentence: “Based on the findings in this report, the Secretary concludes that the present quantities and circumstances of NdFeB magnet imports threaten to impair the national security as defined in Section 232 of Trade Expansion Act of 1962, as amended.” It continued, noting that the U.S. “has extremely limited capacity to manufacture NdFeB magnets and is nearly one hundred percent dependent on imports to meet commercial and defense requirements. In 2021, the United States imported 75 percent of its sintered NdFeB magnet supply from China.

Chart 10

Metals, minerals, and magnets require mining. Lots of mining.

In June 2019, Richard Herrington, the head of earth sciences at the Natural History Museum in London, and seven colleagues sent a letter to the British government that focused on the amount of metals and rare earth elements needed to electrify Britain’s auto fleet. As I explained in a September 11, 2019, piece published in The Hill:

Herrington and his colleagues calculated the amount of commodities, including rare earth elements, that would be needed to convert all the United Kingdom’s 31 million motor vehicles to electric drive. (Rare earths are a group of 17 elements that includes neodymium, an essential ingredient in electric motors.) They found that doing so would require “two times the total annual world cobalt production, nearly the entire world production of neodymium, three-quarters of the world’s lithium production, and at least half of the world’s copper production during 2018.” The U.S. has about 276 million registered motor vehicles, or roughly nine times as many vehicles as the U.K. Thus, if Herrington’s numbers are right, electrifying all of U.S. motor vehicles would require roughly 18 times the world’s current cobalt production, about nine times global neodymium output, nearly seven times global lithium production, and about four times world copper production. Even if there were sufficient political will — and money — to attempt an electric overhaul of the transportation sector, there may not be enough cobalt or rare earth elements to meet demand. (Emphasis added.)

Using Herrington’s calculations, I made the following chart, which shows how much copper, lithium, neodymium, and cobalt would be needed to electrify half of U.S. motor vehicles. (By the way, Herrington came on the Power Hungry Podcast in 2021. Watch it here.) The copper intensity is of particular concern because, as the IEA explained in 2021, each EV requires about 53 kilos of copper. That matters because copper prices have surged to their highest level in nearly two years and are now at about $4.50 per pound. As the subsidies for alt-energy continue to flood the market, the price of copper and other metals may continue to rise, which will make it more difficult for automakers to cut prices on EVs.

Conclusion

In January, I provided written testimony to the Senate Energy and Natural Resources Committee on the EV issue. I concluded that the “Biden Administration’s EV mandates are bad for U.S. energy security and national security. The mandates are unrealistic and unattainable. They will give China control over critical supply chains and increase costs for consumers and taxpayers.”

Nothing has happened in the last three months to make me change my mind. In fact, Tesla’s woes and Ford’s recent move to slash production of its F-150 Lightning have only added to my skepticism. I’ve said it before, and I’ll say it one more time: Electric vehicles are The Next Big Thing, and they always will be.

Please click that ♡ button. And as always, please subscribe and share. Thanks.

EVs are not supposed to be a practical, green alternative to ICE vehicles. They're the transition stage to no vehicles at all. If they were widely adopted the watermelons would suddenly discover what opponents of EVs have said all along: They aren't remotely green. That would require the EVs to be phased out, to be replaced with...nothing. You'll all be living in 15-minute cities. By then the ICE manufacturing plants would be nearly impossible to recreate or start up again. Et voila: Nut zero utopia.

Two things. First, the big adopters of EV are states without winters (Texas, Florida, California). Your big non EV state was North Dakota, obviously a state with a winter. As a Canadian, I have ruled out EVs for now because instead of waste heat from an ICE to heat the cabin, I would need to charge a battery. A real nonstarter. I also like your comment that EVs will always be the next big thing. Fusion is in the same category.